Municipal Golf’s High-Water Mark

There may be no better time to be a municipal golfer than right now — at least when it comes to options.

The NGF’s 2018 Golf Facilities in the U.S. report counts a record number of municipal courses in the U.S. As of year-end 2017, there were 2,497 government-owned municipal facilities and 2,316 18-hole equivalent courses. Those figures account for roughly 17 percent of the total U.S. supply.

“Municipal golf courses offer an opportunity for anyone and everyone to access the game,” says Alex Elmore, the President of Billy Casper Golf, which counts more than 80 municipal facilities among the over 140 golf properties it manages — more than any other third-party operator. “Those municipal locations offer great platforms to provide programs that bring new people to the game. Having a large number of municipal courses in our portfolio is where we see a real opportunity to continue to grow the game.”

The state with the highest concentration of muni golf might actually come as a surprise: Utah, where 50 percent of the state’s 112 facilities are owned by municipalities. Not far behind are Wyoming (37%), North Dakota (35%), Colorado (34%) and Oklahoma (33%).

Every U.S. state has a municipal course. California leads the way with 179, among them the two courses at Torrey Pines on cliffs above the Pacific Ocean just north of San Diego and TPC Harding Park in San Francisco. Illinois is second nationally with 178 municipal facilities, followed by Texas (176), New York (121) and Florida (95).

(NGF members can click here to download the facilities report.)

Torrey Pines is home to two courses, the North and South, and hosts an annual PGA Tour event. (Photo credit: City of San Diego Parks and Recreation Department)

With accessibility comes affordability and that value is an important factor to towns that are maintaining courses as an asset, says Elmore. The average price for 18 holes at a municipal course (peak-season weekend, adjusted for discounts) is $31, while the corresponding cost at a 9-hole muni is $18.

“The cross section of guests that we see at municipal golf courses is probably the most diverse group you get at properties in golf,” Elmore said. “You have great locations in major metropolitan areas where you’ll get the business traveler getting a round in before flying home, local residents who have a regular game and juniors who are being introduced to golf. It’s a cool cross section of people. That’s one of the things that make municipal facilities so unique and exciting.”

While the record number of municipal courses doesn’t reflect a significant jump over recent years – a net gain of 30 municipal facilities since 2013 – it is a rare categorical increase at a time when course closures have outweighed new openings for 12 straight years as part of a necessary correction of supply and demand.

Real estate zoning issues and protecting green space are just some of the reasons behind the record number, according to Ed Getherall, the Director of Consulting Services for the NGF. So is the change in ownership format at many courses.

“Very few (municipal courses) are new construction, so what we’re really seeing are acquisitions,” he said. Since 2013, a total of 67 18-hole equivalent courses have been reclassified from private or daily fee to municipal.

“At some daily fee courses that are struggling, owners are closing the facility in order to cash out,” Getherall added. “Unless the land can never be used as commercial or residential property, owners of a privately owned public course will usually try sell it to a homebuilder. Citizen groups often oppose that effort and try to convince the municipality to buy the course instead. But the cost often comes at a premium since the owner uses the developer option as leverage.”

Northampton Valley CC in Bucks County was saved from development when the municipality stepped in.

Still, the desire to maintain green space and stave off unwanted development often prevails. In Bucks County, Pennsylvania, Northampton Township recently approved the contingent purchase of the Northampton Valley Country Club for $12.5 million.

“The concern we have is that the course could be turned into cluster or high density housing. Certainly more than 100 houses could go into that property, which would put stress on our community, our schools, our roads,” Barry Moore, chairman of the township’s board of supervisors, told www.BucksLocalNews.com. “This is an opportunity we’ve talked about a number of times and we’re right at a point now that we have an agreement in mind of having the township acquire the property and run it as a golf course.”

The former Palo Alto Municipal Golf Course, recently re-opened as Bayland Golf Links, sits on land that had always been zoned for recreation.

“In California, and especially in the Bay Area, there is a high aversion to reducing the amount of green space,” says Getherall. “That entire property was re-imagined and the course was renovated by architect Forrest Richardson. He also freed up some land to use for recreation purposes, including soccer fields, which was appealing to the municipality.”

Baylands Golf Links gives the South Bay region a high-quality, affordable public golf option.

There’s a fundamental difference in funding between munis and independently-owned daily fee courses. Municipal courses generally have a built in subsidy source in the form of a local government, and numerous courses have had accumulated debt erased by that same source, Getherall says. Independently-run courses, however, have no similar external source of funding.

Owners of daily fee courses also often rail against the tax breaks afforded to municipal properties, an understandable position given that many daily fee properties supply the local community with many of the same recreational and social benefits.

While rates can be compressed between GolfNow and other discount programs, the most telling metric for municipal course success remains the number of golfers per 18 holes.

“That’s why some urban areas, like Los Angeles and New York City, even though they have a lot of municipal courses, tend to do better than suburban areas,” said Getherall. “If you don’t have the population density, and there’s an oversupply of courses in the area, then it’s a struggle.”

The Sydney R. Marovitz Golf Course is one of eight Chicago Park District Golf facilities. The course is operated by Billy Casper Golf.

In Jersey City, New Jersey, the Skyway Golf Course at Lincoln Park West is an example of a 9-hole public course that has thrived since opening in 2015, in part because it’s the only public course in densely populated Hudson County. City-owned courses in Los Angeles and New York also continue to experience success, with many of the layouts leased out to private operators. American Golf, for example, operates New York facilities like Dyker Beach in Brooklyn, South Shore in Staten Island, Pelham/Split Rock in the Bronx and Clearview Park in Queens.

“Golf is such a local game and part of the local economy,” Elmore said. “Each municipality that has a golf course has different strengths and challenges. Generally, municipal courses are facing the same challenges that other golf course assets are facing, whether they’re semi-private or even private. That is, you’re not just competing against other golf courses. You’re competing for time and attention from people who have so many other options now.”

However, like parks, zoos, pools and libraries, golf courses remain a fixture in communities and municipalities across the country, offering access to a diverse mix of golfers and opportunity for them to become lifelong golfers. And, despite the challenges, there never have been more munis in the game than right now.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

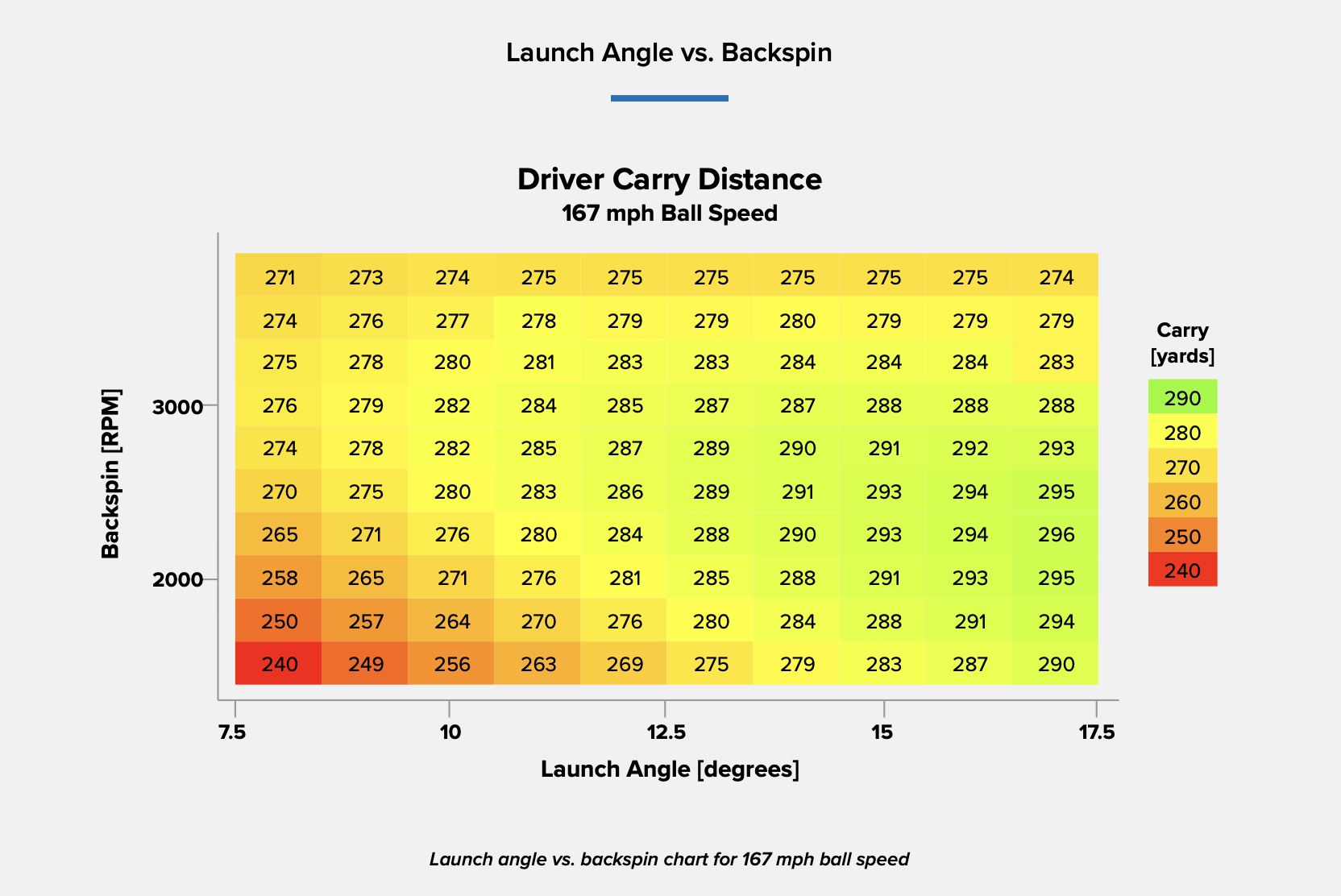

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...