NGF’s 2017 Golf Facilities Report

Correction in Golf Course Supply Continues While Renovations Spur Investment

The golf course industry continues to go through a period of natural correction, as expected, following a 20-year period of the most dramatic growth in the game’s history.

At the end of 2016, there were a total of 15,014 golf facilities in the United States, comprising 14,117.5 open and operating 18-hole equivalent (18-HEQ) courses. The final 2016 count showed a net reduction of 171 courses, which amounts to a 1.2% contraction from 2015.

Golf course “stocks and flows” in 2016 included the permanent closure of 211.5 courses and the opening of 15.5 brand new courses. There were 95 courses that reopened after comprehensive renovations, while another 11.5 courses deemed “permanently closed” welcomed golfers back following a prolonged shutdown. Also noted below in the chart summarizing supply movement are courses that temporarily ceased operation to implement a course renovation.

NGF MEMBERS: Download the complete Golf Facilities in the US – 2017 report here

It is noteworthy that since 2006, when the trend of more golf course closures than openings began, the cumulative reduction of the total supply is just 5.9%. That pales dramatically in comparison to the unprecedented 44% growth in course construction during the two decades prior. The U.S. remains the best-supplied golf market in the world, boasting almost 45% of global facilities.

The approximate 1% net reduction in courses in the 2016 count demonstrates a further contraction of the market.

“NGF views the slow and steady reduction of U.S. courses as the natural economic response to the opening of more than 4,000 new golf facilities between 1986 and 2005,” said NGF’s Chief Business Officer Greg Nathan. “This gradual reduction is indicative of the market’s healthy self-balancing of supply and demand, and a trend we expect to continue for several more years. American golfers have more than 15,000 green-grass facilities where they can tee it up, one reason the contraction in supply has shown no direct impact on frequency of play, with rounds-played in the U.S. increasing each of the past two years.”

Why does NGF use 18-HEQs in reporting total supply?

How does NGF verify Openings and Closures?

Investment in golf facilities remains significant, with major renovation projects replacing new construction as the largest source of U.S. golf course development activity. After the building boom resulted in 4,926 new 18-HEQ courses opened from 1986 through 2005, there have been 492 new courses since.

NGF tracked 986 major course renovations completed since 2006, representing a total investment of at least $3 billion. Examining full renovation projects over the last several years, the average capital investment was approximately $3 million for 18 holes, a conservative figure that takes into consideration a wide range of facilities, project types and geographic locations. The $3 billion investment into America’s golf courses does not include minor rehabilitation projects, which are done without any, or limited, impact on the course’s operation. (Note: to be defined as a renovation, as tracked by the NGF, a minimum of nine holes must be temporarily closed for a minimum of three months to conduct the work.)

Florida leads the way in renovations over the past five years, with 10% of its 1,170 (18-HEQ) courses (the most in the U.S.) undertaking major projects. Texas, California, North Carolina, and South Carolina also rank among the top five states in golf course renovations since 2012.

It wasn’t only private clubs conducting renovation. In fact, the majority of major work was conducted at public courses. Of the more than 400 full-scale course renovations in the last five years, 55% involved daily fee or municipal facilities and 45% were done by private clubs.

There is still new course activity in the pipeline, with NGF tracking 37 (18-HEQ) facilities currently under construction and another 55 in the planning stages. Of those, 28 are daily fee courses, with 12 new facilities and 16 additions to existing properties. Courses such as Streamsong Black in Florida, the reversible Silvies Valley Ranch in Oregon, Bayou Oaks in Louisiana, and Stoatin Brae in Michigan are among those scheduled to open in 2017.

The Loop at Forest Dunes in Michigan, Sand Valley in Wisconsin, Scottsdale National’s “Other Course,” and Mossy Oak in Mississippi highlighted the 18-hole courses opening in 2016.

Mossy Oak, built in Mississippi by architect Gil Hanse, opened in September 2016.

The U.S. golf course supply is now more accessible than ever, as the 2016 municipal facilities count of 2,492 marks an all-time high for the industry. Additionally, with 75% of courses open to all players, it equals the highest ratio of public-to-private facilities in history.

A total of 56 private courses (18-HEQ) were converted to public in 2016, while 31 public facilities turned private. The net impact in 2016 conversions was 25 courses being added to the public supply.

The quality of U.S. golf supply continues to improve, with contraction predominantly located in the most over-supplied areas. More than two-thirds of the courses that closed (69%) in 2016 were value-priced properties, meaning they had greens fees priced below $40, with the majority of closures coming in highly-concentrated golf markets. Bearing this out, four of the five states with the highest course supply were also among the top five states with the most closings: Florida, California, Texas, and Michigan.

These closures shouldn’t have any meaningful effect on the overall number of rounds-played as customers shift to other area golf facilities. The total number of U.S. rounds increased by 1.8% in 2015 and was up 0.6% in 2016.

Driven in part by escalating competition and rising costs, independently-owned courses are increasingly hiring professional management companies to run operations. This trend is part of an ongoing effort to improve customer service levels, enhance course conditions, and add technology and amenities while implementing best practice initiatives. Management companies that run multiple facilities often can provide economies of scale, helping independent operators save money on major purchases such as course equipment and other turf maintenance supplies.

Privately-owned public courses (defined as “Daily Fee”) – which make up 56% percent of the U.S. supply — accounted for 90% of the closures in 2016, with the 10% balance equally split between municipal venues and private clubs.

While the majority of golf courses that were permanently shut down in 2016 were 18-hole layouts, the closures disproportionately affected 9-hole courses. The 9-holers accounted for 29% of all 2016 closures, while 9-hole facilities nationwide represent just 14% of all 18-HEQ.

NGF’s outlook for 2017 is in line with recent years, the golf course business will remain very competitive, inspiring operational innovation and continued investment in renovation over new development. The projection is for approximately 15 to 25 new course openings and 75 to 100 major renovation projects in 2017.

Golf remains oversupplied, so further balancing of supply and demand is expected. Inevitably, the strong real estate market – both commercial and residential – will continue to create demand for desirable golf course properties, leading some facility owners to accept offers as an exit strategy.

The reality is that not all closures are sad stories, as few industries in sports or entertainment have a spatial footprint comparable to golf.

In certain cases, “the dirt is worth more than the grass,” according to NGF President and CEO Joe Beditz, referring to the value of the land courses are built on. Course closures in recent years have been turned into significant development projects, multi-use parkland or nature conservation areas. Thus, closings are projected to be in the 150 to 175 range as the natural contraction continues gradually, extending incrementally into its second decade following the two-decade run of golf course growth.

The Golf Facilities in the U.S. Report – 2017 Edition summarizes the nation’s total supply of daily fee, municipal and resort golf courses, as well as private clubs. The data is broken out by state and region. The report also includes detailed information on golf course openings and closures in 2016, as well as the number of facilities currently in planning and under construction.

For a complete look at the U.S. facility supply, download the full report at www.ngf.org/pages/golf-facilities-us (free for members), or call 866‑275‑4643.

Why Does NGF use 18-HEQs in reporting total supply?

18-HEQs (the total number of holes divided by 18) is a derivative measure NGF uses to provide the most accurate account of total golf course supply in the U.S. For example, two stand-alone 9-hole courses (courses are defined as a tract of land containing at least 9, but not more than 18, holes of golf) are measured as one 18-HEQ even though they are part of two different golf facilities. (Facility is defined as a business location where golf can be played on one or more golf courses). Likewise, a facility with 27 holes of golf would be measured as 1.5 18-HEQs courses. As a result, the total number of facilities and 18-HEQs are not directly comparable.

How does NGF verify Openings and Closures?

Each year, NGF takes exhaustive measures to track openings, closures and renovations to provide the most accurate and comprehensive database of golf facilities in the U.S. (as well as in the other 200+ countries around the world). Every golf course in the U.S. is contacted and their status is verified, including the total number of holes they have and whether they plan to close or currently have nine or more holes closed for renovation. Permanent closures found during these contacts or through other sources are then verified and documented.

In identifying openings, NGF maintains contact with most golf course builders and architects. Additionally, NGF monitors additional sources, including media and industry publications that assist in identifying new openings. Courses previously reported as under renovation are contacted to verify the date of reopen. Additionally, NGF tracks the reopening of courses that were previously closed for reasons other than renovation.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

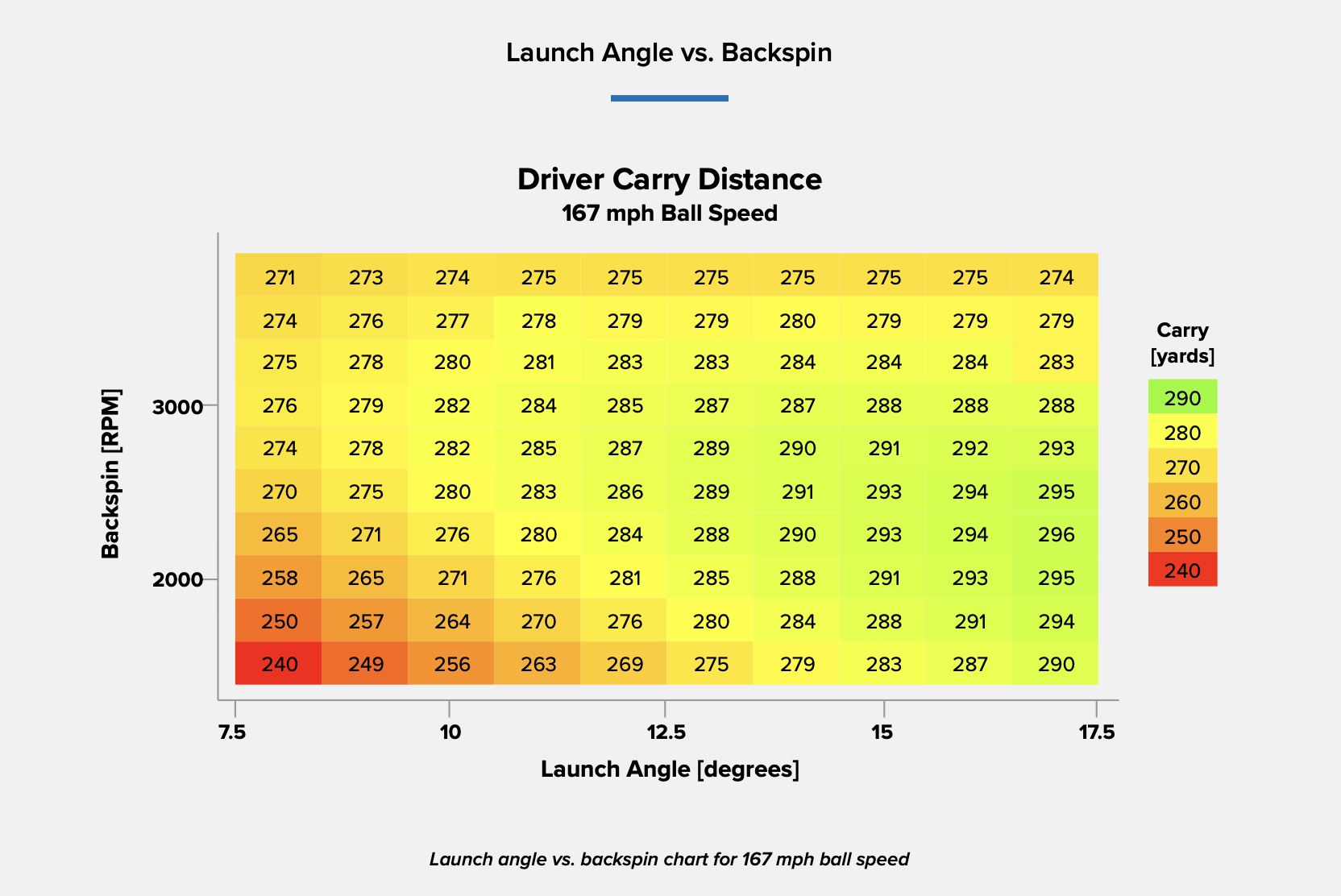

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...