3-Minute Business Insights

Short Game

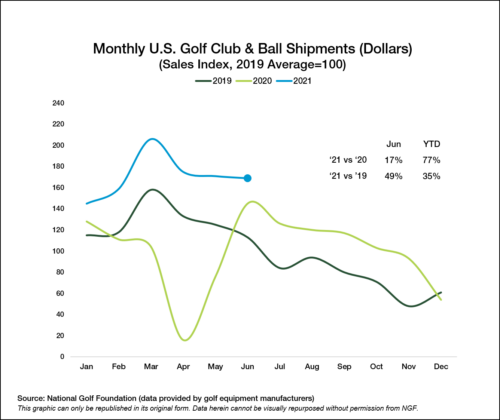

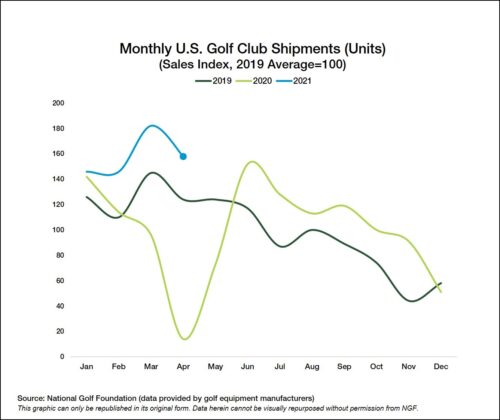

The 2021 first-half momentum for golf equipment sales carries over from second half of 2020. Is it better than 2019?

App use is becoming prevalent in all walks of life, including the golf world. There are now hundreds of golf-centric apps available and usage continues to climb.

Check out these numbers

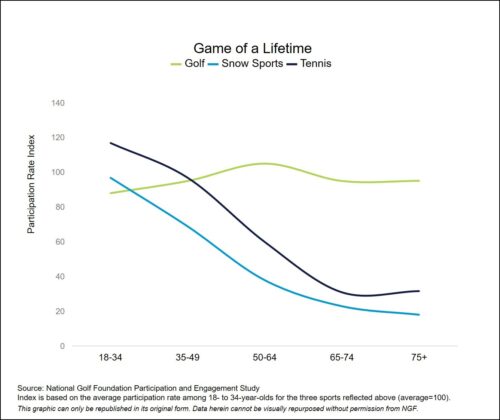

You often hear golf referred to as the game of a lifetime. But is it? Unlike virtually every other sport, golf participation actually holds steady across the ages.

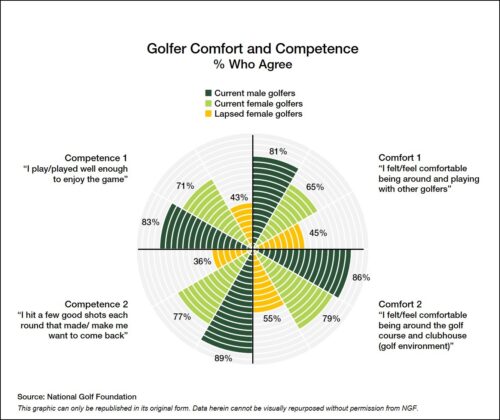

Just seven years ago, the proportion of all golf participants (on/off-course combined) who were women was 27%. Since then, the volume of female participants has grown by 43%, and there's even greater potential.

Golf’s overall participation base in the U.S. – combining on- and off-course players – rose 8% in 2020 to 36.9 million. This leaves us with three closely-sized and mutually-exclusive groups of Americans.

And it probably won’t be long before traditional, “green grass” participants are out-numbered. Perhaps as soon as this year.

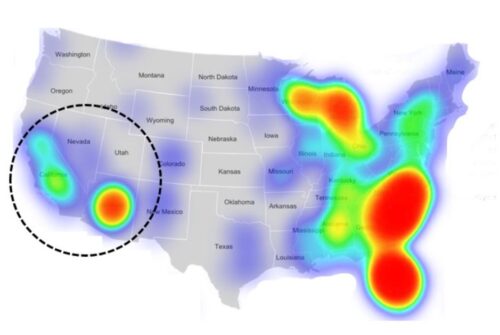

A return to the friendly skies means more golf trips and destinations back in consideration. Core golfers, on average, are now expecting 1.8 golf trips in 2021 -- an increase of more than 60% over 2020.

Working remotely has provided greater schedule flexibility for many people over the past year. It's also had a significant impact on golf.

The latest monthly numbers show something the golf industry hasn't seen in a while -- a decline in play. How much of an impact did Mother Nature have in February?

There was a 31% decline in 18HEQ course closures in 2020, the largest drop on record. Could golf be approaching the end of its 15-year market correction?

The flood of new faces on U.S. golf courses in 2020 was noteworthy, even if some gains were offset. Who were these new people? And who wanted “in” last year?

After the coronavirus struck in 2020, spring shutdowns gave way to an unprecedented summer and fall in terms of play, golfer introductions and reintroductions, and robust, late-season spending.