The $9 Billion Market Under Golfers’ Feet

Commerce and course conditioning converge inside structures most golfers will never visit or notice.

Usually on the periphery of a property, perhaps separated by an access road and guarded by trees and understated fencing, sits a maintenance facility where teams of workers gather every day before sunrise to begin using products that contribute to a $9 billion segment of the golf industry.

Turf and course supplies range from accessories golfers interact with frequently to chemistries with names that are difficult to spell and pronounce. The essentials needed for course preparation add up to big business, which is why 18 turf and course suppliers can be found on the NGF GOLF 100 – the inaugural list of the National Golf Foundation’s top 100 businesses in golf.

The U.S. market for turf care and equipment, chemicals and fertilizers, golf cars, irrigation and course accessories is estimated at about $4 billion annually. Add in labor costs and it puts the total market on the course side of the business in the neighborhood of $9 billion a year.

A grounds crew readies a green for play.

For a company like Standard Golf, a Cedar Falls, Iowa-based manufacturer of course accessories, golf created a viable business. Walter Voorhees realized when golf reached his heartland city in the 1920s somebody needed to make flags, cups, rakes, ball washers and tee markers. After dabbling in other industries, including agriculture, Standard Golf solidified itself as a golf-focused company in the 1970s. Today, more than 95 percent of Standard Golf’s products are manufactured for the golf market.

“We’re neck deep into it,” director of marketing Matt Pauli says.

For a company like Syngenta, an agrochemical and seed giant purchased by ChemChina for $43 billion in 2017, golf represents an opportunity to diversify. Golf is the largest segment of Syngenta’s turf business, which also includes sports turf, lawn care, ornamental and professional pest control units.

Since entering the golf market in the early 2000s, Syngenta has expanded its golf portfolio, which includes solutions for controlling turf diseases (fungicides), weeds (herbicides), pests (insecticides) and slowing grass growth (plant growth regulators).

Evolving in the golf market for Syngenta means creating digital solutions for tracking diseases and pests, developing its Operation Pollinator program to help courses establish habitat for bees, butterflies and other wildlife, offering career development opportunities, and publishing industry studies.

“It’s not always just the chemistries we are working on,” Syngenta turf market manager Stephanie Schwenke says. “That’s obviously a key and very important, but we’re working on other solutions in the digital arena or things like Operation Pollinator.”

From ball washers to tee markers, flags, cups, bunker rakes and practice area products, golf course accessories are absolute essentials.

Standard Golf and Syngenta, along with the 16 other turf care and course suppliers in the NGF GOLF 100, are trying to reach the same group: golf course superintendents.

Facilities entrust superintendents — highly trained and dedicated leaders, many of whom possess two- or four-year degrees from land-grant universities — to lead departments with six- and seven-figure operating budgets. The projected maintenance budget for a golf facility in 2018 is $911,705, according to Golf Course Industry magazine’s annual State of the Industry survey.

“The golf course superintendent is a really smart individual,” Pauli says. “They are really scientists. The things they are talking about … the biology, the chemistry and the agronomy are interesting. They love the outdoors, they are selfless and 10 hours is a short work day for a lot of them. They really put their all into the course.”

Labor, which accounts for 60 percent of a typical maintenance budget, is the largest budgetary line item managed by a superintendent. The average 18-hole course employs a crew of 16, including eight full-time workers. Assistant superintendents, assistants-in-training, equipment technicians, irrigation technicians and spray technicians are specialized positions within a maintenance department.

The other 40 percent of a maintenance budget is devoted to products and utilities. Common line items include fertilizer, fungicides, herbicides, insecticides, plant growth regulators, water, energy, irrigation parts, wetting agents, seed, sand, and mowing, handheld and grinding equipment.

Applying chemicals is a crucial part of golf course preparation and health.

(Photo courtesy of PBI-Gordon)

Most facilities fund equipment purchases and course upgrades through a separate capital improvement budget. The projected capital improvement budget is $313,042 and 55 percent of facilities, according to the Golf Course Industry survey, are planning equipment purchases in 2018, encouraging news for Textron Golf (Jacobsen), John Deere and Toro, the industry’s mowing triumvirate and representatives of the NGF GOLF 100. Deferring capital improvements represented a common management practice during the Great Recession.

The volume of personnel and purchasing decisions make superintendents among the savviest business people in the golf industry.

“It has become more apparent to me in the last 10 years how big the business is,” says Pinehurst Resort director of golf course and grounds management Bob Farren, who leads a department responsible for maintaining nine 18-hole courses in North Carolina’s competitive Sandhills market. “I now look at things from more of a business perspective. But I have always been cognizant of the fact that we are a great contributor to the bottom line, although we are viewed as an expense.”

Golf course maintenance accounts “for at least 50 percent” of the expenses at a Troon-operated facility, says senior vice president of agronomy and science Jeff Spangler. The expenses are necessary because Troon chairman, CEO and founder Dana Garmany observed a strong correlation between course conditions and golfer satisfaction in the company’s early years.

“We built a company around that concept and we really make sure that part of our business stays very vibrant,” Spangler says. “We work really hard to hire competent superintendents and support them at a high level. Their level of accountability and prestige at a facility has grown dramatically over the years.”

Superintendents are also part of the product development chain. Introducing a pesticide, mower, utility vehicle or golf car to the market is a methodical – and costly – process. Textron introduced lithium-powered golf cars under its E-Z-GO brand in 2017. The company started experimenting with the technology a decade before its release, and research and development included five years of user testing and feedback, according to director of product development and strategy Matt Zaremba.

“By the first time the industry sees the product, we are very comfortable with how it performs and how it works long term,” Zaremba says. Textron Golf also manufacturers Cushman utility vehicles in addition to its Jacobsen mowers and E-Z-Go golf cars.

Featuring active ingredients with tongue-twisting names such as chlorothalonil and fluazinam, pesticides can take eight or more years and close to $300 million to develop.

Research and development begins with the discovery of thousands of compounds. Superintendents are heavily involved in the process, testing new products on turf nurseries and practice tees and greens. The time and cost of developing a pesticide, combined with a short patent window, means they are the most aggressively marketed products in turf care.

A view of the floor of the Golf Industry Show at the San Antonio Convention Center.

Products are often unveiled in early February at the Golf Industry Show, an annual event staged by the Golf Course Superintendents Association of America, a Lawrence, Kansas-based professional development and advocacy organization. The GCSAA is also in the NGF GOLF 100 and its 2018 show in San Antonio, Texas, featured more than 500 exhibitors. Corporate desire to support superintendents leads to thousands of educational hours available to superintendents via national and regional shows and conferences, trade publications and webinars.

Multiple turf care companies even stage their own educational events, covering attendees’ travel, lodging and meal expenses.

The focus of industry education has shifted from turf-related topics such as chemical and fertilizer usage to personnel matters and risk mitigation, says Troon’s Spangler. “In many ways education is much more important today because now we are educating toward our weaknesses, not our strengths,” he adds.

Distributors and territory managers are omnipresent figures at educational events – and everywhere else in the industry. Besides selling products, their duties include building personal relationships with superintendents, supporting conferences, golf outings and trade shows, attending university field days, and providing agronomic assistance for customers.

Almost every turf care company in the NGF GOLF 100 employs former golf course superintendents or university researchers. Once trust is established with a superintendent, a vendor becomes a key resource in the team responsible for producing desirable course conditions.

“Day in and day out they are tasked with providing so much information while trying to put a product out there that the superintendent needs to do the maintenance job right,” says Larry Hanks, who leads Landscapes Golf Maintenance, the contract maintenance division of golf construction and management company Landscapes Unlimited. “Superintendents really listen to them. It’s a good exchange back and forth. You can talk to the fertilizer and chemical companies, the universities, and the equipment companies. They really listen because their R&D is very expensive. Interactions with all of them are very important.”

Quail Hollow recognizes the turf & course supply companies that helped it run the PGA Championship.

The 2017 PGA Championship at Quail Hollow Club in Charlotte demonstrated industry support and synergy at the highest level, as 33 turf care manufacturers and distributors were involved in tending the course, helping a crew of turf care employees and volunteers that swelled past 100.

Quail Hollow’s maintenance building is secluded, tucked unobtrusively between the 10th green and 11th tee.

During championship week, only a few dozen spectators even wandered toward the area.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

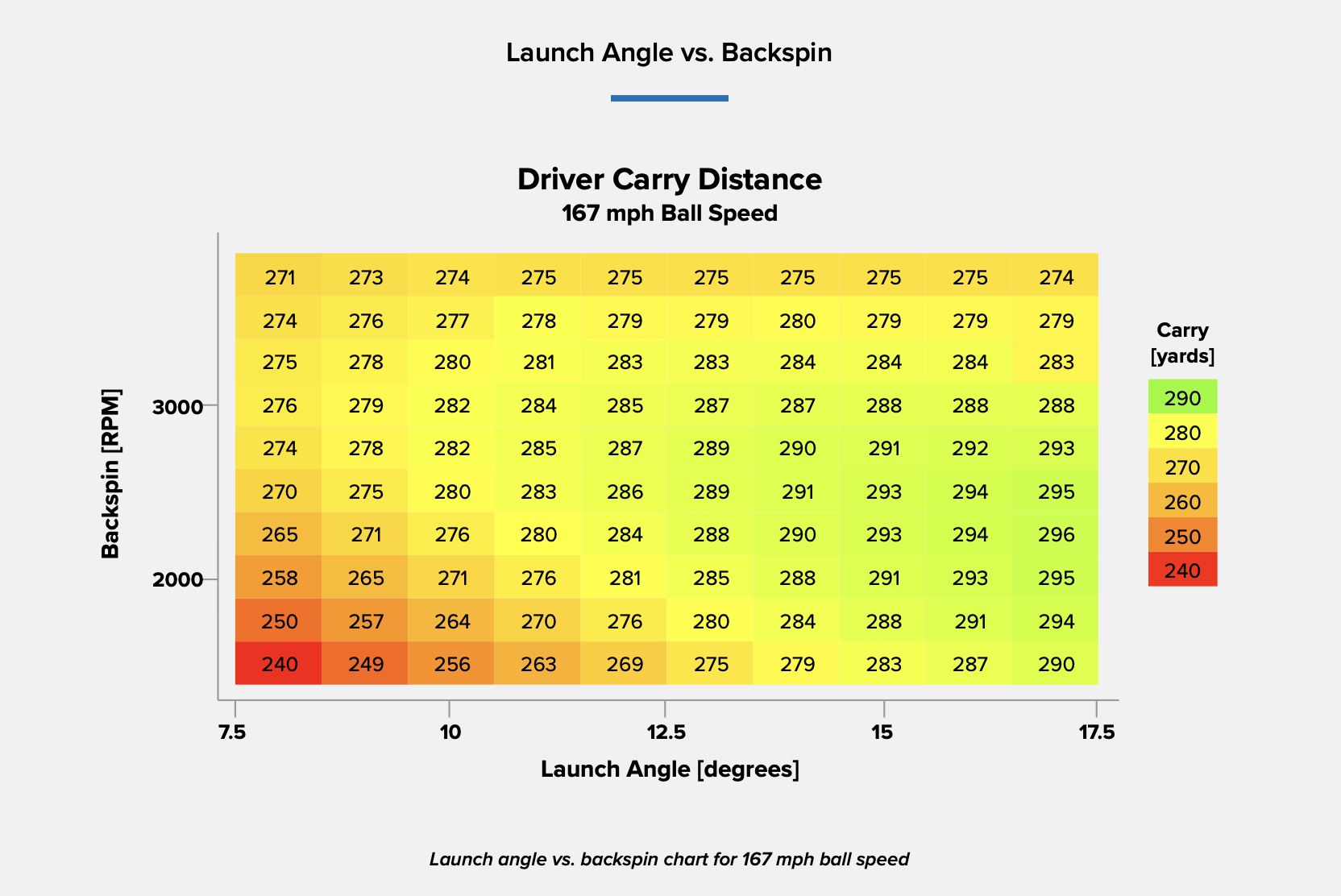

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...