3-Minute Business Insights

A return to the friendly skies means more golf trips and destinations back in consideration. Core golfers, on average, are now expecting 1.8 golf trips in 2021 -- an increase of more than 60% over 2020.

Limitations on golf trips in 2020 have created a bottled-up demand to return to golf travel. Here's what golfers are saying and operators are seeing.

Working remotely has provided greater schedule flexibility for many people over the past year. It's also had a significant impact on golf.

Working remotely has changed the contours of the work day for many over the past year. NGF recently conducted golfer research to gain deeper insight about the relationship between golf and the work-from-home dynamic.

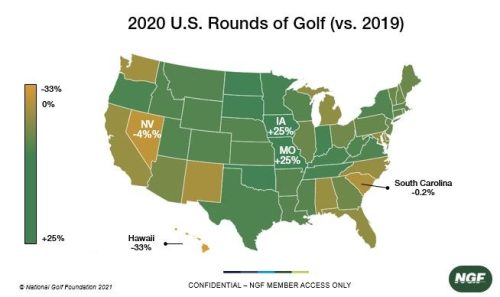

The latest monthly numbers show something the golf industry hasn't seen in a while -- a decline in play. How much of an impact did Mother Nature have in February?

February rounds were down 4.7% nationwide compared to a year ago, when play for the month had been up 19% before the pandemic hit the U.S.

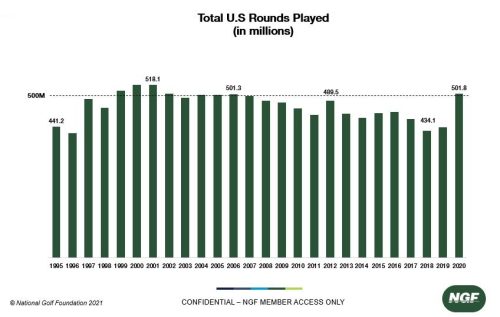

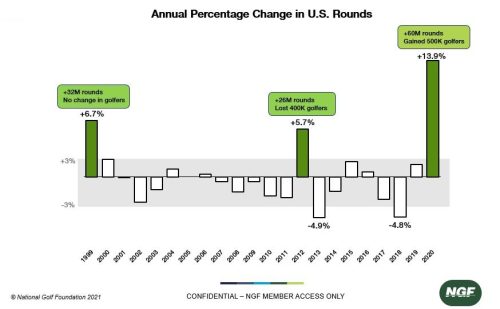

NGF's Graffis Report, a overview of an unprecedented year for the golf business in 2020, is now available for NGF members.