3-Minute Business Insights

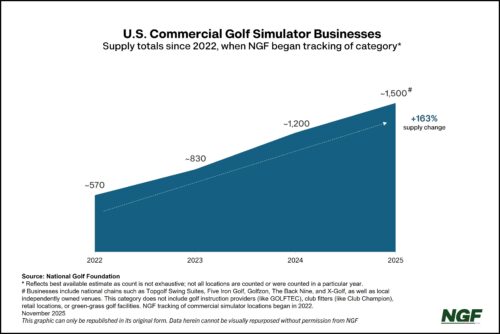

The golf simulator niche is one of the fastest-growing sectors in the golf industry, and the number of commercial golf simulator venues has proliferated in recent years. NGF continues to try to size and scope the explosive growth in the market.

Member Presentation: Understanding Golf’s Hidden Phone Costs

NGF research shows the majority of golf course operators are aware of the opportunity cost of 6 million phone hours, but only a small percentage have actually implemented technology solutions to minimize waste, with a fraction more exploring their options. This gap points to a competitive advantage opportunity for operators willing to act.

Midyear Update: Golf Supply and Development

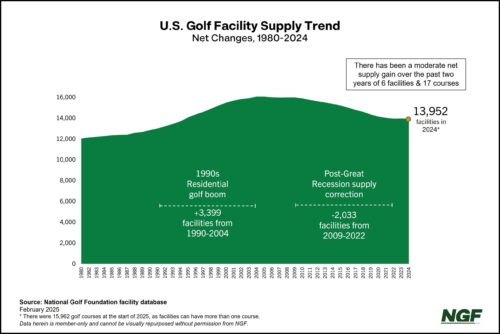

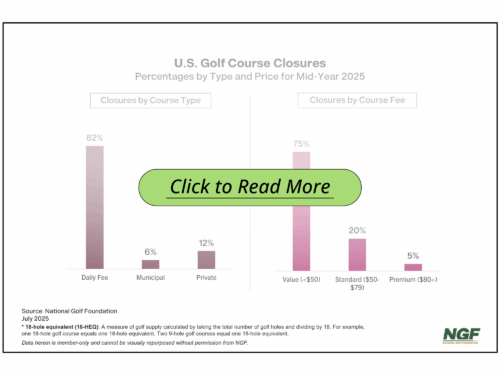

The U.S. golf market continued its march toward equilibrium at the midway point of 2025, with supply and development patterns reinforcing trends that emerged in 2024 and previous years.

Topic: Facility Management

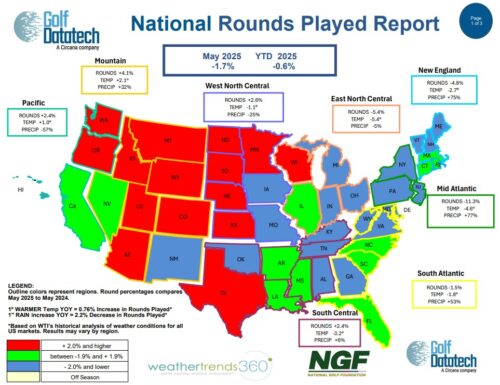

Rounds of golf for June -- one of the most high-volume months for play -- were virtually unchanged from a year ago, as the U.S. market remained within striking distance of the record-setting rounds pace of 2024.

Topic: Course Operations

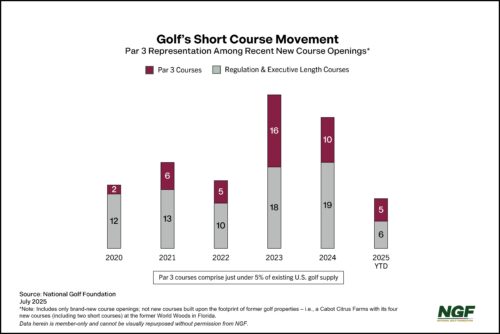

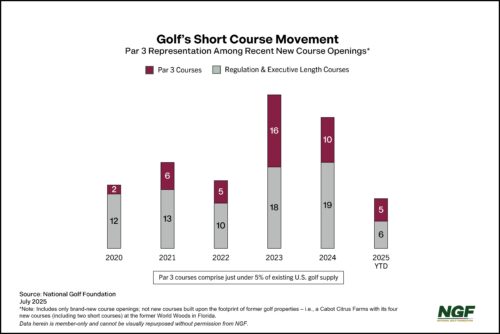

Short Course Supply Update

Member update on Par 3 supply and development in the U.S.

Over the past 5 1/2 years, “short courses” – Par 3 courses, in particular -- have accounted for over one-third of new openings. While overall U.S. golf development remains relatively limited despite a recent uptick, this trend is more than just a blip on the radar.

Cooler, weather May weather in parts of the East coast contribute to a slight national dip in year-over-year play.

U.S. golf course development and investment in existing faciltiies are up, including an increased number of renovations, reconstructions, and resurrections. Meanwhile, the number of annual course closures has decreased for five straight years, with the 2024 total dipping to its lowest levels in two decades. The result is a supply stability that has legs.

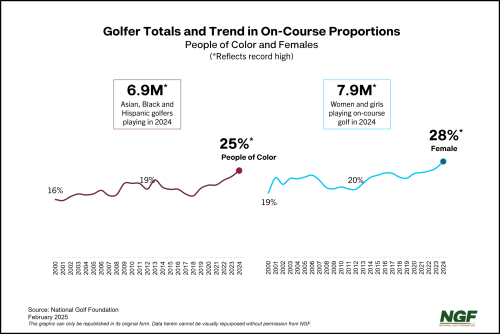

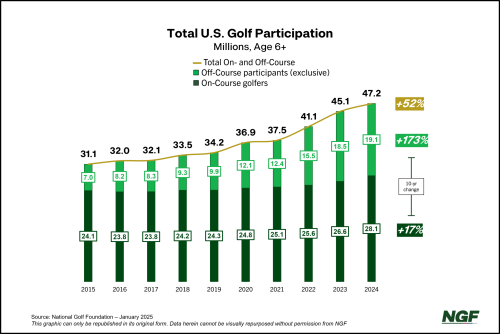

The face of golf may have changed more in the past five years than the previous 50. Golf’s latest participation numbers are out and they reveal unprecedented diversity in the game -- both on and off the course.

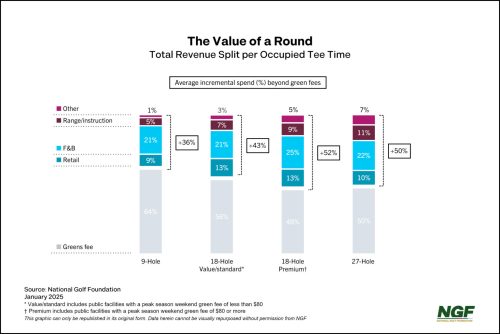

When a tee time goes unfilled, a golf course doesn’t just lose the greens fee – it loses all the revenue accompaniments that would have come with it. It’s why we dove deeper into the concept of RevPOTT, or the estimated total revenue per occupied tee time at public golf facilities.

NGF's annual state-of-industry report is out and available for members, providing a holistic look at the U.S. golf industry for 2024. Momentum across the recreational side of the U.S. golf industry remained broadly positive this past year, and future indicators point to sustainability when it comes to participation and play.

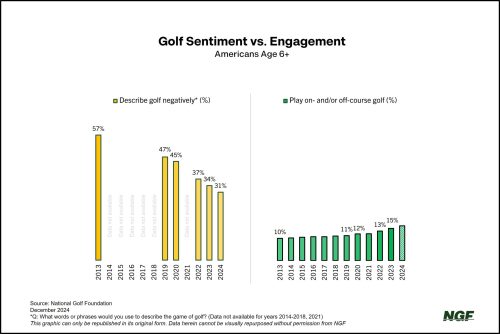

Recreational golf has enjoyed a renaissance in the post-pandemic era – with increases in participation, play and engagement – and a key driver has been an increasingly positive narrative surrounding the game. Perceptions of golf and golf’s brand have shifted dramatically over the past decade or so, and social media has helped lead the charge.