With the peak season behind us and just a couple months left in 2025, the golf industry is on the verge of another record for rounds-played for the fourth time in five years.

And it could be the play at private clubs that pushes the industry over the top.

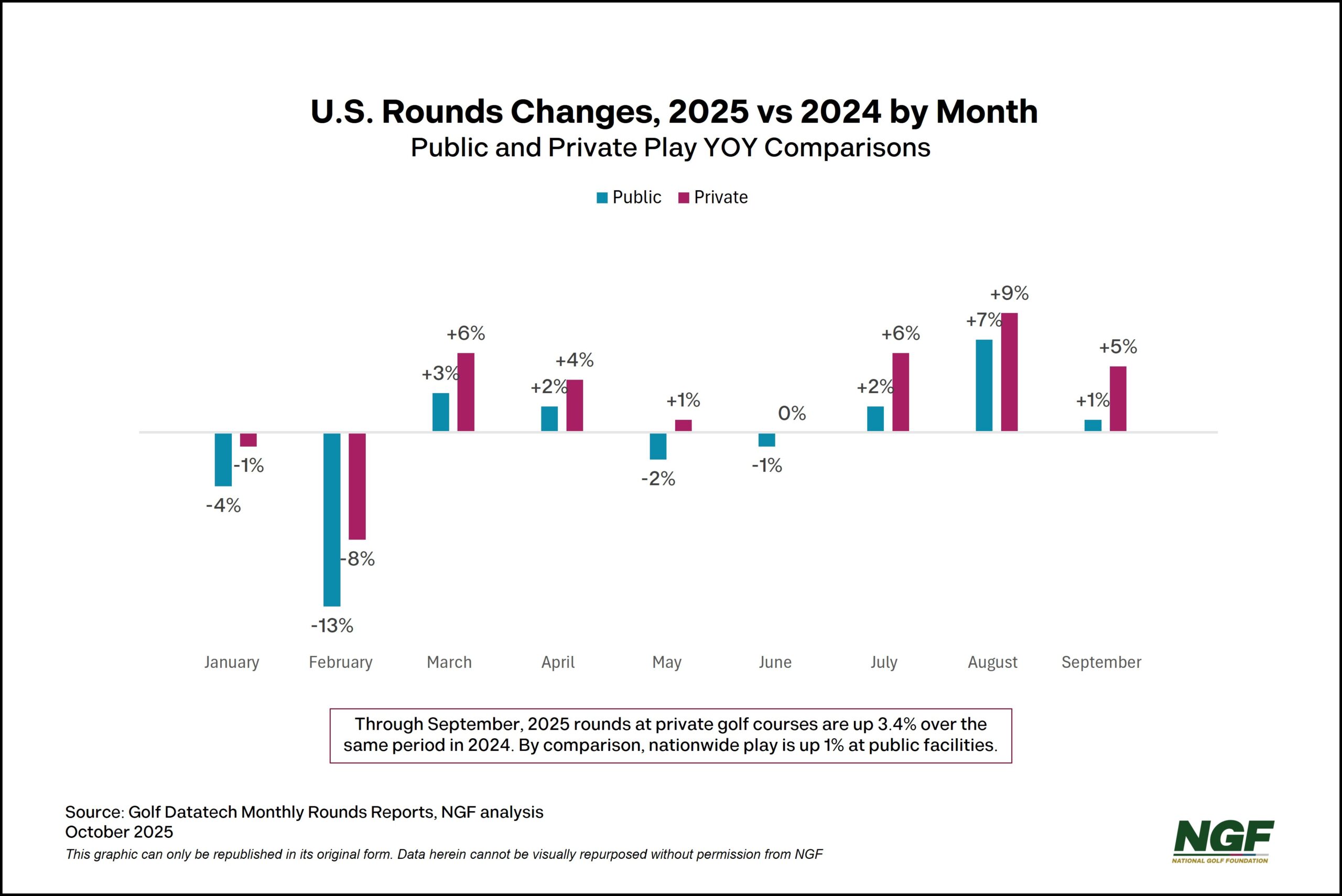

In looking at year-over-year comps, private golf round gains have trended ahead of those on the public side in every month so far in 2025. The recent trajectory has been particularly notable.

The latest rounds report, through September, revealed that private golf play was up more than 5% nationwide relative to September 2024. By comparison, public golf play was up about 1%. The trend was similar in August (+9% private vs +7% public) and July (+6% private vs +2% public).

Of course, the majority of U.S. golf is played at public courses.

Nearly 75% of the nation’s courses are open to public play, and historically almost 80% of rounds are played at public daily fee, municipal and resort courses.

Yet it is significant that YOY comps reveal that positive changes in private play also outpaced that of public in January, February, March, April, May and June of this year, in addition to the recent momentum.

The evident demand – at least on a broad level – may help explain to some extent why private clubs account for more than 50% of new development – far higher than their current representation in the market.

NGF operator surveys reveal that almost 2/3 of golf facilities indicate they are at or near “capacity,” meaning how much play they can handle before it begins to have a negative effect on business. And the proportion of U.S. facilities at perceived capacity is higher on the private side than the public. Be on the lookout for a future Short Game piece on the topic.

As 2025 winds down, it’s clear the surge in private play is more than a blip on the radar. It’s helping push the entire industry toward another record year — and reinforces that enthusiasm for the game is being driven from both sides of the fence. That balance could be the key to keeping golf’s momentum rolling into 2026 and beyond.

NGF members can CLICK HERE to find more takeaways on the private side of the game in this one-page summary report.