Executive Members

Q1 2024 – Cumulative U.S. Rounds Played

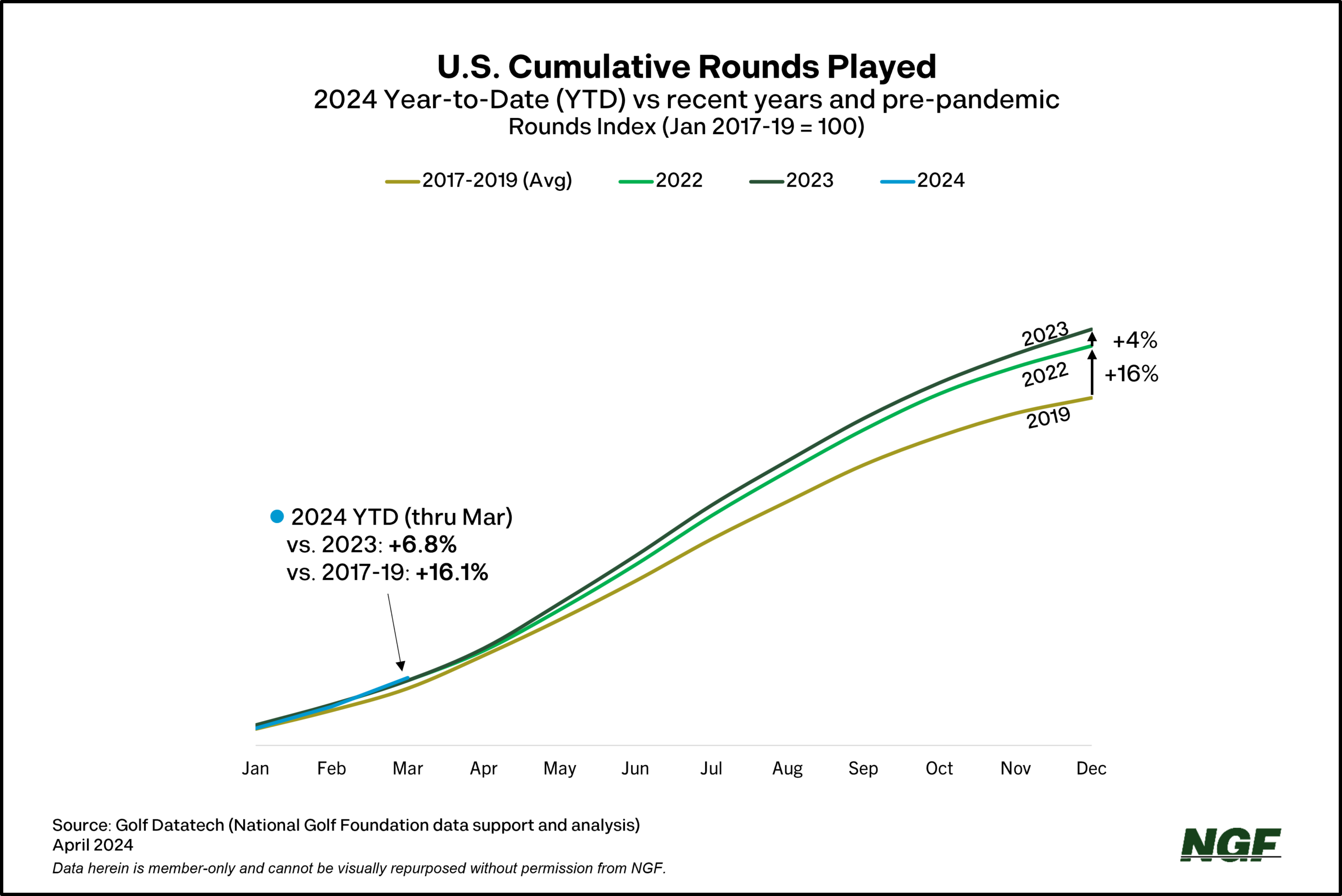

The accompanying graphic is a trend of cumulative rounds played in the U.S. in 2024 (blue line) in comparison to other recent years and the three-year, pre-pandemic average. Through the first quarter of 2024, the blue line at the bottom left remains relatively low due to the lower volume of total rounds early in the season but is now tracking ahead of the others after a strong March. This line will climb in a steeper fashion throughout the spring and summer with a greater volume of play. Total collective play nationally in January, February and March was about 7% higher than a ...

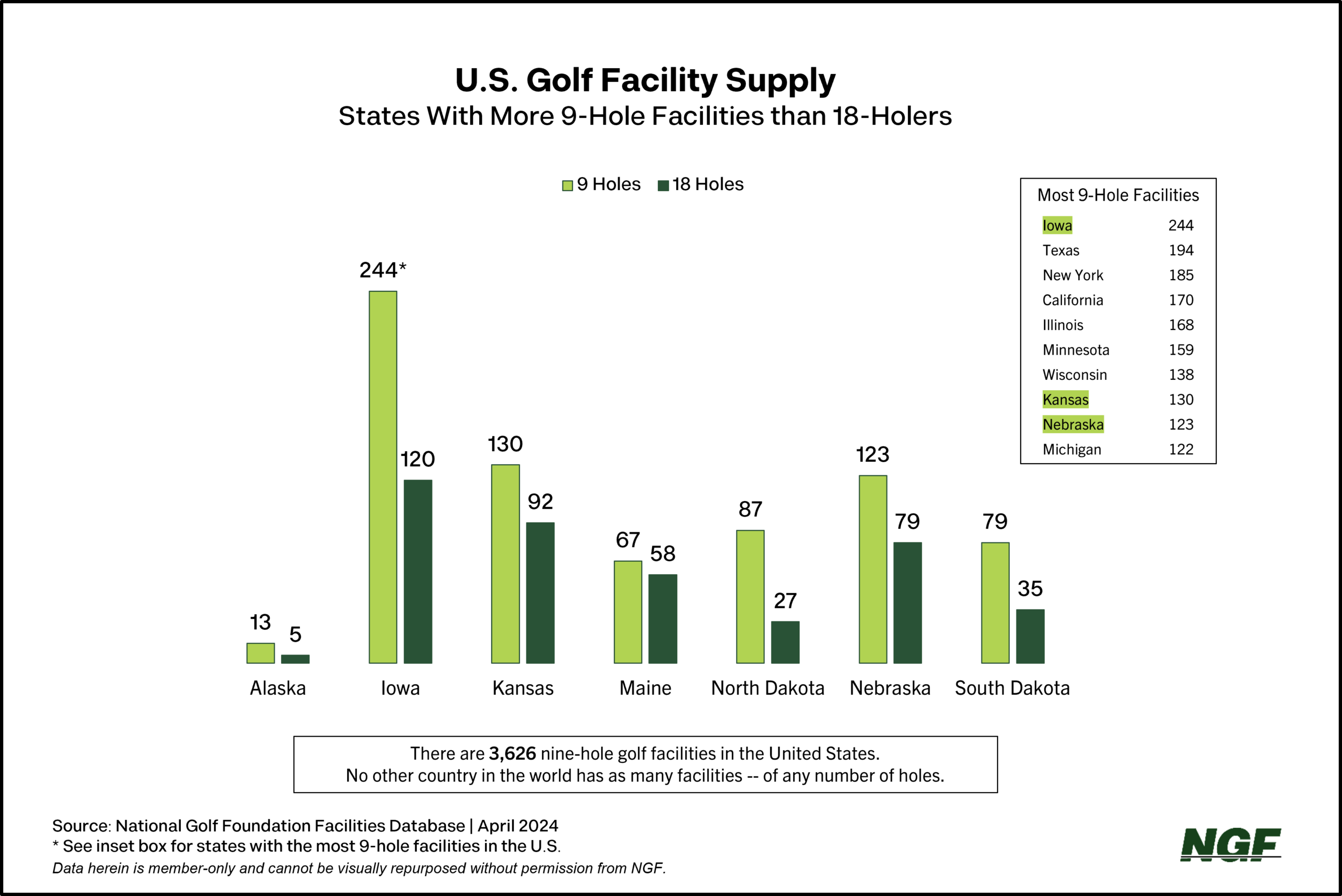

9-Hole Golf: States With Most Facilities, Highest Proportion

Iowa has far and away the most 9-hole golf facilities in the nation, more than well-supplied states like Texas, New York and California. Florida, by the way, isn't even in the Top 10 when it comes to 9-hole facilities, but has a wealth of 9-hole courses spread across its many facilities. Only seven states in total have more 9-hole facilities than 18 holers, most of which are rural and more sparsely-populated.

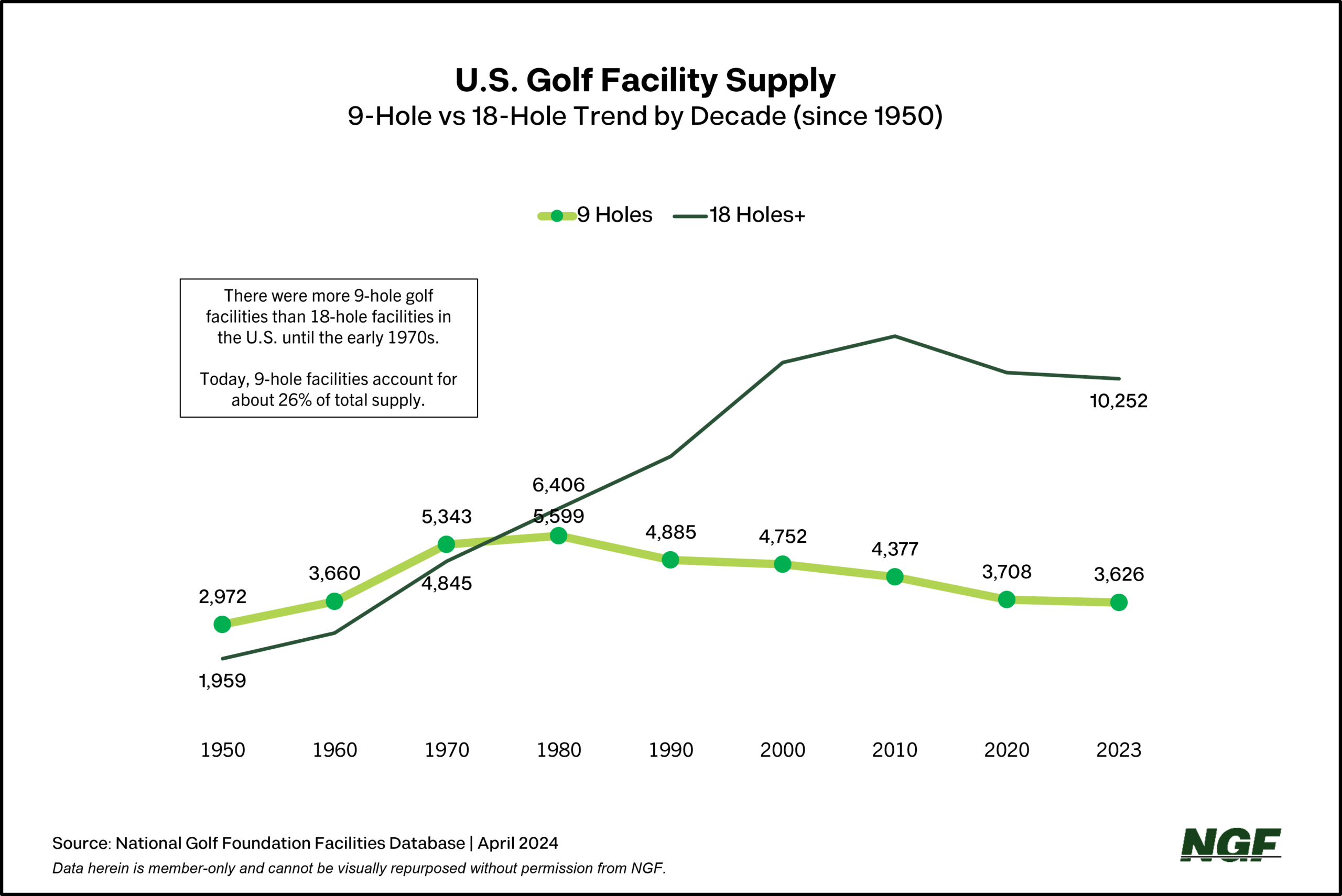

9-Hole Facility Supply Trend

Did you know that the number of 9-hole golf facilities in the U.S. outnumbered the number of 18-hole facilities until the 1970's? The 1960's ushered in the democratization of golf, helped in part by a charismatic "everyman" in Arnold Palmer, as demand from a growing middle class drove the development of public courses across the nation. From 1960 through 1975, more than 5,000 new facilities were opened -- and the majority of those were 18 holes rather than 9. Since 1980, the number of 9-hole facilities has dropped fairly significantly, either due to closures or, more frequently, adding another nine to bring them to 18 holes (...

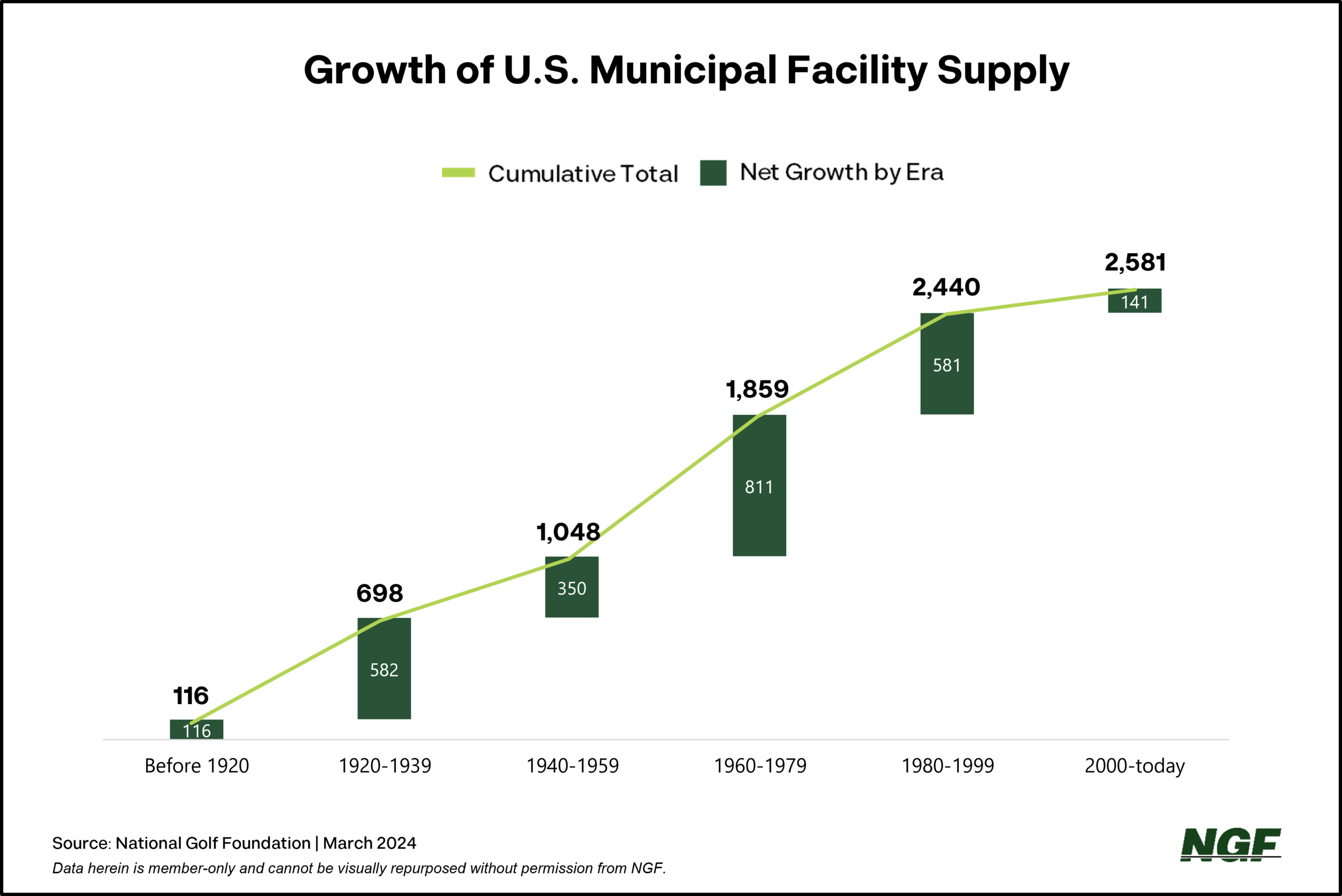

Historical Growth of Municipal Growth

The 1960s saw the democratization of golf, when demand from a growing middle class drove the development of public courses across the nation. A robust 445 new municipal courses opened that decade, a record number that has never been seriously challenged. Another 350+ municipal facilities were added in the 1970s, as municipalities continued to provide golf for its citizens, building new courses and acquiring existing ones. That two-decade stretch remains the most significant era of growth for municipal golf.

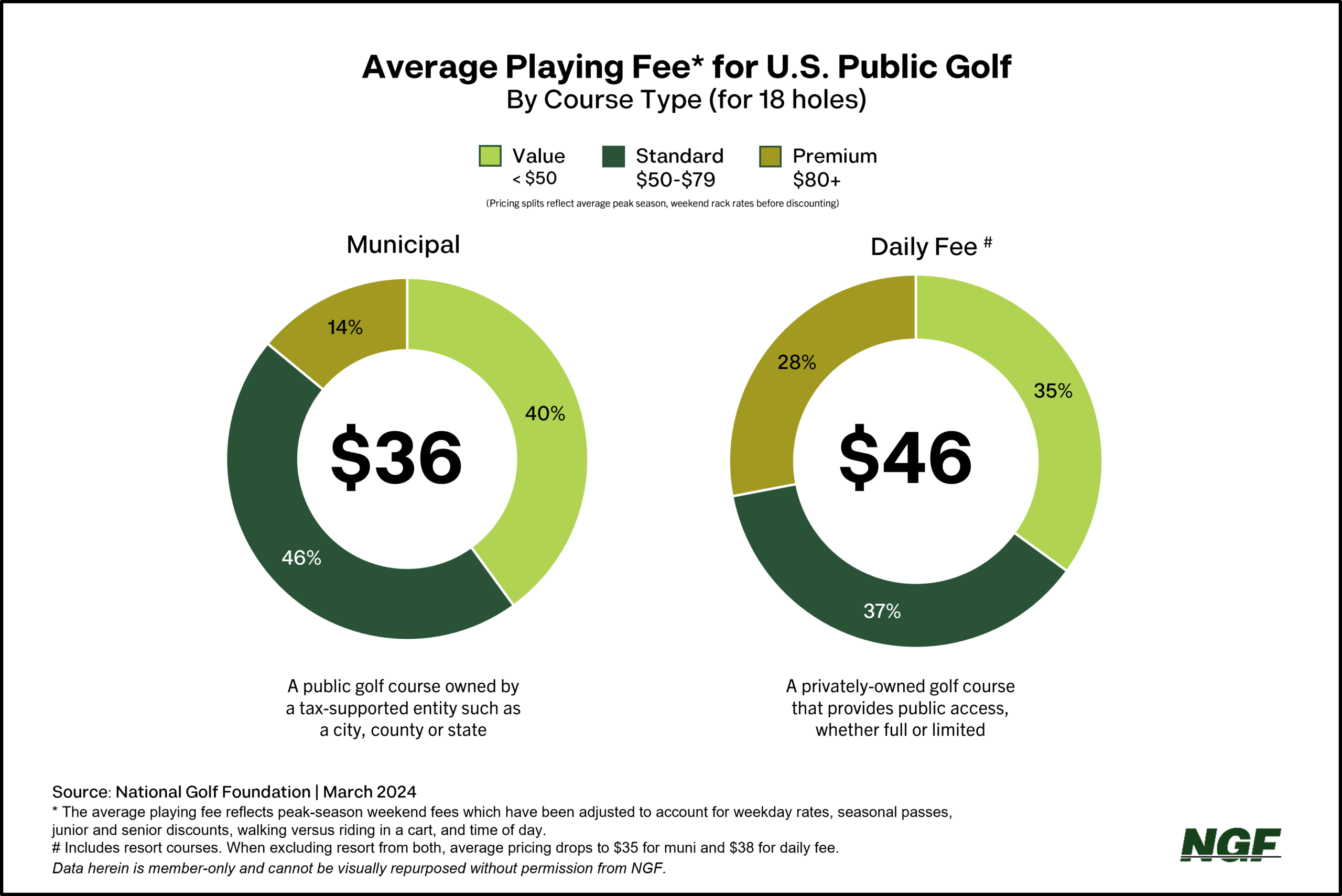

Average Costs for U.S. Public Golf

The average playing fee for an 18-hole round of golf at a U.S. public golf course was $43 in 2023, an increase of about 18% since 2019. This cost reflects peak-season weekend fees which have been adjusted to account for weekday rates, seasonal passes, junior and senior discounts, walking versus riding in a cart, and time of day. Average playing fees at municipal courses are roughly 22% lower than those at daily fee courses (including resorts). When excluding resort courses, average municipal pricing is still 8% less than the average at daily fee public courses.

The accompanying graphic is a trend of cumulative rounds played in the U.S. in 2024 (blue line) in comparison to other recent years and the three-year, pre-pandemic average. Through the first quarter of 2024, the blue line at the bottom left remains relatively low due to the lower volume of total rounds early in the season but is now tracking ahead of the others after a strong March. This line will climb in a steeper fashion throughout the spring and summer with a greater volume of play. Total collective play nationally in January, February and March was about 7% higher than a ...