Tariffs on Chinese Products Could Affect Golf Industry, From Hats to Bags

Some sectors of the golf industry could find themselves in the rough as a result of the proposed tariffs on $200 billion worth of U.S. imports from China, among them golf bags, hats and mower parts.

The tariffs would mean a 10 percent to 25 percent tax on imported goods, potentially forcing some companies to increase prices or move manufacturing elsewhere unless they absorb the added expense.

“It’s something we are watching very closely as it could potentially impact our supply chain and cost of goods if the change in fact becomes reality,” said David Shaffer, the Vice President of Sales and Marketing of Imperial Headwear, an NGF Top 100 golf business. “We still don’t know if or when it might go into effect so it’s difficult to say exactly how we will handle it. But we are evaluating all options at this time so we are prepared in the event the duty is increased for headwear coming out of China.”

Shaffer said Bourbon, Missouri-based Imperial has multiple manufacturing factories around the world, including several in the U.S. that make certain styles and lines domestically.

Imperial, a leading manufacturer of premium and customizable golf headwear, is keeping a close watch on the tariffs situation.

Hats are among the more than 6,000 tariff lines under consideration as a result of a directive from President Trump. Other items on the U.S. Trade Representative list that could potentially impact the golf industry include golf bags with an outer surface of leather or composition leather, parts of mowers for sports grounds, and gloves specifically designed for use in sports.

John Iacono, the President of golf glove-maker Zero Friction, said his company is “keeping an eye on the tariff situation and will address it as needed. But at this time, our company is not very affected.”

Under Armour and Nike are among the shoe brands with a golf presence that have been critical of the tariffs, saying they hurt consumers, jobs and business.

The new levies proposed by the Trump administration were a response to China’s decision to retaliate against the U.S.’s initial round of 25 percent tariffs on $50 billion worth of Chinese goods. The USTR will hold hearings Aug. 20-23 in Washington, with a deadline for post-hearing rebuttal comments on Sept. 5.

Some business leaders in the golf industry are monitoring the tariff situation closely but have been reluctant to comment publicly due to Trump’s involvement in the golf business. Trump Golf, another business in the inaugural NGF GOLF 100, owns 19 golf facilities worldwide, including 12 in the U.S. that have supply chain connections with a number of manufacturers.

The U.S. Senate on July 26 did pass a Miscellaneous Tariff Bill that lowers existing tariffs on a wide variety of imported goods that includes golf club heads for drivers, hybrids, irons, wedges and putters.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

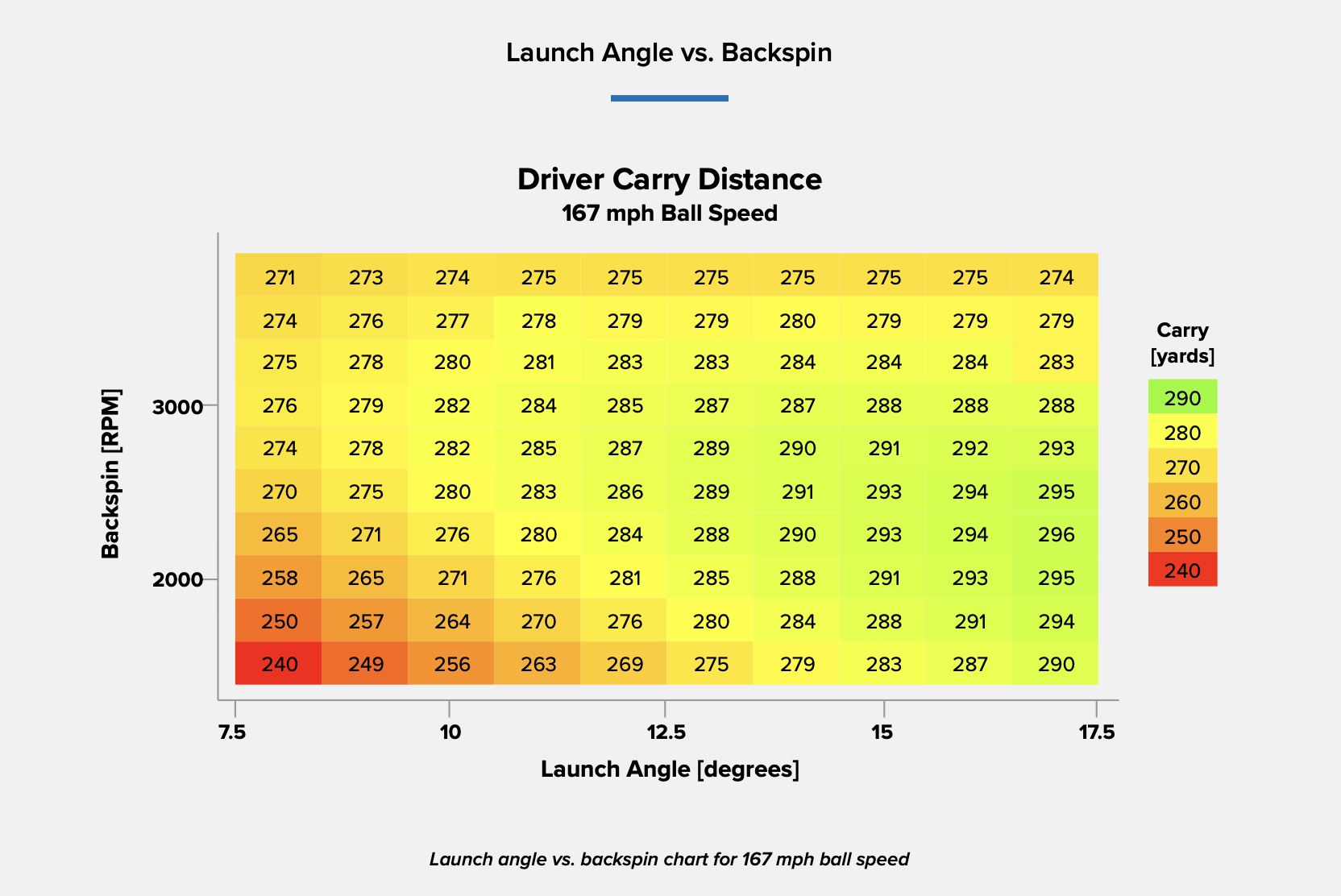

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...