3-Minute Business Insights

Short Game

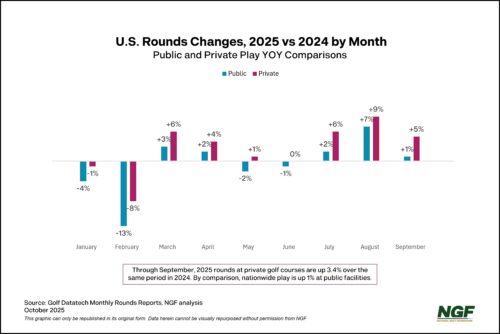

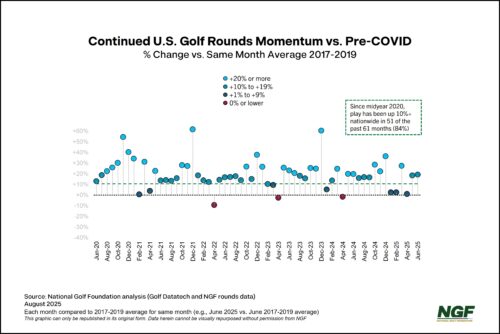

The golf industry is on the verge of another record for rounds-played for the fourth time in five years, and it could be the play at private clubs that pushes the industry over the top.

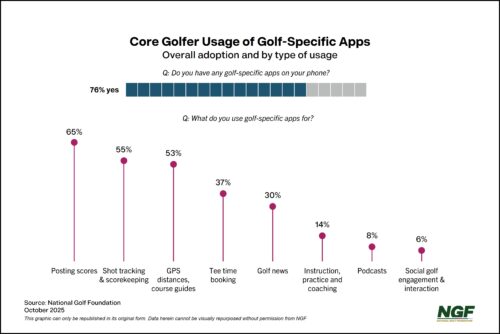

As the traditional game continues to modernize and evolve, mobile apps are an increasingly important part of the golf experience, on and off the course. More than three quarters of Core golfers say they use golf-specific apps, with the most notable recent increases in usage coming in several main areas.

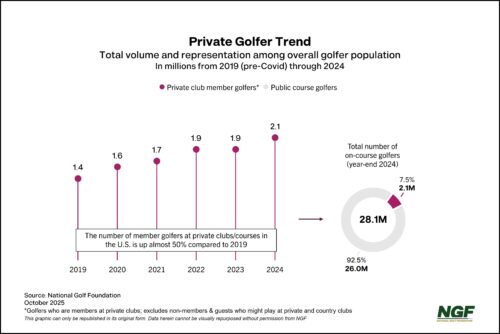

Private club golfers account for less than 8% of golf's green-grass participation base, but this group plays and spends more on the game and is a popular target market audience for businesses inside and outside the golf industry.

A New Yardstick of Success

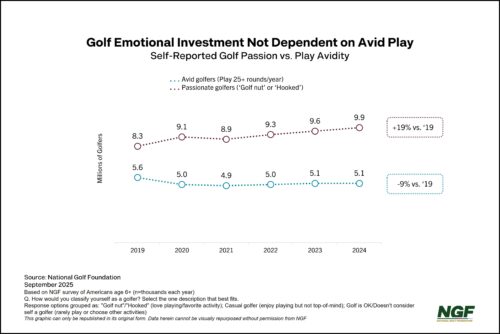

Whether temporarily or otherwise, golf has captured the global zeitgeist. So, what are the notable differences when it comes to golfers in the current era? For one, the number of golfers who place themselves on the highest level of NGF’s ‘passion scale’ has grown nearly 20% since the pandemic.

Topics: Course Operations, Green-Grass Facility

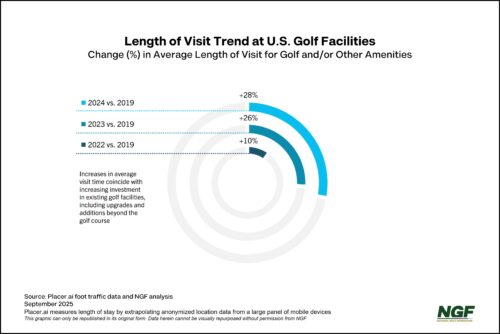

Golfers aren’t just playing more, they’re also spending more time at golf facilities in general. As golf courses continue to position themselves as destinations beyond on-course golf – from practice and retail offerings to additional amenities and broader food & beverage offerings – the average length of stay has increased significantly compared to the pre-Covid era.

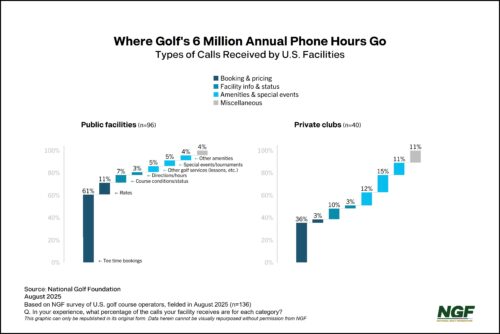

NGF research shows many golf facilities are hemorrhaging resources on avoidable (and often trivial) phone calls, diverting staff from higher-value touch points and revenue-generating activities. Consider that two-thirds of golf course calls are about reservations and pricing, and only 40% of golfers are booking tee times exclusively or mostly online – compared to 80-90% for flights, hotels, and rental cars.

When it comes to indicators of golf’s sustained play levels -- at least nationally -- consider this: all 26 peak-season months dating back to 2020 have seen rounds trend at least 10% higher than recent pre-Covid comparisons. And based on mid-year play data, it’s quite possible 2025 could hit record levels yet again.

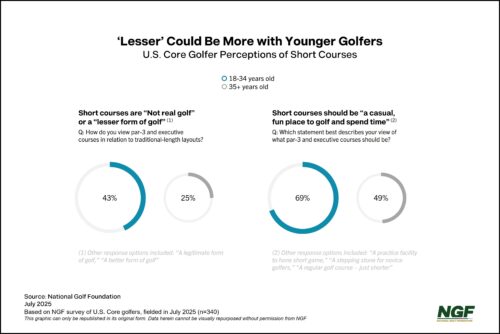

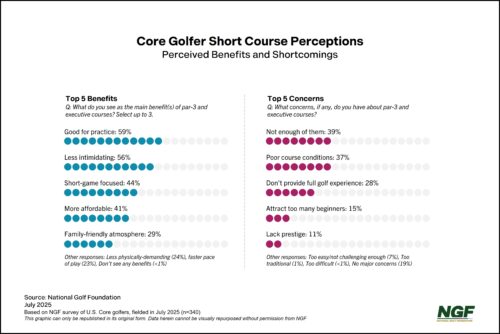

For decades, many short course operators have marketed themselves with a "championship-lite" promise to deliver all the hallmarks of the "real thing," but with the added benefits of speed and accessibility. While a sensible strategy for some, the pursuit of legitimacy through scaled-down emulation appears to have created a perception trap for many short courses.

Topic: Course Operations

Golfers’ perceptions of Short Courses are crucial to understanding their place – and untapped opportunity – within the golf landscape, particularly when considering 'transitional' golf facilities that can convert beginners to lifelong golf consumers. Our recent survey on the perceptions of Core golfers revealed some stark contradictions.

Topic: Green-Grass Facility

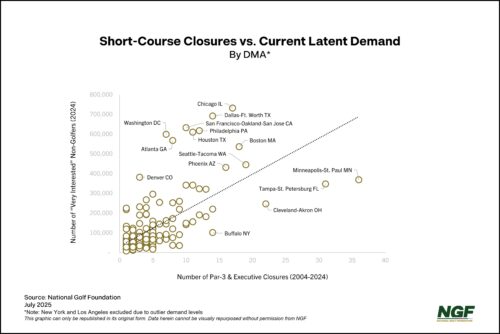

The perceived "Short Course movement" in golf, and engaging players with less time-consuming options, conceals a disconnect in the market over the past two decades. While millions of dollars are being actively invested in extraordinary par-3 experiences, the more “local” short courses that could serve as everyday developmental pathways have closed at disproportionate rates.

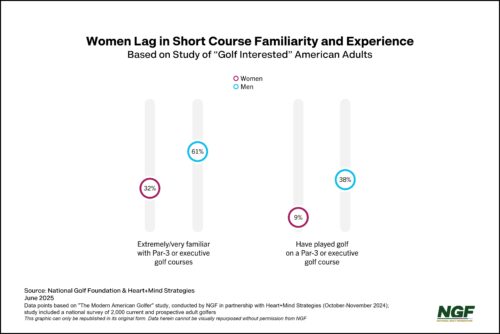

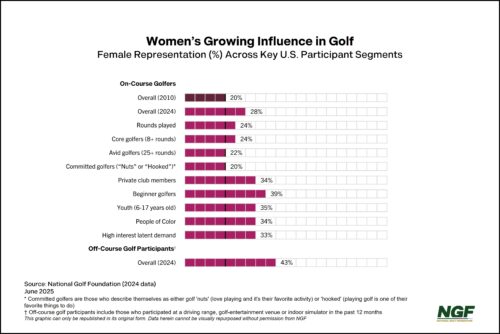

Women and girls have accounted for almost half of the sport's growth over the past decade and now represent one-third of all golf participants including on- and off-course players. But this remarkable surge comes with multiple challenges: getting more to make the jump to traditional golf and then keeping them coming back once they do.

Women and girls have quietly become the driving force behind golf's post-pandemic resurgence. What makes the growth particularly significant is its youthful energy. More than half of net participation gains among women have come from those under 30, and equally encouraging is the cultural shift that's taking hold.