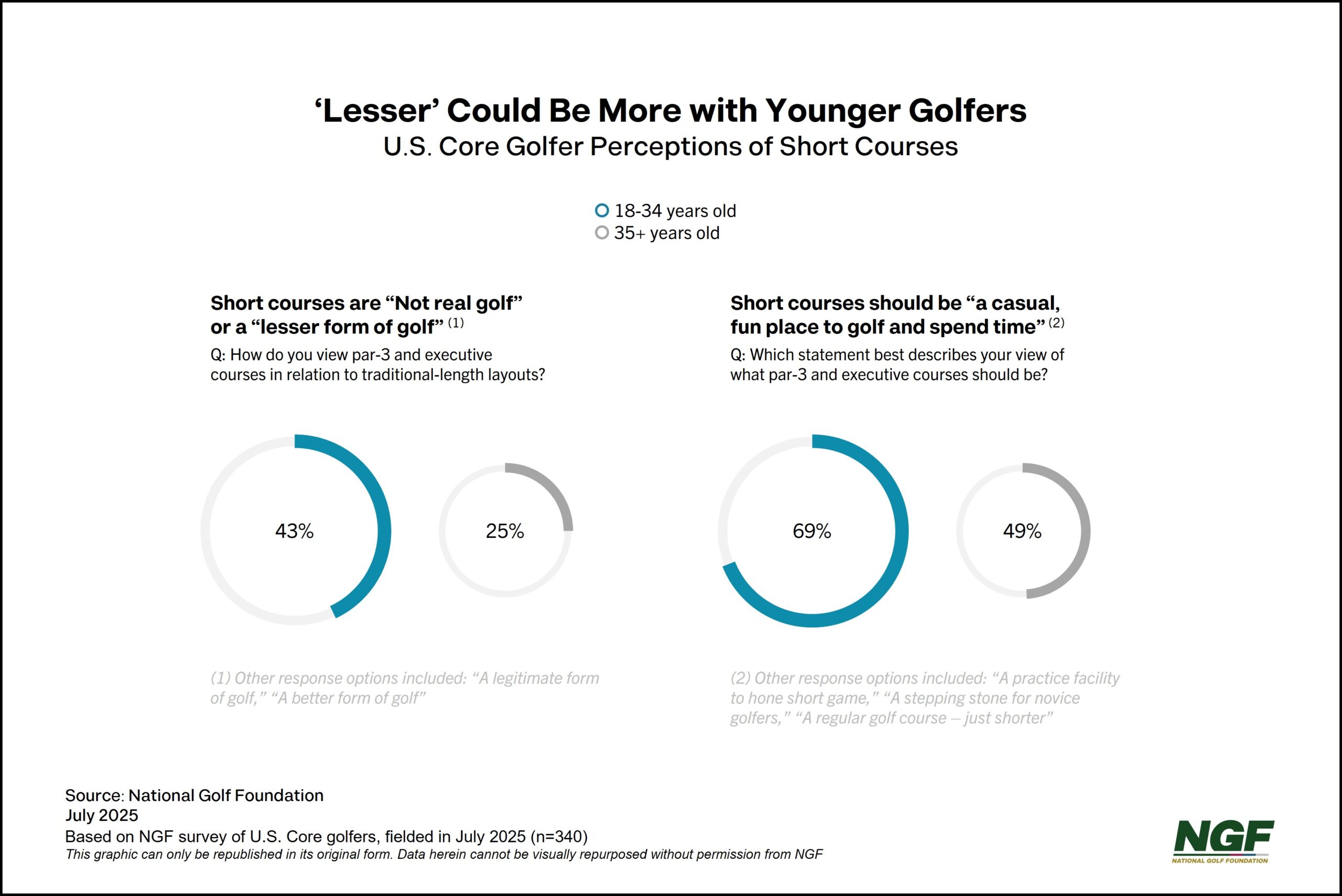

As we close out our discussion on short courses – for now – we’re struck by a perception that exists among younger Core golfers. While fewer than 10% of 18- to 34-year-olds view Par-3 and Executive courses as “not real golf,” more than a third still see them as a “lesser form” of the game (vs. “legitimate” or “better” versions – other views captured in our research).

It may not seem like much, but for an industry desperate to attract and keep this demographic – and considering the potential we believe exists for short courses to serve as community magnets and bridge points along the user pathway – the combined sentiment of illegitimacy would appear to be a fatal flaw.

Before deciding if it is, let’s consider how we got here.

For decades, many short courses have marketed themselves on a functional, “championship-lite” promise to deliver all the hallmarks of the “real thing”: challenging layouts, tough greens, noted architects – but with the added benefits of speed and accessibility. It’s a sensible strategy, at least for private clubs, resorts, and communities whose addressable market skews toward serious and competitive golfers. For the rest, though, the pursuit of legitimacy through scaled-down emulation appears to have created a perception trap, inadvertently reinforcing their own inferiority among a significant share of the game’s younger generation.

This helps explain why “poor conditions” are a primary short course concern for half of 18-34 year-old golfers, and why almost the same proportion express reservations about them providing a “full golf experience.” Many facilities have embraced regulation-like value propositions they simply cannot match, given fundamental resource and footprint constraints.

But maybe the strategic error is to treat the “lesser” perception as a problem to be fixed. Maybe the real opportunity is to accept it as a license – a mandate, even – to be different. If a significant portion of your target market perceives your experience as “lesser,” why try to be a scaled-down version of something else? What if the path to winning isn’t about proving your legitimacy, but building your value as something authentically its own … something fresh and, dare we say, countercultural?

Our research supports this thinking. The same younger golfers who seem most dismissive of the format are also most likely to feel enthusiastic about its potential – two-thirds believe short courses, in general, could be best positioned as “casual, fun places to golf and spend time,” compared to fewer than half of their older counterparts, who tend to see them in more of a traditional light, as proper play and practice venues.

The irony is perfect: to succeed with ‘next gen’ golfers as “not real golf,” many short courses should become more “real” than the traditional game itself. More laid-back in their hospitality, more irreverent in their community-building, more honest about what they offer, warts and all. Allowing ‘lesser’ conditions and rougher edges to become part of the charm. Creating vibrant hubs so enjoyable they make comparisons to the regulation game irrelevant.

The potential is clear, and yet there’s a meaningful gap between what younger consumers might respond to, and how short courses are actually engaging them – not only through the experience itself, but the digital spaces that help shape their offer.

Consider Instagram, one of the most popular apps in the world with an estimated 2 billion monthly active users – 60% of whom are in this 18-34 age cohort. Analyzing a random sample of 200 U.S. short courses, our team found that only half maintained any presence on the platform, and those that did averaged a mediocre content quality score of 1.98 out of 3 (we were pretty lenient graders, too). These facilities are missing the chance to connect with a generation that craves culture, experience and “vibes,” instead defaulting to traditional golf marketing that copies the very experience they should be distinguishing themselves from – assuming they market at all.

Especially as higher-end facilities continue to raise short course expectations through extraordinary and well-capitalized developments, the future of everyday short course golf will likely belong to facilities that recognize an open lane in the golf ecosystem, and avoid chasing traditional notions of legitimacy.