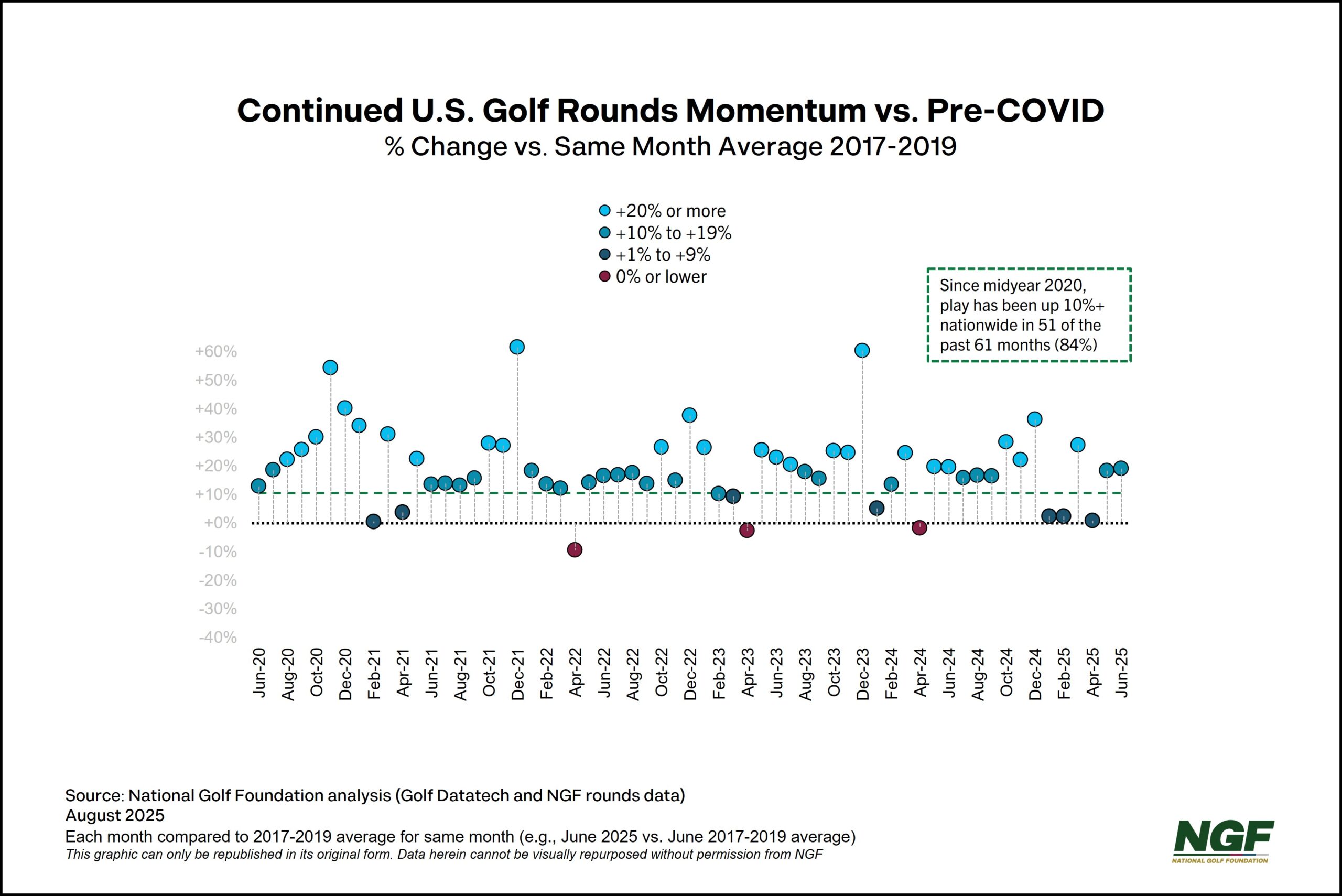

When it comes to national indicators of golf’s sustained play levels, consider this: all 26 peak-season months dating back to 2020 have seen rounds trend at least 10% higher than recent pre-Covid comparisons.

For anyone who’s tried to get weekend public tee times in densely populated metro areas, that’s probably not a surprise.

Based on U.S. play data available through the first half of 2025, it’s quite possible that five years post-Covid the industry could hit record levels yet again. Total play at the mid-year point in 2025 trails last year’s record rounds by less than 1%.

Rounds are trending ahead of both 2021 and 2023, each of which established records prior to last year’s unprecedented showing.

Overall, it’s been 61 months since pandemic-related restrictions on golf were lifted. Only three times during that five-year stretch have rounds for that month failed to surpass their pre-pandemic equivalents (using 2017-2019 monthly averages as the comparison). On each occasion, the underperformer was April, which is statistically the most unpredictable weather month of the year when it comes to golf. This year, even April saw a slight increase.

The market’s true test, however, is golf’s peak season. And golf courses, generally speaking, continue to pass with flying colors. During the months of May through September from 2020-2025, play is up an average of 18%.

Given the way the golf season seemingly continues to extend, it’s almost fair to include October at this point, too. Sustained demand has driven October play up by at least 25% over pre-Covid comps in each of the past five years.

Data from GolfNow corroborates the momentum. So far this year, the world’s largest tee time reservations platform has broken monthly records for rounds booked in March, May, June and July, with the latter setting an all-time high for the online marketplace as its portfolio expands further. Other technologies continue to streamline the booking and re-booking of unused tee times, as operators at public facilities embrace ways to improve efficiency while contending with capacity challenges.

Meanwhile, demand for golf balls remains another indicator of sustainability, as play is very much tied to golf’s ultimate consumable.

Our aggregated Industry Sales Reports* show golf ball shipments are up 59% compared to recent pre-Covid levels. There could be multiple contributors in play depending on one’s interpretation, among them retailers stocking shelves to prepare for high levels of demand or address tariff concerns, newer golfers losing more balls, or hopeful golfers stockpiling for future play. As for consumer online searches for golf balls, levels at the tail-end of the summer have been at their highest of any time post-June (after Father’s Day and U.S. Open) in the past five years.

Demand remains exceptionally strong on a national level.

Ultimately, with an outdoor sport that’s heavily dependent on the weather, whether this is another record-setting year for rounds might come down to the whims of Mother Nature. But signs suggest the appetite is as healthy as ever.