NGF’s 2017 Participation Report

So what is golf participation?

It’s appropriate that the NGF’s 2017 participation report begins with that fundamental question. Like many things, engagement with golf is evolving and so too must the method of measuring it. A broader definition is needed to appropriately gauge participation – whether that’s due to societal shifts and behavioral patterns or the growth and proliferation of non-traditional forms of a very traditional game.

The long-standing measure of green-grass participation – playing golf on a golf course – remains essential and invaluable for those in the golf industry. At the same time, it doesn’t tell the whole story.

Many of the trends in traditional participation are encouraging: the total number of beginning golfers (those playing on a golf course for the first time ever in 2016) rose to a record-high 2.5 million, surpassing the previous record set in 2000, when Tiger Woods was at his prime and drawing newcomers to the game in unprecedented numbers. There is even greater interest among those looking to take up the game. The NGF’s national study found that the number of non-golfers expressing the highest level of interest in playing golf increased by 7.6% to 12.8 million.

NGF MEMBERS: Click here to download your copy of Golf Participation in the U.S.

While the latest research indicates a modest 1.2% decline in on-course participation – dipping to 23.8 million (age 6+ who played at least once) in 2016 from 24.1 million in 2015, commitment to the sport in many respects is more evident than ever before. The number of committed golfers – a group that accounts for approximately 95% of all rounds-played and overall spending – rose for the first time in five years, from 19.5 million to 20.1 million.

When factoring in an 11% increase in off-course participation – from driving ranges and Topgolf facilities to indoor golf simulators – overall involvement in the game is actually up. Driven primarily by the popularity and growth of Topgolf, a non-traditional form of golf entertainment, there were an estimated 20 million off-course participants in 2016. Of those, 8.2 million didn’t play on a golf course.

Considering both on-course and off-course participation, golf’s consumer base increased to 32 million in 2016, up from 31.1 million a year earlier.

“NGF has been planning the reporting of off-course participation for some time,” said NGF President and CEO Joe Beditz. “There are a couple of good reasons for doing so: first, to make our golf participation numbers better reflect overall golf activity and play; and, second, to make our measure more comparable to other sports.”

Off-Course Participation Measures

While off-course participation hasn’t been previously included in NGF’s participation report, the NGF has historically tracked the number of people who participated in golf at golf ranges only, rather than at golf courses. Three years ago it also began tracking the number of participants at Topgolf and indoor golf simulator facilities with an eye on the emerging need to expand the definition of golf to include participation at facilities other than traditional golf courses. “Green grass golf participation remains an essential measure of golf’s vitality, and we will continue to measure and report on it the way we always have,” says Beditz. “But we decided it was time to add off-course participation in order to track the dynamic growth we have seen there, and which we believe will continue.”

Other sports such as basketball and baseball measure participation very broadly, including many forms of related activity. Keith Storey, vice president of Sports Marketing Surveys, is responsible for conducting participation research on over 100 sports and physical activities for the Physical Activity Council (PAC), an organization comprised of seven different trade associations. When asked recently if a father and son playing HORSE using a hoop hung over the garage would be counted in the PAC report as basketball participants, his response was telling: “Yes, certainly. Most sports don’t limit themselves to participation at a particular type of facility, as golf has done.” Indeed, the engagement measures for team sports include casual or pick-up play in addition to more organized league or school participation.

When the NGF began its annual golf participation research in 1986, it defined a golf participant as a person over the age of 6 who played golf on a golf course at least once in the previous year. Back then, metal spikes and persimmon woods prevailed, golf simulators were just being introduced, and the idea of embedding RFID chips in golf balls was inconceivable. At the time, “playing golf” meant a round of golf at a golf course. Not anymore.

“I really applaud the NGF for looking at the broader picture of golf and the nearly 100 million people that consumed our great game – in many different forms – in 2016,” said LPGA Commissioner Mike Whan, who is also the chairman of the World Golf Foundation. “It’s hard not to be excited about key growth drivers such as beginning golfers, latent demand/interest and off-course participation – all of which were at record levels. As our game evolves and the definition of ‘playing golf’ expands, it’s important for our industry to track those evolutions and fully embrace all aspects of consumers that are part of golf’s ultimate impact.”

It’s important to note that NGF’s expanded definition of golf participation includes only activities that involve hitting a golf ball with a golf club (not a putter). As such, miniature golf and video game golf are not included in golf participation, although those activities are also tracked by NGF researchers.

Golfer Engagement

For most businesses that make a living in golf, the increases in latent demand and new trials are encouraging, but their most important segment remains the “engaged” group – committed golfers who enjoy the on-course game and are most likely to continue playing. While the total number of participants playing traditional green-grass golf has seen a gradual decline in recent years, the segment of engaged golfers measuring 20.1 million now represents 85% of those who play. It’s the highest percentage of committed golfers in the U.S. since the NGF started the measurement in 2011 and the first increase in four years.

NGF has divided green-grass golf participants into three segments:

Avid golfers indicate golf is a favorite activity and describe themselves as “golf nuts” or say they are “hooked” on golf. According to NGF there were 8.8 million avid golfers in 2016, and while they accounted for just over a third of all golfers, they were responsible for almost two-thirds of all rounds-played and spending. Ninety-eight percent said they were likely to continue playing golf in the future.

Casual, or recreational golfers, numbered 11.3 million. Almost half (48%) of golfers place themselves in the “casual” category. But these casual golfers are almost as committed to the game as their avid counterparts. Ninety-six percent say they will continue to play in the future, and that’s important given that they account for almost a third of all rounds played.

The last group is the Fringe, or unengaged golfers, numbering 3.7 million. This is a group, according to NGF, that sees many of its members come and go, perhaps playing once or twice one year, or even skipping a year or two before playing again. This group averages less than 5 rounds a year and, while numbering in the millions, account for only four percent of rounds played.

The decline in total on-course participants over the past five years is almost entirely limited to the loss of fringe golfers – those players who never really got into the game in the first place.

The Changing Face of Golf

The junior golf population remains relatively stable at 2.9 million and continues to show a transformation in diversity compared to years past.

Thirty-three percent of golfers in the 6-17 age range are females, up from 17% in 1995. This significant gain is likely the result of the increased visibility of the LPGA Tour and developmental programs such as LPGA*USGA Girls Golf. By comparison, 24% of all golfers are women. Also among junior golfers, 27% are non-Caucasian, a percentage that’s up from 6% in 1995 and driven by development organizations such as the First Tee and its National School Program, which is in more than 9,000 elementary schools across the U.S. Other high profile national programs, such as the PGA’s Junior League Golf and the Drive, Chip and Putt Championship run in conjunction with the USGA and The Masters, also help bolster the industry’s overall junior golf efforts.

The young adult category (18-34) is the sport’s biggest customer age segment, with 6.2 million on-course participants, and another 3.1 million off-course participants. Latent demand is also highest among the Millennial generation, with over 15.2 million saying they are “very” or “somewhat” interested in taking up the game. Similar to the diversity trend evident with junior golfers, a higher percentage of Millennial on-course golfers are female (29%) and non-Caucasian (24%).

Beginning golfers show even more diversity than juniors and Millennials. Thirty-four percent are female and 32% are non-Caucasian. The movement in these segments illustrates the changing face of golf.

Latent Demand

The number of people who say they are “very interested” in taking up golf has doubled over the past five years, growing at an annual rate of nearly 15%. In addition to the 12.8 million non-golfers who said they’re very interested in playing golf, there are another 27.8 million who responded they’re “somewhat interested” in taking up the game. That increase has driven growth in the number of beginning golfers, with those who played on a golf course for the first time jumping to 2.5 million in 2016 from 1.5 million in 2011.

Recent increases in interest (latent demand) and beginning golfers appear to be correlated with increases in consumer confidence, spending and other favorable economic indicators. Just as these measures trended downward along with golf during and following the recession, they are now increasing as interest in traditional green-grass golf builds, and participation in non-traditional golf activity, such as Topgolf, rises.

Golf’s overall reach remains extensive, and steady. An estimated 95 million people (or one out of every three Americans age 6+) played, watched or read about golf in 2016, the same number as in 2015.

The game’s challenge remains the same: getting more of those who express interest to actually give golf a try, and converting more beginners into committed participants. The encouraging sign for the industry is that the committed participant group now appears to be stabilized, while the number of players picking up a club at off-course facilities continues to build.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

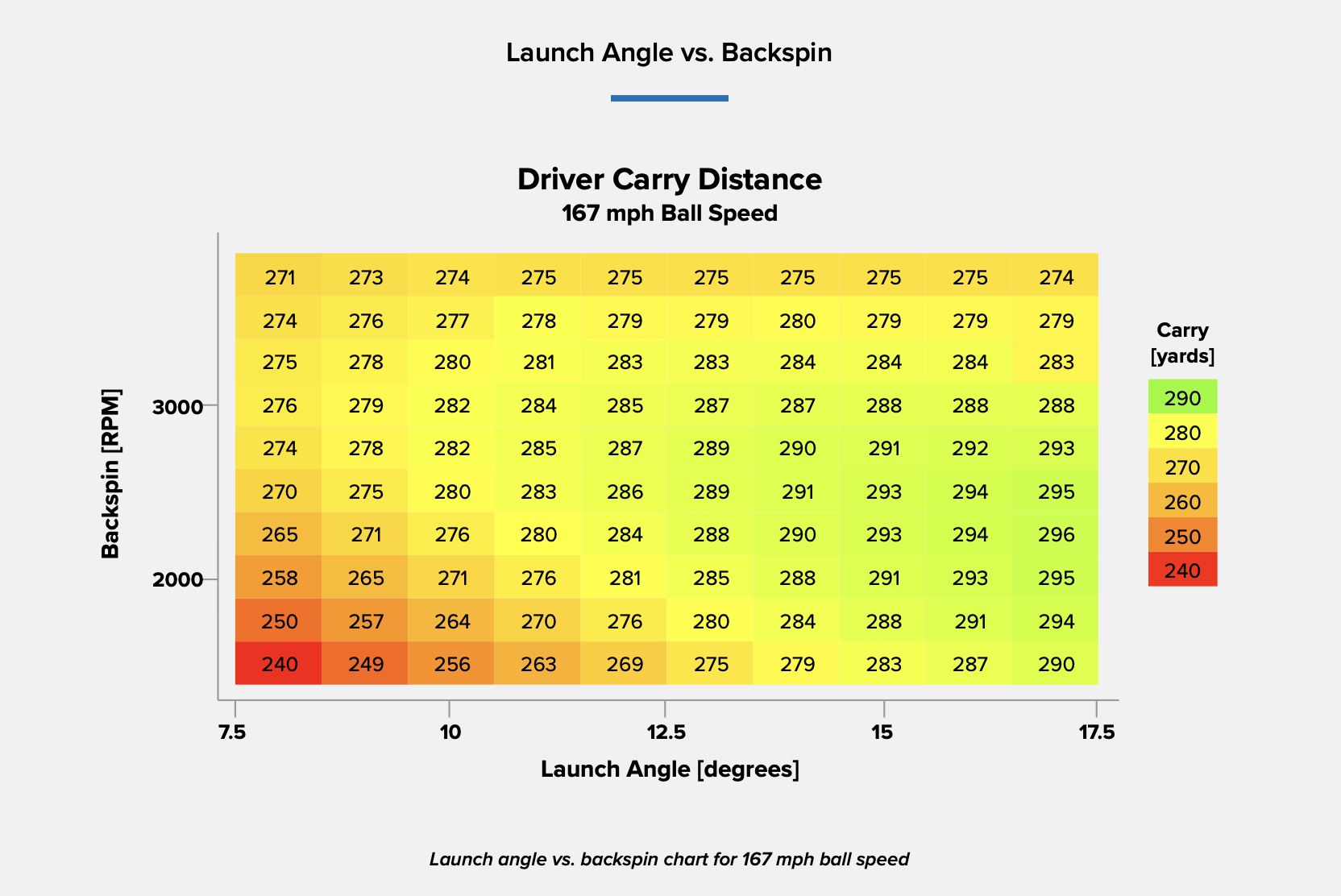

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...