NGF’s 2019 Golf Industry Report Overview

Golf is an $84 billion industry that is adapting to cultural and behavioral shifts, like many other aspects of society.

Golfers play, watch, engage and consume the game in different ways than in years past. Their spending habits are changing too — not only what they’re buying, but how they’re buying and how often they’re buying.

The NGF’s annual Golf Industry Report takes a high-level view of this evolution, presenting a balanced state-of-the-industry overview that aggregates many of the game’s key metrics. It is intended to help inform business leaders in all segments of the industry while providing a holistic view of the game to the public and media.

NGF Members: Click here to download the report

While not at pre-Great Recession levels, golf is experiencing a recent stabilization in on-course participation, with a new support level around 24 million golfers. Total golf participation climbed to 33.5 million in 2018 when factoring in increasingly popular off-course forms of the game such as Topgolf, Drive Shack and indoor simulators. Almost one in every nine Americans plays golf in some form, more than participate in sports such as basketball, tennis, baseball and skiing.

Golf is the No. 1 outdoor pay-for-play, individual participation sport in the U.S. and, as a result, its revenues and spending are inexorably tied to outside factors such as the weather and economy.

That was abundantly clear in 2018, when rounds-played dipped 4.8 percent to 434 million, a decline driven by heavier precipitation levels than normal across the country during the busiest months for golf. The reduction in rounds was more due to a lack of playable days than a lack of interest, however. In fact, participation increased incrementally for the first time in 14 years, with an estimated 24.2 million people playing golf on a course.

There were 2.5 million junior golfers last year, and another 2.2 million in that age group (6-17) who played exclusively off course. Accounting for about 10% of all on-course golfers, the junior ranks are more diverse than ever: 36% are girls compared to 15% in 2000, and almost one quarter are non-Caucasian while 6% were minority participants 20 years ago.

The number of female golfers has held steady at approximately 6 million for the past five years (5.6 million currently, including 900,000 juniors). This represents 23% of all golfers. Females represent a disproportionately higher percentage of beginners (31%), juniors (36%) and off-course participants (44%) than they do in the overall golf population.

There were an estimated 2.6 million beginners (those who played on a golf course for the first time) in 2018, which is near record levels and marks the fifth straight year with over 2 million newcomers.

Interest in playing golf among non-golfers is at an all-time high, with 14.7 million people saying they would like to play golf on a course, but that latent demand is not enough to celebrate. The industry needs to continue making golf more welcoming and less intimidating for beginners while at the same time embracing its steady pool of committed golfers, a core group that accounts for about 95 percent of spending and rounds-played.

Future growth will also be dependent on converting more trials into committed players and further expanding the demographic mix of participants to include more women and non-Caucasians.

As the game faces persistent economic and societal headwinds, the big-picture view of golf’s most recognizable measurables – approximately 15,000 facilities, 24 million golfers and in the neighborhood of 450 million rounds-played — is strikingly similar to 20 to 25 years ago. That was before a transcendent player named Tiger Woods spurred unprecedented levels of interest and, buoyed by a strong economy and housing market, a course building boom that would prove unsustainable.

Woods’ latest comeback from back surgery was a boon for the golf industry in 2018, contributing to a surge of interest and a ratings jump of almost 30 percent for televised tournaments in which he played. In addition to the participant base of about 33.5 million — both on-course and off — there were another 74 million who watched or read about the game without playing, a year-over-year increase of approximately 12 percent that’s in part attributable to Woods and a host of emerging stars throughout professional golf.

Golf’s total reach of 107 million overall is noteworthy, representing more than one-third (36%) of the U.S. population over the age of five.

Engagement with the sport also extends to what golf-related products consumers are buying in addition to how much they’re playing and how they’re watching, listening to or reading about the game. The market for golf clubs and balls was $2.7 billion in 2018, up about 6% from the previous year.

Even so, golf-related businesses face a highly-competitive environment in terms of how people are choosing to spend their free time and discretionary income, in challenges from other recreational activities, and even in proposed tariffs on U.S. imports from China including golf bags, hats and mower parts. Consolidation in the equipment and retail markets continues, as a greater percentage of consumers turn to online purchases over traditional brick-and-mortar businesses. Many retail businesses are adapting by offering more services (lessons, clinics, repairs) or experiential offerings (club fittings, launch monitors, simulators) to complement their sales of equipment and apparel.

On the supply side, the course closures that have outweighed new openings since 2006 are part of an ongoing correction within the industry.

A total of 198.5 18-hole equivalent courses closed throughout the U.S. in 2018, while 12.5 new 18-HEQ opened, a net reduction of 1.2% in the world’s best-supplied market. Among the highly-regarded new openings were Mammoth Dunes and the 17-hole Sandbox par-3 course at Sand Valley Resort in Wisconsin; Sage Run at the Island Resort and Casino on Michigan’s Upper Peninsula; the Ohoopee Match Club in Georgia; and Ozarks National at Big Cedar Lodge in Missouri.

This balancing of supply and demand is one that many course owners have taken advantage of thanks to soaring real estate values, often choosing to sell their property as part of a planned exit strategy. Development activity remains concentrated on renovations rather than new construction, with owners and operators investing more than $3.5 billion in major renovation projects over the past 13 years. As a result, remaining golf facilities, in general, are in stronger financial health and are actively seeking to improve their overall quality.

Information contained in the NGF’s Golf Industry Report is made possible by the industry’s biggest research department dedicated to the game and business of golf. NGF research is funded in large part by its members, who continue to support the organization’s mission to supply the golf industry with objective and reliable data on the state of the game, helping foster smarter and more energized golf businesses.

Interested in NGF Membership? Click Here to Find Out More

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

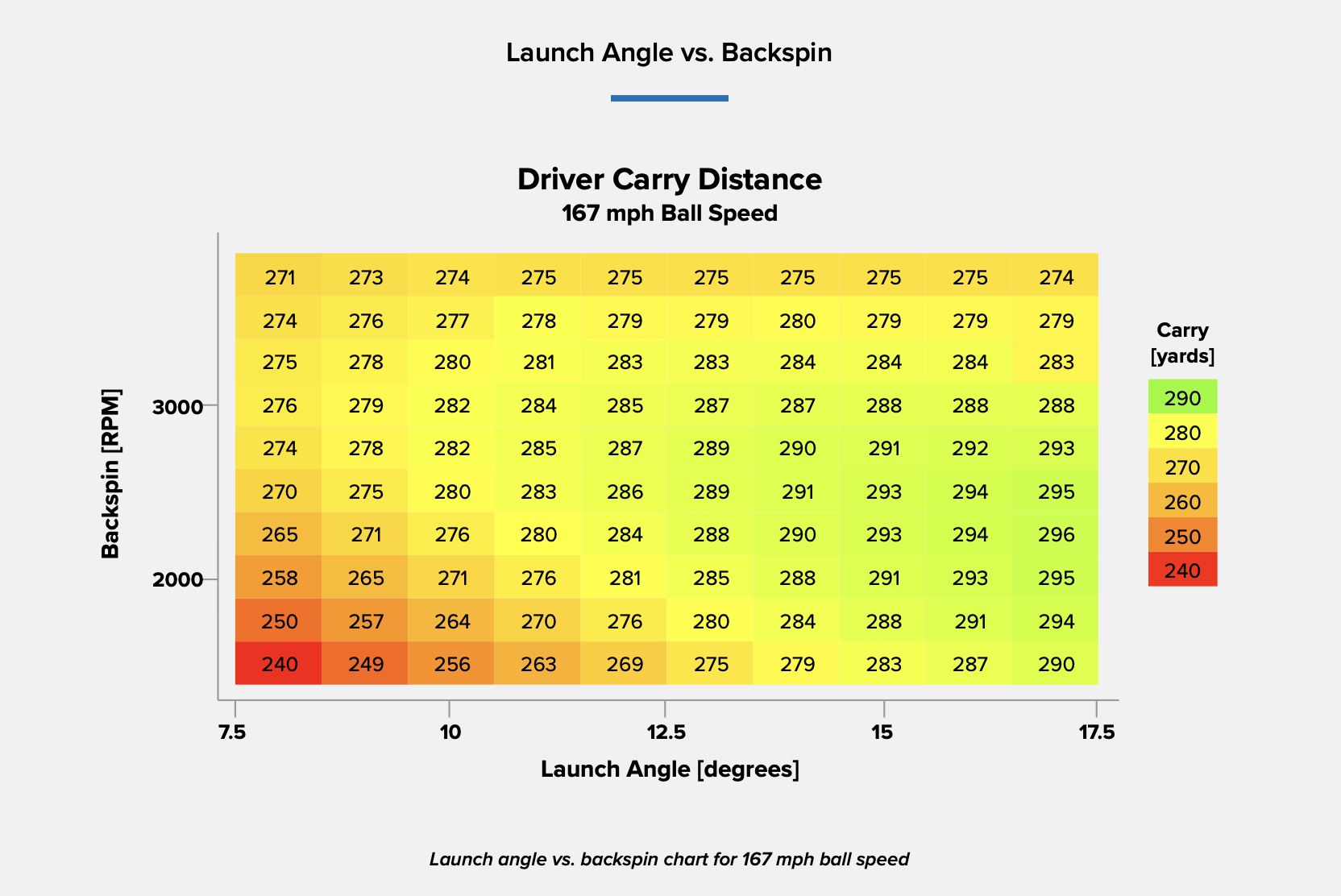

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...