NGF Issues 2018 Golf Industry Report

How many Americans play golf and how many of them are beginners, juniors or women? What is the U.S. golf course count and what percentage of those is open to the public? That and much more can be found in the National Golf Foundation’s new Golf Industry Report.

The comprehensive state-of-the-industry overview consolidates many of the game’s key data points in a single publication and is intended to provide the most holistic view of the business of golf and the health of the game to stakeholders and the media. The Golf Industry Report (GIR) includes the latest NGF research on golf participation, engagement, rounds-played, golf course supply and development, retail supply, golf equipment sales, and golf’s reach.

NGF Members: Click here to download the report

Golf’s participation base remains solid, with an estimated 23.8 million people who played golf on a course in 2017 — the same as a year earlier. Another 8.3 million only played off-course, a year-over-year increase of 7%, putting the game’s overall participant pool at about 32 million.

To more accurately reflect the evolution of golf’s overall consumer base, the NGF’s expanded definition of participation looks beyond traditional on-course golf and also factors in off-course engagement, which tracks those who swing a golf club at facilities like Topgolf, indoor simulators and driving ranges.

Total golf participation in the U.S. (2017)

While new forms of golf engagement continue to emerge and proliferate, the sport’s most devoted participants remain committed to the traditional game. Indeed, the game’s most committed golfers – those who account for approximately 95% of all rounds-played and spending – held steady at roughly 20 million last year. This segment, those golfers essential for businesses that make a living in the industry, represents about 82% of those who play.

Meanwhile, an estimated 21 million people hit golf balls with a club at off-course locations, with Topgolf the most popular form of engagement. Among off-course participants, 61% of them (12.7 million) also played golf on an actual golf course in 2017.

“Golf participation is evolving,” says NGF President Joe Beditz. “On-course, green-grass participation is holding its own and off-course is continuing to grow. There’s no denying that we’re down from our pre-recession highs, but it appears to us that traditional participation is stabilizing and there may be a new support level between 23 million and 24 million.”

Click here for NGF President Joe Beditz’s full perspective on golf participation

Many of the green-grass participation trends remain encouraging, particularly when it comes to beginners and latent demand. The number of people who played on a golf course for the first time ever rose to 2.6 million, up from 2.5 million a year ago, again eclipsing the numbers set when Tiger Woods was in his prime and drawing a wealth of newcomers to the game. Approximately 35% of newcomers are women, while 26% are non-Caucasian.

When it comes to the junior ranks, there were about 2.7 million kids in the 6-to-17 age range who played golf on a course in 2017. An additional 2.3 million played some form of off-course golf.

Latent Demand

NGF research found the number of non-golfers expressing that they’re “very interested” in playing golf increased to 14.9 million from 12.8 million in 2016, an increase in part attributable to off-course participation and its role in helping create a favorable impression of the game. The biggest challenge for the golf industry remains two-fold: getting those who express an interest in playing golf to actually give it a try and then converting more beginners into committed participants.

A total of 456 million rounds of traditional golf were played throughout the U.S. in 2017, down 2.7% as compared to a year earlier. That decline is consistent with the average weather-related fluctuation of approximately 2% to 3% and comes after two straight years of increases.

On the supply side, the total number of U.S. golf facilities declined 1.5% in 2017, with the permanent closure of 205.5 18-hole equivalent courses and the opening of 15.5 new 18-HEQ.

The contraction represents a continued correction in the industry, with supply and demand returning to balance after an unsustainable 20-year period of growth in which the U.S. golf market added more than 4,000 new facilities and increased overall supply by 44%. Since 2006, when the trend of more golf course closures than openings began, the cumulative reduction of the total supply is approximately 7%.

“While no golfers like to hear stories about golf courses shutting down, the NGF ultimately views this gradual reduction in the U.S. course supply as a natural economic response,” said NGF Chief Business Officer Greg Nathan. “It helps the supply and demand balance in an over-saturated industry and, with American golfers still having almost 15,000 green-grass facilities at which to tee it up, it’s a trend we expect to continue for several more years.”

The U.S. remains the best-supplied golf market in the world, with its 14,794 facilities representing about 45% of the global supply.

Affordability and Accessibility

Affordability and accessibility is a continuing theme in the golf course industry. The average price paid for an 18-hole round of public golf is approximately $34, while the 2017 count of 2,497 municipal facilities marks an all-time high for the industry.

With 75% of U.S. courses open to all players, it equals the highest public-to-private ratio of facilities in the game’s history. In certain cases, this is a reflection of municipalities acquiring courses to control land use, in turn preserving these locations as an amenity for local communities.

While the 2017 debuts of new courses like Streamsong Black in Florida, Shepherd’s Rock in Pennsylvania and Bayou Oaks in Louisiana generated excitement among golfers and in the golf media, the biggest investment in the industry remains major renovation projects.

The NGF has tracked about 1,100 major course renovations – a minimum of nine holes temporarily closed for at least three months — completed since 2006, representing a total investment of almost $3.25 billion. That total doesn’t account for the even more extensive list of minor rehabilitation projects which are done with very little, if any, impact on a course’s operation.

The NGF’s outlook for 2018 holds form with recent years, with the expectation for a further balancing of supply and demand. In a competitive and oversupplied environment, the projection is for approximately 15 to 25 new course openings, 75 to 100 major renovation projects, and the additional closure of 1% to 1.5% of the total supply.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

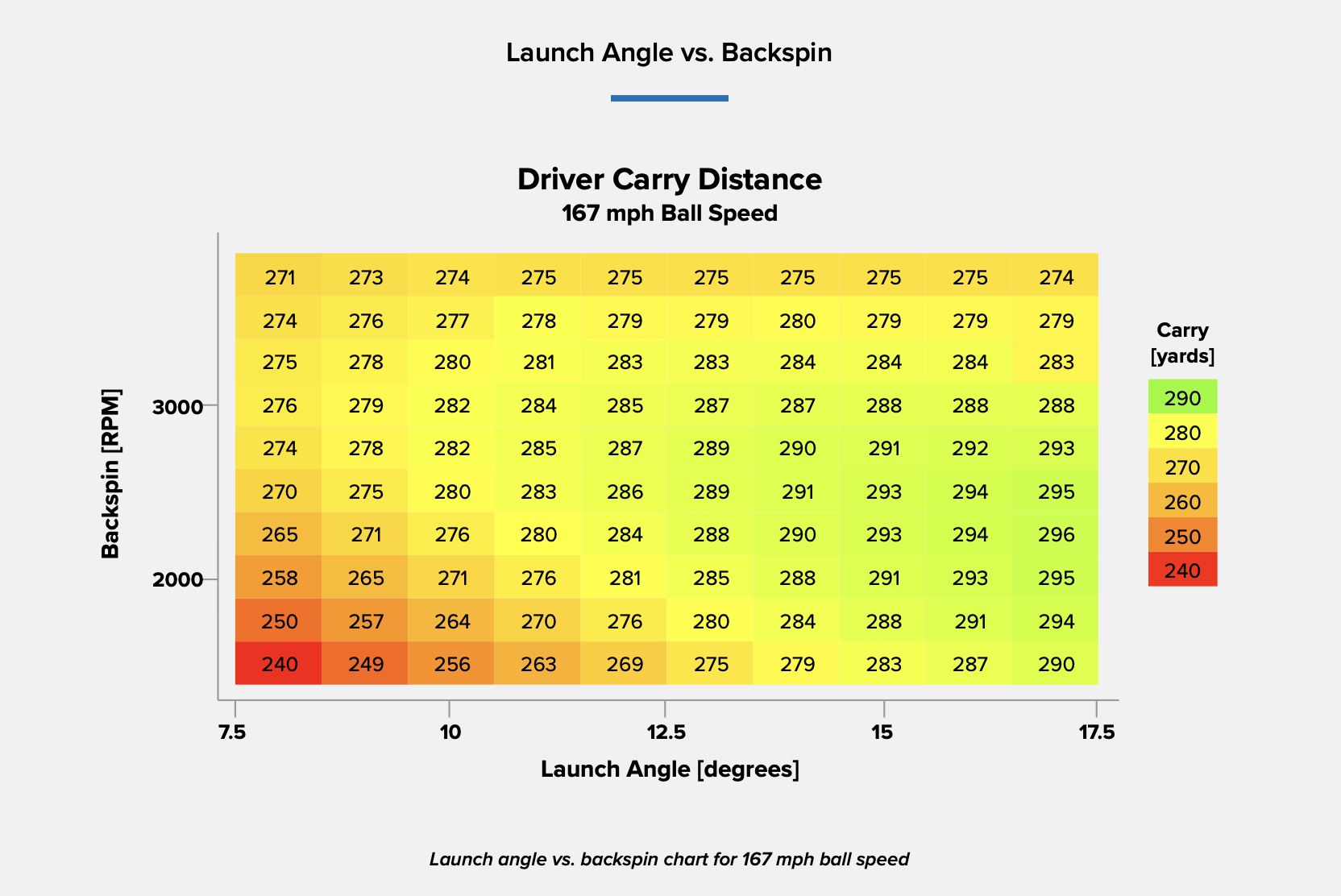

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...