The Churn

The big question in March and April was whether golf courses and retail would reopen and remain open. In May and June, we wondered how quickly and strongly the golf economy would bounce back from spring losses. Then, in July and August, our curiosity turned towards understanding how golfers were behaving differently in the new normal, and which consumer groups were contributing to the summer spikes in play and spend.

Now, as play has continued to increase month over month, the big unknown seems to be the extent to which we might retain new golfers and sustain increased levels of play when Covid is finally in the rear view. That’s of course a longer-term question, but we can certainly speculate based on past and current knowledge.

Let’s first recognize how we got to this point. There’s no question the leading driver of golf’s nationwide surge is less resource competition – fewer commitments, fewer trips, fewer available activities, and fewer ways to spend disposable income. There have been other transient factors too, like favorable weather, extended shutdowns at golf entertainment venues, and perhaps even a pandemic-induced need for mental and physical escape.

But nothing about the past few months seems structurally different for golf, whether with the product itself, the service that supports it, or the overall user experience … unless you count extended tee time intervals, which for a time seemed to produce faster, smoother and more enjoyable rounds.

Either way, we weren’t suddenly marketing ourselves differently, onboarding new players differently, or managing customer relationships differently. (In fact, remote check-in procedures may have made it more impersonal.) Which is to say we should expect a similar churn rate as before, because nothing changes if nothing changes.

The ability to retain customers has been golf’s Achilles heel for some time now. In the past five years alone we’ve “welcomed” more than 12 million people to the traditional game, and yet our ‘sea level’ has risen by only 200,000, give or take. It’s almost inexplicable, and signals a serious issue with the experience and/or perceived value among new customers.

We can certainly hope that the pandemic reorients consumers – making them appreciate open space, fresh air and less crowded activities than before. But those are probably fleeting effects.

Perhaps the one thing that may be different these days, and should contribute positively to golf’s retention rate, is the fact that more and more beginners are coming in with off-course experiences under their belts – specifically golf entertainment – which means more competence and confidence. Our data shows that beginners who’ve played at a golf entertainment venue are 20% more likely to say they’ll stick around, barring health or financial setbacks.

This message isn’t meant to be a tub of ice water dumped over the hopes of those currently celebrating golf’s surge, but it is a ‘bucket challenge’ of sorts.

If it motivates some to fight the natural tendency to relax and enjoy the extra business, and instead strive to identify our newcomers and make an extra-large effort to ensure that their experience is sticky … then it was worth the risk of dampening some of the enthusiasm out there right now. Encouragingly, we’ve had recent dialogues with operators about this very topic (experience and retention), and can sense a different level of determination.

Short Game.

"*" indicates required fields

How can we help?

NGF Membership Concierge

"Moe"

Learn From NGF Members

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Ship Sticks Secrets to a Hassle-Free Buddies Golf Trip

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

Read More... Golf Course Turf, Soil and Water Quality Diagnostic Testing

Golf Course Turf, Soil and Water Quality Diagnostic Testing

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

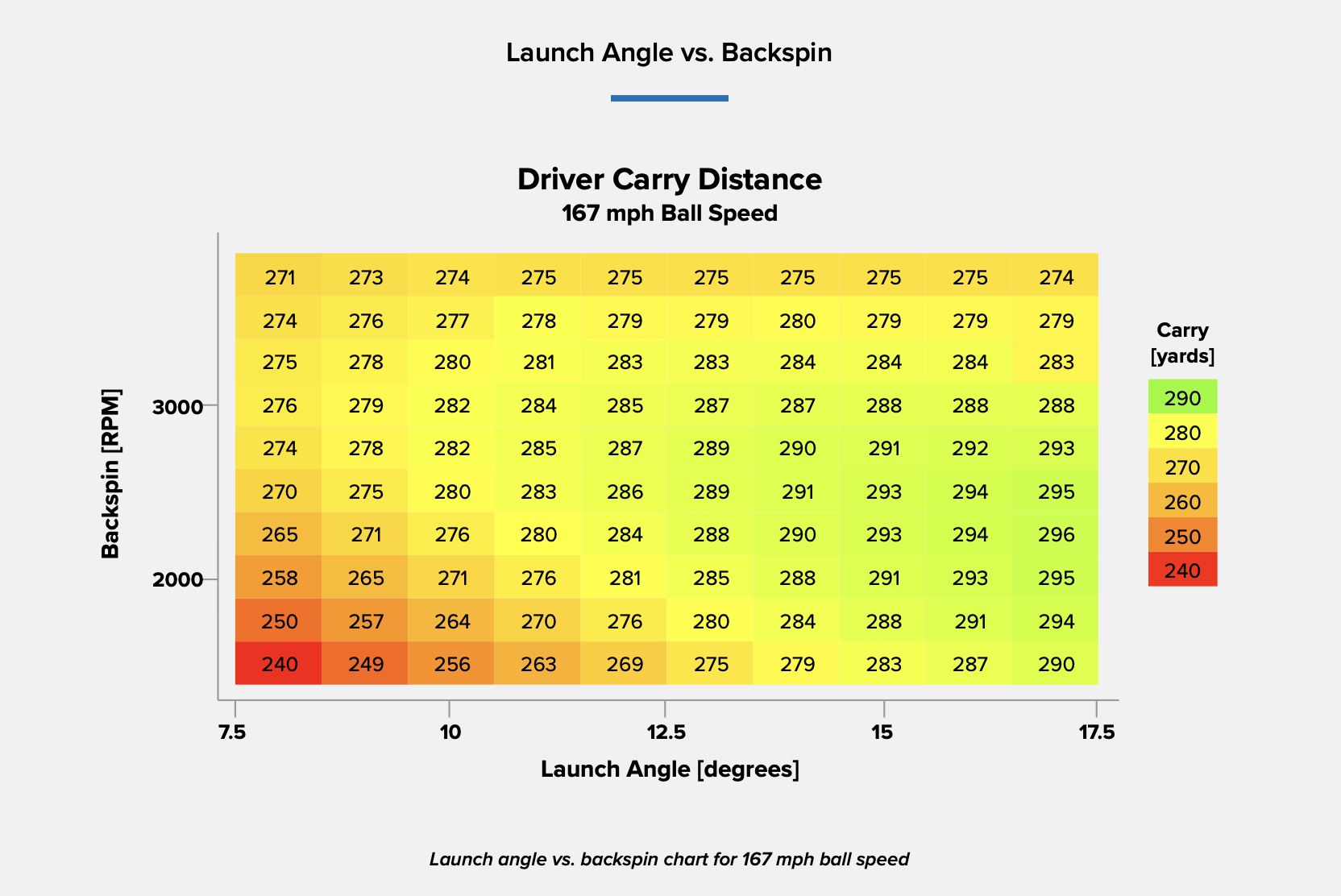

Read More... Unlocking Distance: Launch Conditions and Angle of Attack

Unlocking Distance: Launch Conditions and Angle of Attack

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

Read More...