(

The past three years have seen record or near-record numbers of U.S. golfers traveling to play the game.

Whether buddy trips, couples’ weekends, short getaways, or destination golf experiences, more than 12 million Americans have traveled to play golf each year since 2022, up from an estimated 8.2 million in 2018. This appetite not only highlights golf’s popularity, but mirrors a broader societal trend toward experiential pursuits. And it’s being driven especially by the allure of aspirational courses and bucket-list destinations.

Over the past five years, more than 40% of new golf course openings have had resort ties or can be considered “destination” locations where golf is the prime focus. The former category includes recent debuts at high profile resorts like Bandon Dunes in Oregon (Shorty’s), Streamsong in Florida (The Chain), Sand Valley in Wisconsin (Sedge Valley), and Pinehurst Resort in North Carolina (No. 10), while the latter encompasses private or public getaway destinations such as Broomsedge, Old Barnwell and The Tree Farm in South Carolina, or GrayBull and Landmand in Nebraska.

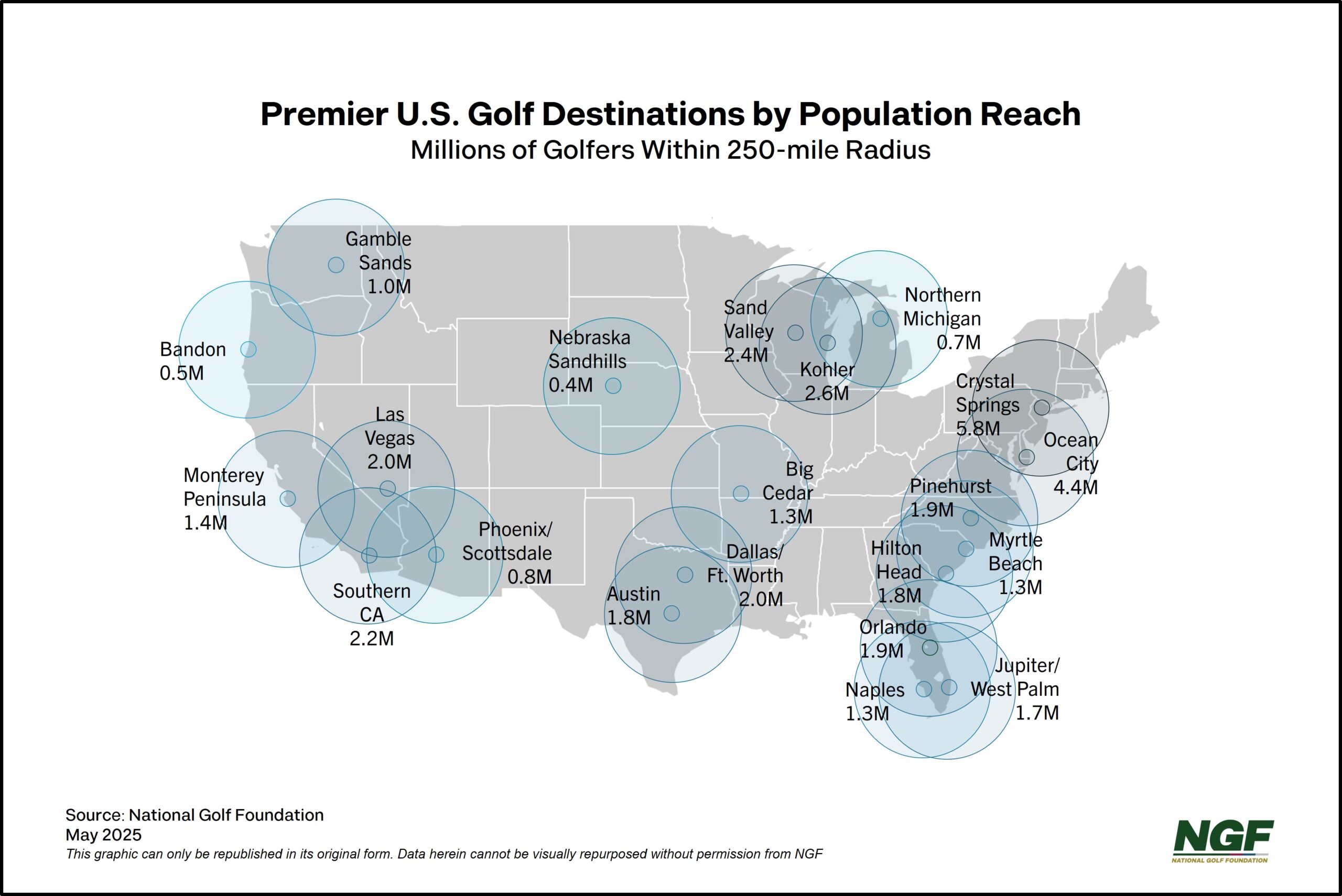

While many of the more prominent golf travel hotspots are highlighted in the below graphic, more than 1,250 golf facilities in the U.S. overall have a resort component. And thousands more are sojourn-worthy destinations that are helping fuel what is the second-largest contributor to the U.S. golf economy: travel & tourism.

As the broader travel industry appears to be experiencing some cooling – reports from major financial institutions and airlines suggest tourism is “tapping the brakes” – our research suggests more moderate impacts within the golf sector. Golf retailers report that sales of travel bags remain strong, and our surveys show only a slight decline in the percentage of golfers making overnight golf trips. (41% of Core golfers indicate they traveled for business or leisure with an overnight stay to a destination where they played at least one round of golf, compared to 43% in 2024).

What’s particularly significant about golf travel statistics is what we consider the ‘travel window’ effect.

We’ve found that 50-60% of a traveling golfer’s yearly spending occurs within the expanded trip timeline: planning and preparation, the destination experience itself, and the weeks following their return. It’s during these windows when golfers are at their most engaged, enthusiastic, and inclined towards purchases. This creates a unique opening for golf businesses at all levels – from equipment manufacturers to local pro shops, instructors, and of course the destinations themselves. The golf traveler, with heightened anticipation before, peak enjoyment during, and deeper appreciation after their trip, represents perhaps the most valuable business opportunity in the entire golf economy, offering windows of engagement where meaningful interactions can establish stronger customer relationships.

As for those trips and destinations, click here to see our team’s latest findings about why word of mouth for golf is so critical.