Over the past year or so we’ve talked about the improving supply/demand balance for golf in the U.S.

We continue to see indications of this move toward equilibrium in the year-end 2021 data, from a drop in course closures and improved overall facility health to an increase (however slight) … yes, an increase… in not one, but two facility types.

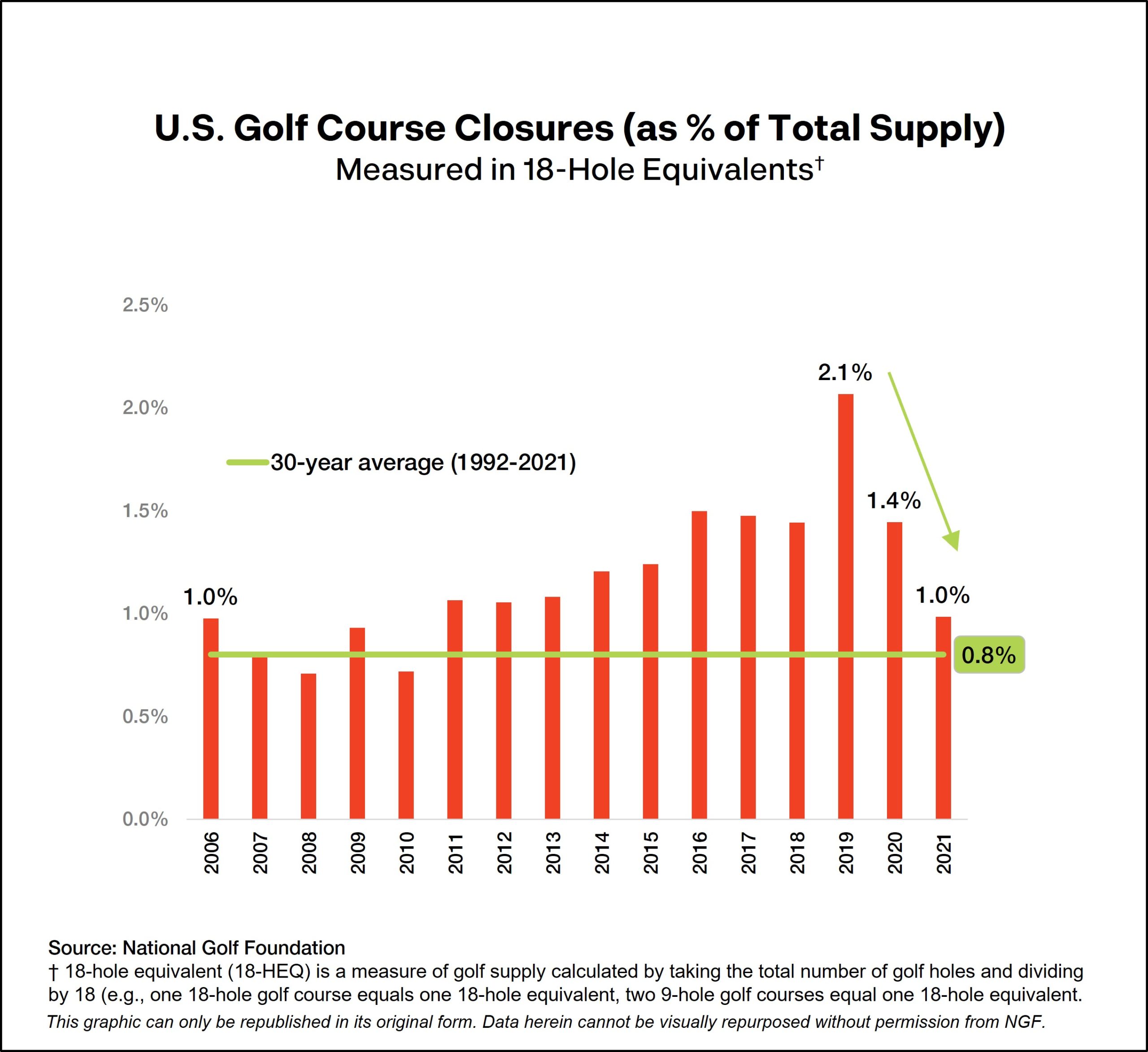

Golf courses are always going to close, such is the nature of any business. And when you have a business with an average footprint of about 150 acres, that’s going to hold particular interest for developers. So, it’s notable that the number of golf course closures in 2021 – 130.5 as measured in 18-hole equivalents – is down 53% from its peak two years ago, prior to the pandemic.

That’s less than a 1% decline in the overall U.S. supply, which totals 16,035 golf courses across 14,033 facilities nationwide.

So, how big is the U.S. market really?

Consider that if you combined all the courses in golf-rich countries like Australia, Canada, England, France, Germany, Ireland, Japan, New Zealand, Scotland, South Africa, South Korea, Sweden and Thailand, the U.S. still has over 400 more.

This despite the number of U.S. courses (measured in 18-HEQ) having dipped about 11% from its peak as the market continues to right-size. During the ongoing correction, more courses have closed than opened every year since 2006. The impetus for this shift – beyond the unsustainable building boom that saw over 4,000 courses open in the two-decade span up to that point – was the burst of the housing bubble that precipitated the Great Recession.

This continued correction makes it noteworthy that the number of municipal and private courses increased in 2021.

The number of munis has actually risen by 4% over the past decade, mainly boosted by municipalities acquiring financially-challenged daily fee or private clubs and offering them as a community amenity and preserved green space.

Perhaps more surprising is that the private course total increased in 2021 for the first time since 2007. In recent years, private supply had experienced a slight downturn, mostly because of financially-strapped midlevel clubs closing or converting to public facilities. The net rise of 12 private courses isn’t dramatic, but it’s another indicator of the movement toward a better balance of supply and demand.