NGF has been vocal in recent years about the runway for growth in off-course golf… and why it’s important.

In addition to conducting annual verifications of the nearly 16,000 green-grass golf courses in the U.S., our database team diligently works to track everywhere that golf can be played away from the course. It’s a fast-moving target, particularly when it comes to simulator-driven golf entertainment businesses, as new locations seem to pop up weekly.

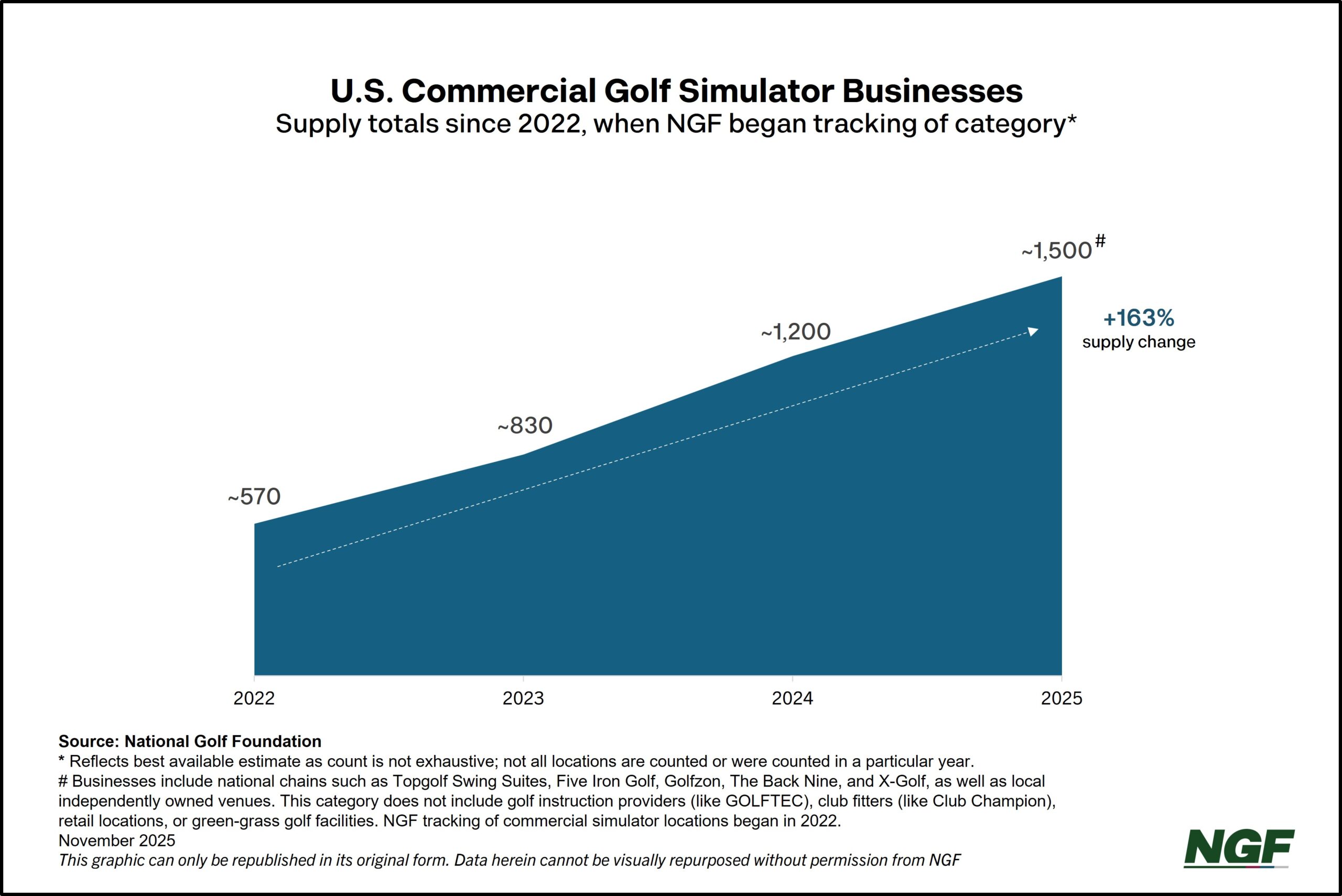

While the development pace of new large venues (such as Topgolf) has slowed, the proliferation of commercial simulator locations is substantial. Our count isn’t exhaustive, as facilities are being discovered and added every day, but there are now at least 1,500 simulator businesses nationwide – from brands such as Topgolf Swing Suites, Five Iron Golf, GolfCave, Dryvebox, Golfzon, The Back Nine, Golf Lounge 18, and X-Golf to standalone, locally owned and operated locations like All Seasons Golf & Social Club in Cedar Knolls, New Jersey.

This total has nearly tripled since 2022, an increase reflective of both new businesses and others that are being discovered. This doesn’t include simulators at golf course facilities or at retail stores or clubfitters.

The growing golf simulator footprint in the U.S. is still far from the supply in South Korea, which has nearly 9,700 screen golf locations for a population that’s about one-sixth the size of the U.S.

The average age of commercial simulator businesses in the U.S. is only about three years. They average between three and four hitting bays, with just over half having food offerings and just under 50% serving alcohol. More than three-quarters offer membership options.

As the number of simulator businesses continues to increase, so too does the number of simulator participants. It’s not just the younger generation embracing technology and the game’s evolution either. While the most substantial growth, in terms of volume, is among participants under the age of 50 – with over 3 million more than just four years ago – the number of users who are age 50 and up has jumped even more significantly during that same span, up 184% from a small base.

NGF members can find more information about the simulator space here.

Questions still loom, however: How saturated is the market? How high is the ceiling (our first simulator pun)? And while there are different business models for commercial simulators – from entertainment and F&B-focused to golf-centric and membership only — how sustainable is the business model?

As our team keeps tracking the category and counting venues, we’ll continue to delve into consumer and operator attitudes and behaviors to learn more and share insights about one of the hottest growth sectors in the industry.

______________________________________________