Over the past few months, we’ve been exploring the concept of loyalty in golf, including a surprising disconnect between industry self-perception and customers’ actual experience, plus what it’ll take to build more meaningful connections. Today, we take the conversation a step further by examining a more fundamental challenge: the narrow conceptualization of who plays golf and why.

It begins with something as innocuous as stock photography, where a look at the most downloaded “golfer” images reveals startling uniformity: middle-aged white men, dressed neatly in their pressed khakis and polos, captured swing posing – perfect form – against pristine backdrops.[i]

While many in golf have expanded beyond these conventional portrayals, for decades the industry perpetuated this kind of visual homogeneity, and in doing so unintentionally narrowed perceptions of not only who plays, but how and why they play – suggesting golf is primarily about decorum and the pursuit of technical excellence.

A collection of some of the most downloaded Adobe stock “golfer” imagery.

This traditional archetype isn’t wrong, and continues to represent a valuable segment for golf businesses, but it overlooks significant demographic and psychographic truths.

Demographically, for example, women have powered 60% of on-course growth since 2019, while Black golfers represent 28% of the net gains (the latter group now makes up 7% of the active green grass participant base, up from about 4% five years ago). Beyond that, almost half of golf’s top prospects come from these same segments, which means the traditional visual narrative fails to reflect not only current growth drivers, but future ones as well.

The idealized mid-swing portraits also inadvertently narrow the story of why people play. From subtle visual cues to explicit messaging, most golf marketing tends to target “strivers” and “grinders,” but the reality is that only a subset of golfers – Core golfers even – say competition and challenge are their primary motivations for playing, which would explain why fewer than 20% take lessons, and an even smaller percentage maintain an official handicap. The rest are motivated by universal recreational factors like time in nature, stress reduction, social connection and travel opportunities. For them, golf is a unique means to these ends, rather than the end itself.

These gaps between marketing imagery and reality – demographic and motivational – trigger what psychologists might call ‘belonging uncertainty,’ which can create meaningful barriers to both initial and deepening engagement.

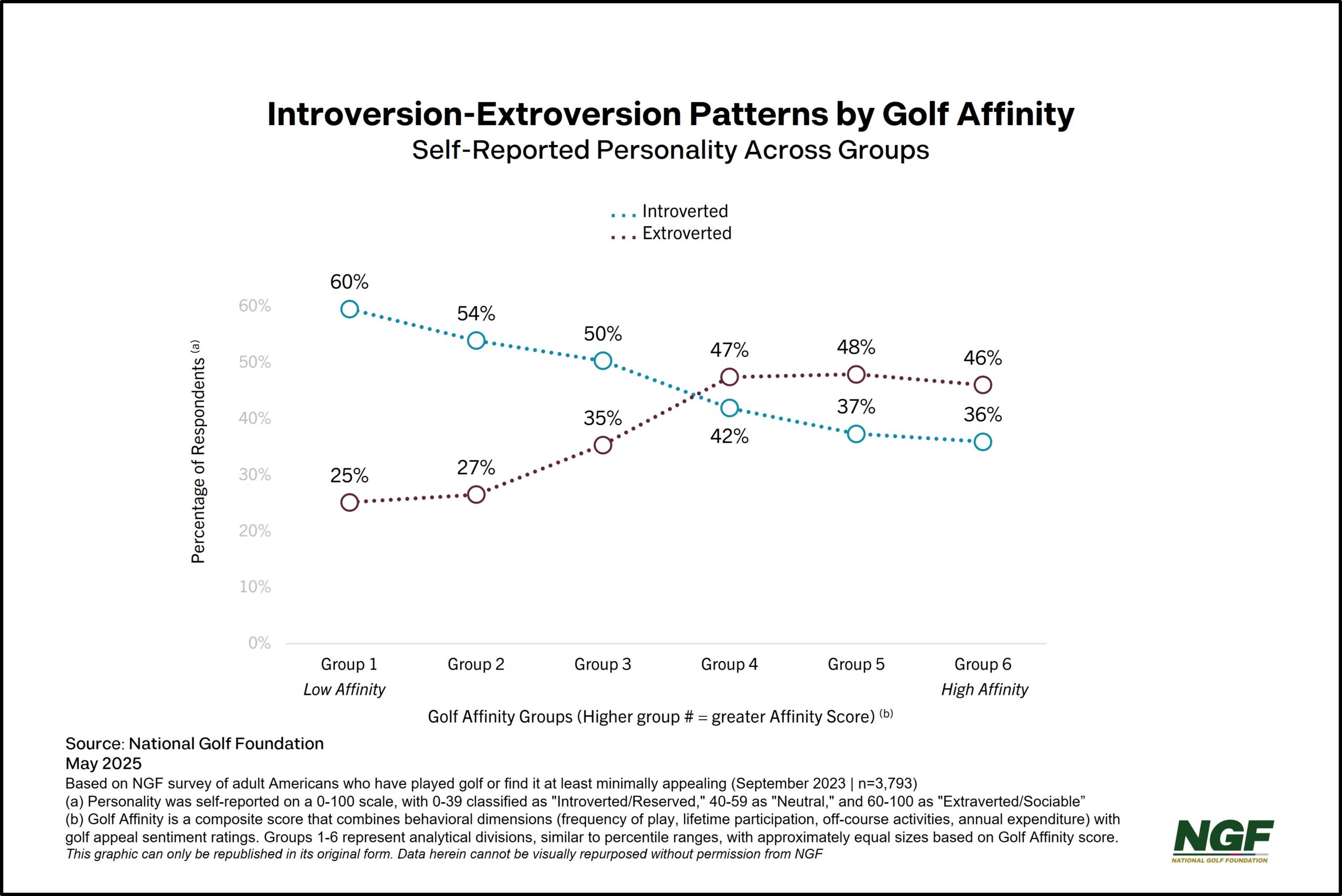

But the consequences of our historically-narrow view reach beyond marketing, likely influencing experience design itself. Our research reveals a surprising moderate correlation between depth of golf affinity and extroversion. It’s almost counterintuitive. Golf, with its built-in opportunities for quiet reflection, individual focus, and peaceful outdoor immersion, would seem naturally suited to introverted temperaments, and yet, somehow, the data suggests that as involvement deepens, the participant profile skews more extroverted. Is it possible that our imagery, messaging, play environments and/or experience design favor extroverted traits, and therefore create subtle barriers for a significant portion of the population (as much as 50% or more)? [ii]

The challenge of balancing traditional imagery and experiences with diverse and shifting needs creates a classic growth dilemma that spans industries. Consider Harley-Davidson, whose stock has plummeted more than 60% over the past decade as they’ve struggled to connect with younger generations seeking different experiences from their motorcycles. As described by one financial news institution, the company found itself ‘trapped between brand loyalists and future growth’ – honoring tradition and core customers whose preferences conflicted with those of emerging segments.[iii]

Golf isn’t ‘trapped,’ and there’s certainly no mandate for unlimited growth (particularly at the expense of the game’s distinctive character), but the industry still faces a similar strategic challenge. Long-term demand sustainability will depend on continuing to adapt messaging, experiences, and offerings with broader valuable segments in mind. Competitive athletes looking for life after sport (but without formalities and ceremonial trappings). Travel and experience collectors. Wellness warriors. Career-minded connectors. Groups for whom golf provides the context rather than the content of what they truly value.

With these challenges and opportunities in mind, we embarked last year on a major segmentation study with Heart+Mind Strategies to size and map the priority needs of modern golf consumers. We look forward to sharing insights from this research in the months ahead, as we work to ensure golf’s continued relevance for generations to come.

David Lorentz has served as Chief Research Officer at the National Golf Foundation since 2019, after joining the organization as an analyst in 2012. Lorentz leads a team dedicated to empowering golf business leaders through data-driven insights. Known for his rational thinking, economic mindedness, and human-focused approach, he brings valuable perspective and foresight to understanding the evolving business and consumer. Industry leaders rely on Lorentz's original research and insights to inform strategic decisions across both commercial and industry levels. He holds an M.S. in Applied Economics and Statistics from Clemson University and a B.A. in Economics from Xavier University. Lorentz is also a very proud native of Cincinnati, Ohio.