Bay Harbor Golf Club on Lake Michigan, one of three Northern Michigan golf resorts operated by Boyne Golf, is poised for another record year.

Prior to the coronavirus pandemic, Boyne Golf enjoyed six consecutive record years for guest visits and play at its three resorts in Northern Michigan. Despite losing six weeks of the season in 2020 in the wake of Covid, Boyne’s properties rebounded during in the summer and fall months for another record-setting revenue year.

And like many U.S. golf facilities, Boyne saw that momentum continue in 2021, again breaking records for guest play across the 10 courses it operates. So, as the 2022 golf season gets underway in the northern reaches of the country, what’s the outlook – at Boyne and beyond?

“We’re ahead of where we were last year on room nights and even further ahead in terms of tee times and package revenue,” said Ken Griffin, the Director of Golf Sales and Marketing for Boyne Golf. “It’s all good news.”

“The most amazing thing (about 2021) was, in a typical summer, about 20% of our guests come out of Ontario, and we did that all with no Canadians. We would have said we would have never done that without Canadians,” Griffin added. “Now this summer we get Canadians back. They’re booking and the border restrictions right now have lessened, so it’s more reasonable for them to come across. That’s going to be a sheer gain. Because we had basically written them off for two years.”

The return of Canadian golfers is just one of the reasons golf destinations like Boyne are anticipating a big year. A recent NGF survey of 75 U.S. golf resorts found that advance bookings for 2022 golf trips are up 12% over the same period last year, and almost 20% versus before the pandemic.

The golf season is also just getting started at Destination Kohler in Wisconsin, but rooms are filling fast for the summer and fall months, as are the four championship courses, including 2021 Ryder Cup host venue Whistling Straits.

“Rounds, packages and group events bookings are all as strong as we have ever seen in our history,” said Mike O’Reilly, Kohler’s Director of Golf and Operations Manager. He also noted that the resort, as a result of hosting the Ryder Cup, is seeing increased bookings from Europe on top of North American travelers.

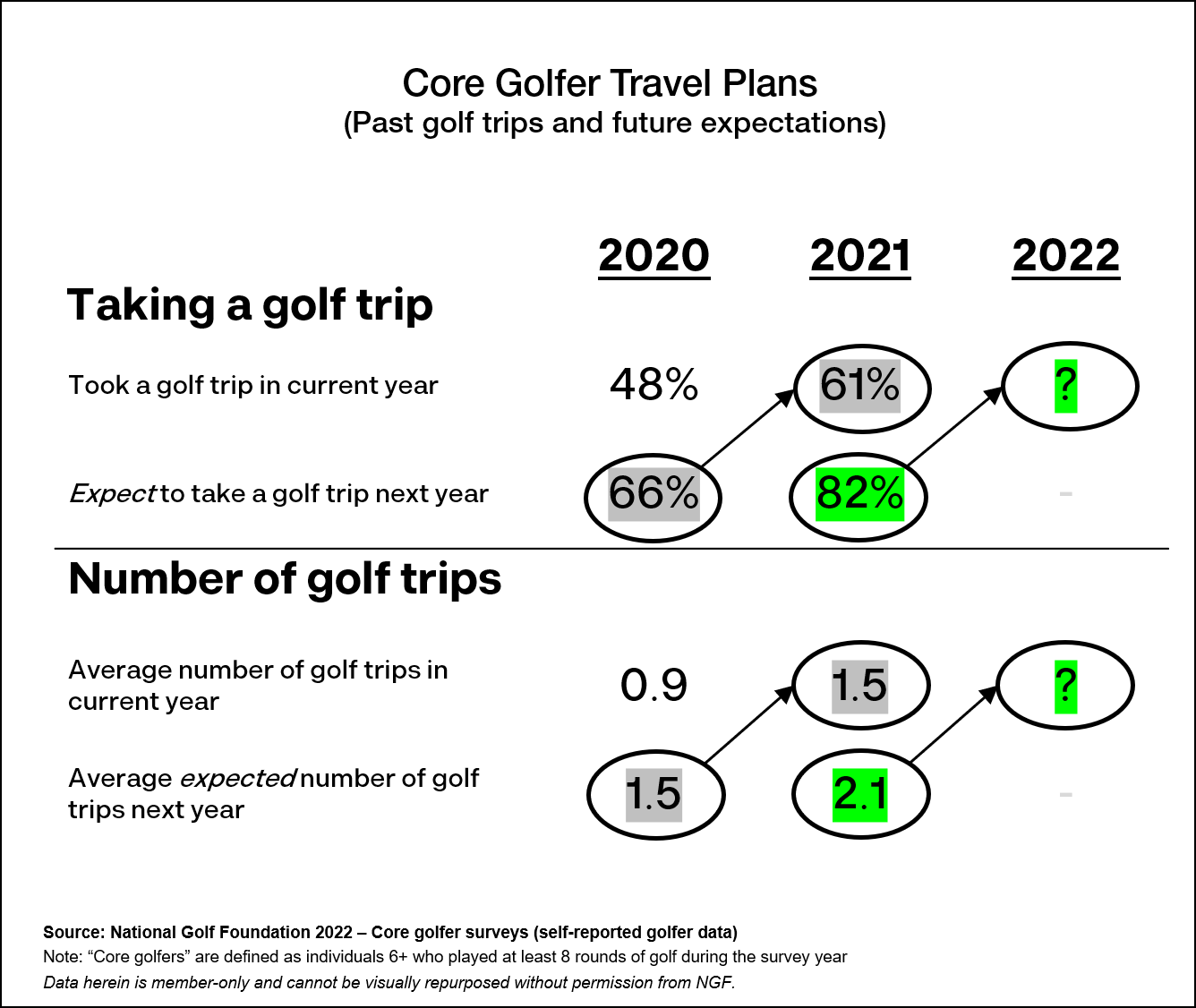

This momentum is corroborated by a survey of Core golfers. Among this devoted group (those who play 8+ rounds annually), 82% said they expect to take at least one golf-centric trip in 2022. This is up from two-thirds of Core golfers one year ago and would translate to more than 10 million Americans traveling to play golf.

Prior to the pandemic, approximately 8 million golfers made at least one overnight trip away from home that included golf.

And while it’s golfer-reported data – and perhaps tinted with a little bit of optimism – indications are that Core Golfers plan to take more golf trips, on average, than last year, when U.S. courses saw more play overall than any time in history.

“Coming into the year it looked strong and it’s bore out that way,” said Steve Mays, the President of Founders Group, which owns 21 golf courses and two golf package companies in Myrtle Beach, South Carolina.

“We’ve had a strong spring and it looks like we’ll have a relatively strong summer too. It all helps to keep momentum going with the travelers coming in,” Mays added. “Last year was one of the best fall seasons Myrtle Beach has had in a long time. To be honest, we’re probably a little off pace from that, but it’s so far out I think we’ll still have a great fall and will match or exceed what we did last year.”

King’s North in Myrtle Beach, one of more than 20 golf properties on the Grand Strand operated by the Founders Group.

For the most part, these travel rounds aren’t incremental rounds. They’re primarily rounds that move from local markets to resorts, although anyone who’s been on a golf getaway surely knows they tend to play more than they would have back home.

And while these travel rounds might come at the expense of local courses, it’s worth noting that many in-season local markets have been reporting crammed tee sheets anyway. So rather than losing rounds when regulars get away to play at a resort or destination course, it could actually create opportunity for other locals.

More than half of golf trips (almost 60%) include golfers hitting the road by car, whether it’s their own or a rental.

That’s why some destinations that have an emphasis on the drive-in market are watching closely to see how rising gas prices might affect summer travel. One of those is Big Cedar Lodge, which has a diverse mix of five golf courses at its sprawling outdoor-focused resort in the Ozarks of Missouri as well as a rich concentration of more than 5.6 million Midwest golfers within a 500-mile radius.

At this point, advance bookings for 2022 are almost identical to 2021 at Big Cedar.

“We are still having a lot of buddies’ groups coming (16+ players) and a lot of small groups (2-8),” said Matt McQueary, Big Cedar Golf’s Director of Sales & Marketing. “Corporate groups and outings are still down, as they have been since the start of the pandemic, but we are noticing they are starting to come back as corporations are lifting their travel restrictions to their employees for work events and retreats.”

Other resorts are seeing the benefit of improved access, particularly an increased number of direct flights from a greater variety of cities.

This is the case in Northern Michigan, for example, where Traverse City, is now up to 17 direct flights, having recently added major cities like Atlanta, Boston, Charlotte, Dallas, Denver, Newark, Orlando, Tampa and Washington D.C. That’s up from just five or six Midwest hubs just six years ago.

That’s a significant boost in a state like Michigan, which actually ranks third nationally in the number of golf resorts behind only California and Florida.

“In Michigan, our courses are some of the more expensive public courses. But on a national basis, when we go against the national comp set, we’re a really good deal in part because Michigan has so much golf we can’t price it out of the sky,” said Boyne’s Griffin. “Because we have to be in both sand boxes – what’s reasonable in Michigan and what’s reasonable outside — we’re inexpensive in that comp set. Strategically, that’s why we tried to reach out beyond Michigan.

“During Covid, we were quite frankly very scared because we put our eggs in this travel basket,” he added. “But the Michigan growth made up for Canada (absence) and we actually grew in the more distant markets because Traverse City added all these direct flights. So, we saw growth in the fly-in markets in spite of Covid.”

After some understandable limitations on golf travel the past two years, particularly in 2020 after the initial coronavirus outbreak, indications from golfers and resort operators are that golf travel is poised for a strong season.