It’s been an unprecedented couple of years for Boyne Golf, which has 10 championship courses spread across three Michigan resorts. When the coronavirus hit in 2020 and Michigan began to ease golf restrictions a bit later than some other states, only one of those 10 courses was walkable and able to open for play. Hotels in golf-rich Michigan couldn’t open until June, further hampering a destination property like Boyne, which has the Inn at Bay Harbor, The Highlands at Harbor Springs Resort and the Boyne Mountain Resort in its portfolio.

Even so, play exploded at Boyne throughout the second half of 2020, enabling its golf facilities to finish down only 3% in rounds from 2019, and up in revenue.

Like many in the golf industry, Boyne VP of Golf Operations Bernie Friedrich wondered whether the momentum of late 2020 would continue in 2021.

“The plan in ’21 when we got started, we were going to need as much early (spring) play as we can because we thought we could never keep up with the fall of 2020,” Friedrich said. “It was truly amazing because we got a lead and kept it. We ended 17% up in rounds over ’20 and 26% up in revenue. It was an absolutely fantastic year.”

The example at Boyne highlights a trend seen in 2021 that yielded record play totals, topping not only the Covid-driven surges of 2020, but the previous U.S. highs set in the early 2000s.

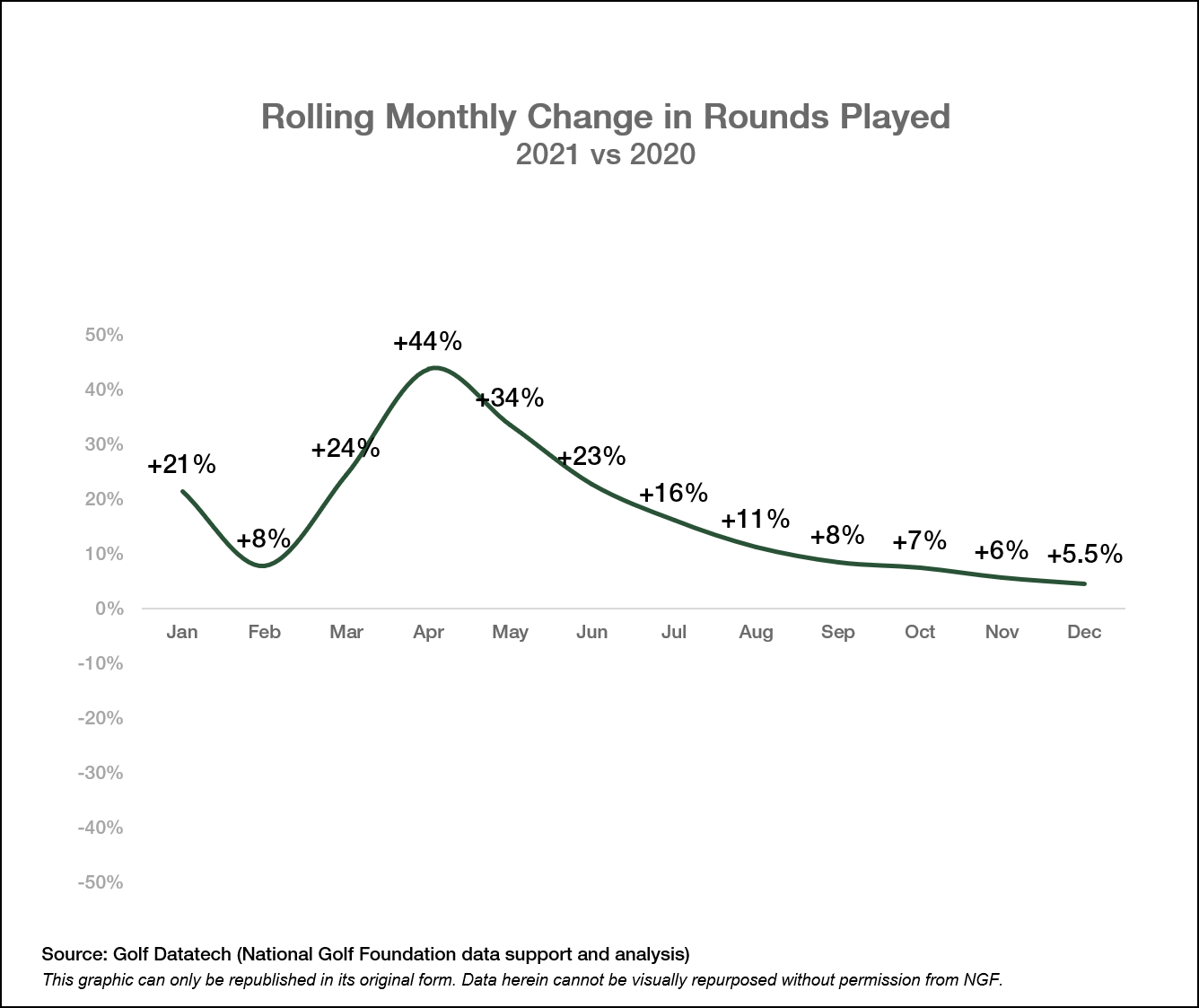

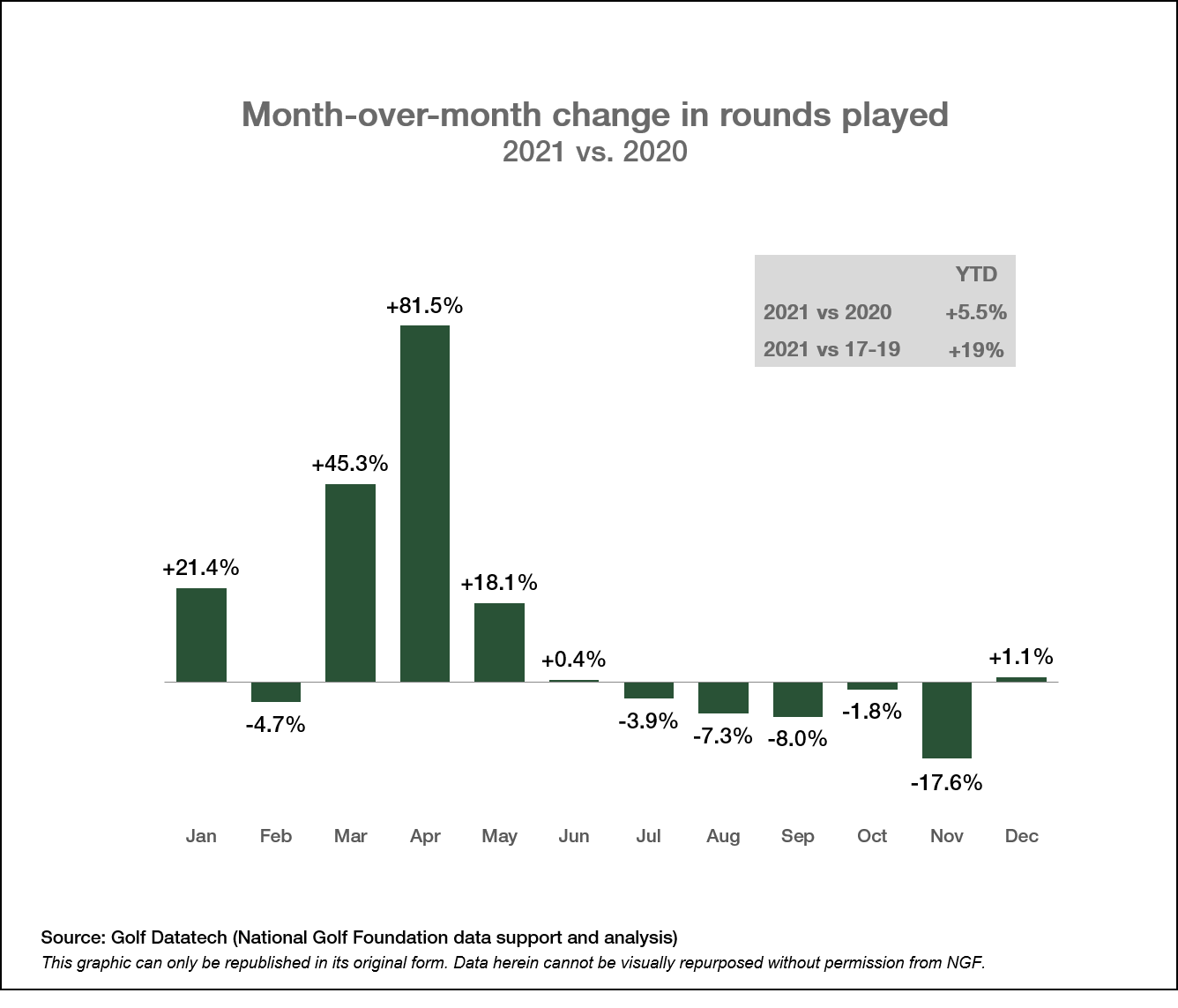

The almost 6% increase over 2020 was certainly spurred by a spring rebound like that seen at Boyne’s courses. Nationwide, almost 30 million more rounds played in March and April than the previous year, when more than half of the 16,000+ courses in the country were temporarily closed due to coronavirus-related restrictions.

Digging into the year-end data, the gains seen in 2021 were driven primarily by public golf courses.

Rounds at daily fee, municipal and resort courses increased about 7% compared to 2020. It’s a particularly notable boost given that public golfers overall play almost four times as many total rounds as private club golfers. While play at private courses was also up, the bigger jump at public facilities makes sense, as those had been generally more constrained by operational restrictions in 2020 – especially the government-operated munis and resort courses dependent on travel and tourism.

U.S. Rounds Played Changes vs Previous Year

| Year | Overall | Public | Private |

|---|---|---|---|

| 2021 | +5.5% | +6.7% | +1.1% |

| 2020 | +13.9% | +12.4% | +19.9% |

The Chicago Parks District is among the municipalities that saw a significant jump in 2021, with play up 27% at the six golf courses operated by Indigo Golf Partners.

Total rounds jumped from just over 167,000 in 2020 to more than 212,000 last year, and that doesn’t include all the people who visited the free-to-play, 3-hole learning course at Douglass Park. But, again, this rise is somewhat understandable given the early-year limitations of 2020 – and especially in Chicago.

The city of Chicago had some of the longest golf-related shutdowns in the nation, with five facilities closed for almost 2 ½ months (from March 26 through June 8). One of them, Columbus Park, was restricted to play on Saturdays and Sundays only until July 4 as the facility’s parking lot was converted to a Covid testing site. The other two muni golf facilities remained closed until June 22 and, even when the Sydney Marovitz course re-opened, golfers had to drive through a security checkpoint and show proof of a tee time because the park surrounding the course remained closed to the public. So, while play boomed during the second half of 2020 at those public Chicago courses, it’s little wonder that rounds increased the way they did this past year.

The 4th and 5th holes at Sydney Marovitz Golf Course and the Chicago skyline. Photo courtesy: Peter Wong

“2021 saw something resembling a normal weather pattern, which was golf-friendly,” said Bill Colgan, Regional Director of Operations at Indigo. “Leagues, outings and championship events returned. Junior participation was up 46% vs 2019 and 23% vs 2020. Our instruction vehicle, Chicagoland Golf Academy, increased its capacity for clinics and individual instruction. They sold out every offering, extended their teaching season well beyond traditional timeframes and saw 81% growth vs both 2019 and 2020. The courses and ranges remained busy and active, but we did see a small decline vs 2020 as we entered the fall.”

Similar patterns were seen elsewhere, from coast-to-coast.

Arizona’s Westin Kierland Golf Club saw a 27% rise in rounds to over 77,000 in 2021.

Indian Wells Golf Resort in Palm Springs, California, saw the same 27% YOY increase, to more than 67,000 rounds.

In Myrtle Beach, South Carolina, play rose by 19% in 2021, with more than 2.3 million rounds played at the 62 courses tracked by Golf Tourism Solutions, the marketing cooperative that promotes golf-related tourism along the Grand Strand. The recovery shows the impact that the loss of golf packages and traveling golfers had on the region in 2020, particularly during the usually-busy spring season derailed by Covid. Thanks to strong momentum throughout the summer and fall, 2021 was one of the best years for Myrtle Beach golf courses in almost two decades, with rounds up more than 12% over the three-year, pre-pandemic average from 2017-2019.

“We had a good spring coming out of 2020, but we were not nearly doing the volume we were doing in 2019, at that point,” said Steve Mays, the President of Founders Group International, which owns and operates 21 courses in and around Myrtle Beach. “But you’re feeling good because you’re getting closer to those 2019 numbers and people are traveling. Then it was like a light switch turned on in May. That’s when we started not only matching what we saw pre-Covid, but exceeding pre-Covid. The sheer volume of golf remained strong through 2021.”

While it was public courses that saw the biggest net gains from 2020 to 2021 – really driving the increase in the total rounds number — private courses sustained high levels of engagement. The 1% year-over-year national gain in private club play in 2021 is still over 18% higher than the five-year, pre-pandemic average.