An Update on the Golf Management Space

(🔉 Click to listen to audio version)

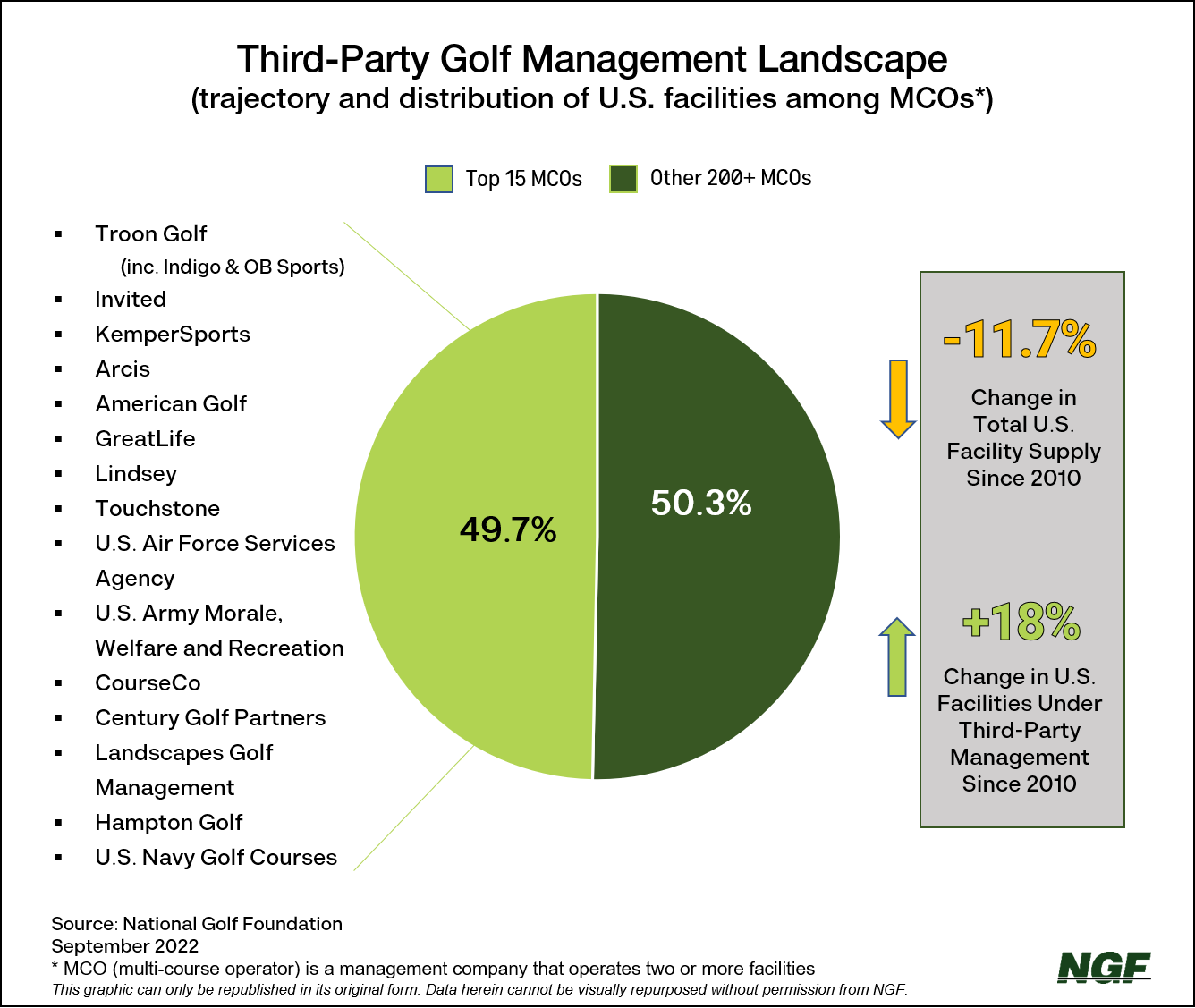

Since 2010, as the U.S. was coming out of the Great Recession, golf course capacity in the world’s biggest market has been reduced by 11.6%. That’s due in part to an oversupply correction in certain markets and heightened demand for land in other places.

Over that same decade-plus period, the number of facilities engaged with third-party management companies has climbed by more than 18%. Today, more than one-out-of-seven U.S. golf facilities, almost 2,100, are being managed by an MCO, or multi-course operator.

NGF’s database shows 218 golf management companies in the U.S. operate two or more facilities — from the AAG Golf Group to YHB Hospitality. The best known are the bigger operators, such as Troon, KemperSports and Invited (the private club owner/operator formerly known as ClubCorp), which together manage hundreds of courses and facilities. The top 15, in fact, represent half of all those facilities under management. The balance is managed by the 200+ others, an average of 5.2 facilities per operator.

If you were to guess one facility in your market under third-party management, chances are you’d probably go with a higher-end, daily fee public course. Odds are, you’d be right.

Daily-fee facilities account for half of those under management. No big surprise, perhaps, given they represent 56% of total supply. And premium-priced facilities (which we define as having a peak green fee of $70 or more) are disproportionately represented.

That said, private clubs and municipal courses are not only proportionately in the mix, they’re a growing proportion. The number of private facilities under outside management has risen almost 15% over the past decade as private club supply has declined by 9% over that same stretch. And while overall municipal supply has inched upwards 4% since 2012, the number of munis under outside management has climbed by 21%.

Together, private and municipal facilities today account for 44% of U.S. supply, but comprise half of the properties being managed by an MCO.

So, how will the landscape evolve in the years to come?

For a deeper look at the third-party management space, click here for the accompanying Spotlight sidebar story.

For a one-page overview report on the sector, NGF members can click here.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...