In February of 2022, not a single round of golf was played on the two 18-hole courses at White Deer Golf Complex, a municipal facility in Central Pennsylvania, about seven miles south of the Little League World Series complex in South Williamsport. That’s not necessarily unusual, but this year, thanks to more favorable weather, White Deer’s two courses saw more than 1,300 February rounds.

It was a similar story in March, with 1,800 rounds compared to about 1,000 a year ago.

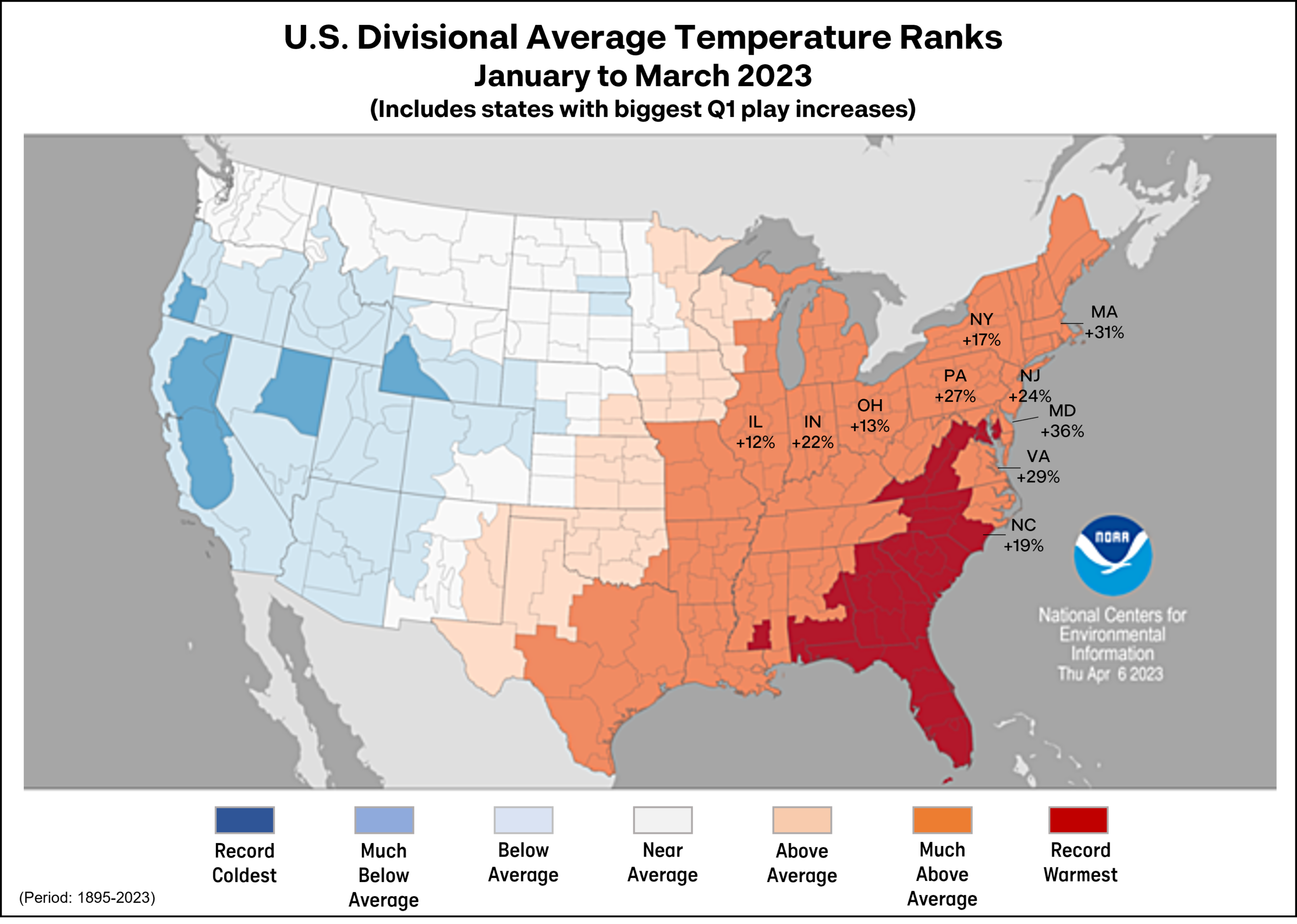

And White Deer wasn’t alone in enjoying some offseason golf in Pennsylvania, a state with 664 golf courses, the seventh-highest total in the nation. The three-month stretch from January through March was the third warmest first quarter (Q1) for Pennsylvania over the past 129 years, according to the National Oceanic and Atmospheric Administration. Statewide, Pennsylvania courses experienced a 27% year-over-year increase in Q1 rounds.

“This is all attributed to the weather,” said White Deer General Manager Justin Dahin. “We had a great winter and spring started strong.”

In total, 20 states had one of their three warmest January-March stretches on record, with more than two-thirds of those located in the Northeast or Midwest – regions in the Snowbelt that often see limited days of Q1 golf due to snow, rain or still-frigid temperatures. Warmer weather led to at least a little more golf in many states, with Connecticut, Delaware, Indiana, Maryland, Massachusetts, New Jersey, Rhode Island, Virginia, and West Virginia all seeing at least a 20% YOY increase in rounds.

North Carolina, which had the warmest Q1 ever in the state’s history, had a 19% lift in play while rounds at New York courses were up 17% compared to 2022.

To access the free monthly national rounds reports, click here

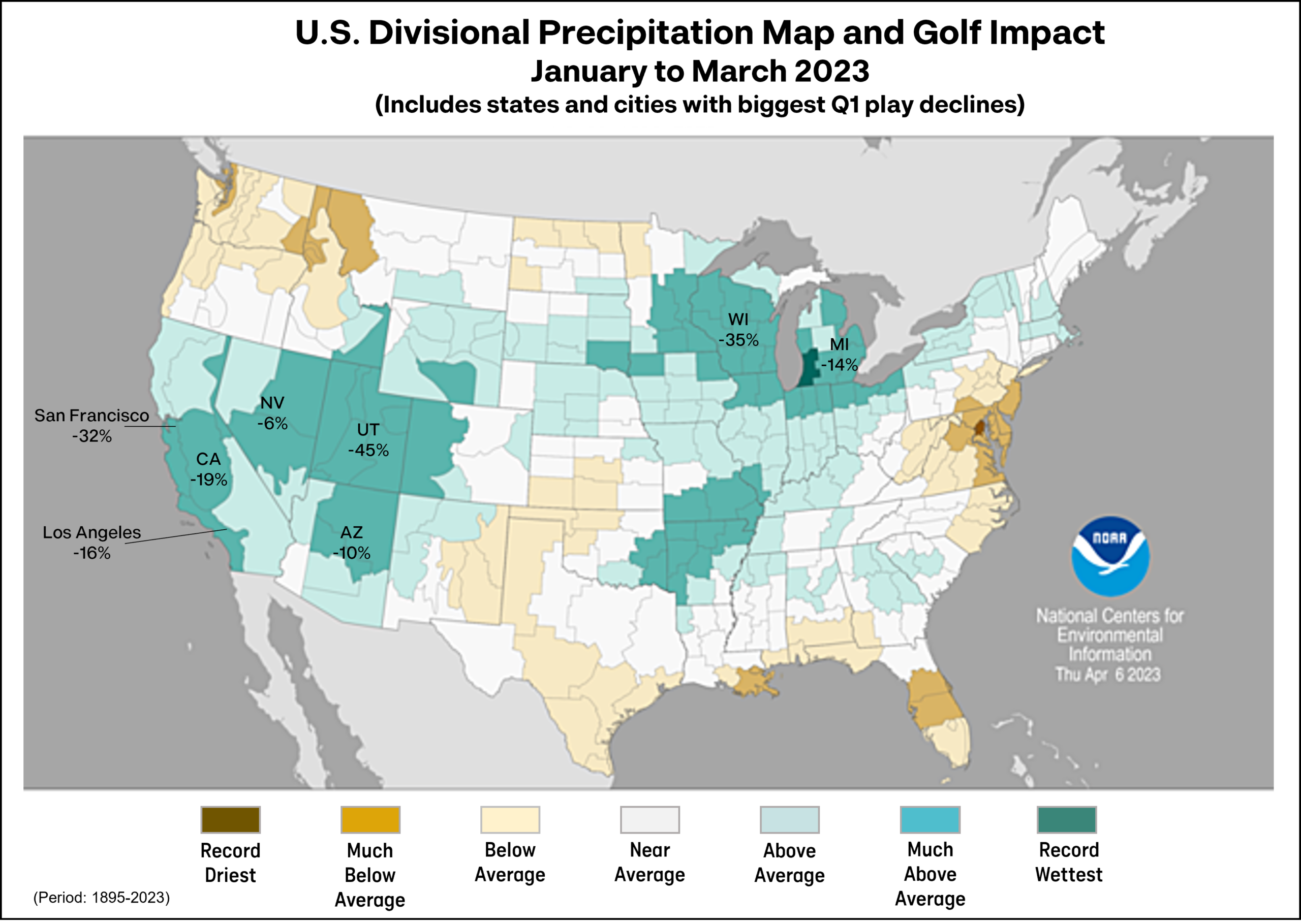

Meanwhile, many of the biggest YOY decreases in Q1 play came in states and regions in which there was significantly more precipitation than past years.

Among the biggest drops were in Utah (-45%) and Wisconsin (-35%).

But when it comes to the combination of an in-season state with a lot of supply and generally less-than-favorable golf weather, the biggest Q1 story had to be in California, where play was down 19% vs 2022. Storms, including two atmospheric rivers in March, hampered Q1 operations at a notable percentage of California’s 964 courses (second nationally only to Florida). In and around several of the state’s biggest cities, play was down 16% in the Los Angeles area, -31% near San Francisco, and -32% in the capital city of Sacramento.

At WildHawk Golf Club, an 18-hole municipal course in Sacramento, Q1 rounds were down by 6,400 compared to a year ago, but the facility saw a rebound in April as the weather improved.

“January to March of last year we had only a few rainy days,” said head golf professional Mandy Garcia. “The golf course definitely experienced a decrease in rounds due to the atmospheric rivers. But we did great in April with the desirable weather and even a quick heat wave, and had about 5,800 rounds. Many days there was a player count of over 230. The interest is still there with many people purchasing new equipment, range plans and playing passes.”

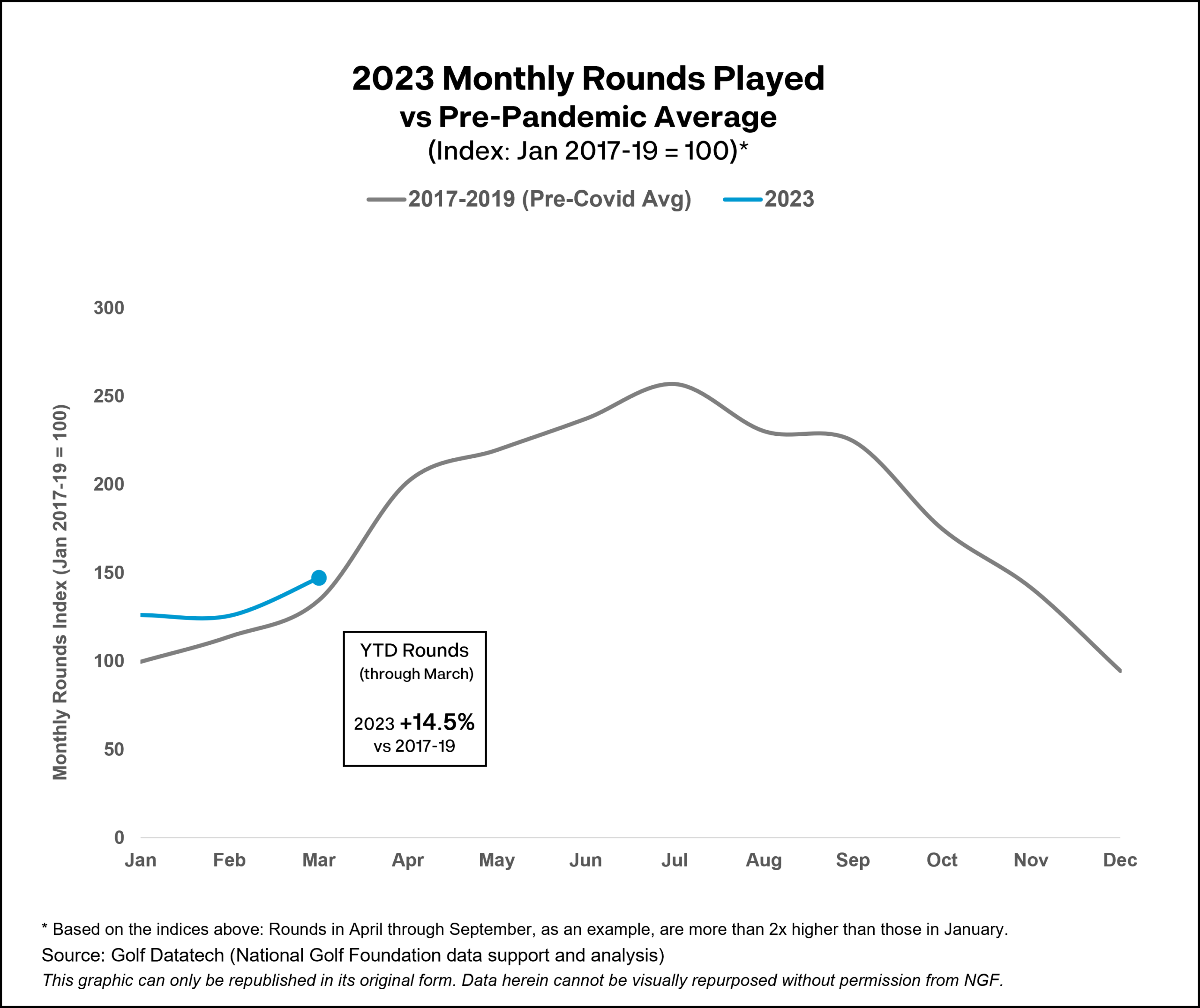

As detailed in this Fortnight piece, Q1 play for 2023, like the last several years, continues to trend above recent pre-pandemic years.

While year-to-date play is flat compared to 2022 (-0.2%), rounds over the first quarter are up 14.5% compared to the three-year average from 2017-19. It’s an indicator that demand remains strong heading into the busiest months of the golf season.

The five-month stretch from May through September accounts for about 55% of the annual national rounds total. And it could be even more if the weather cooperates.