Exclusive NGF Articles and Reports

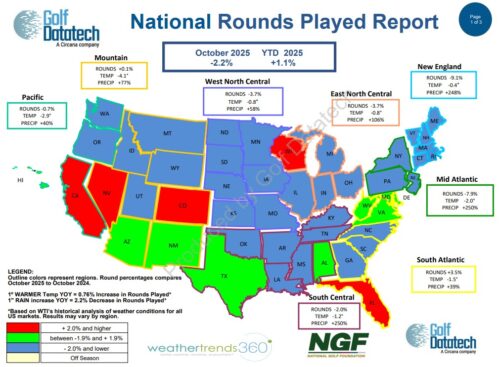

October rounds see slight national year-over-year decline as cooler, wetter weather slows strong play momentum in certain regions.

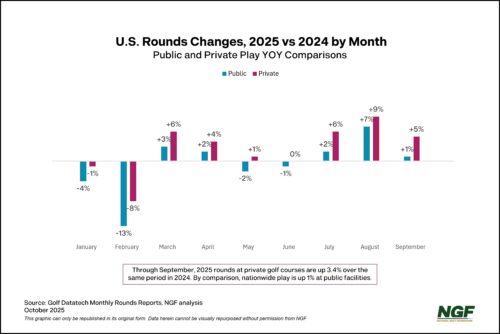

The golf industry is on the verge of another record for rounds-played for the fourth time in five years, and it could be the play at private clubs that pushes the industry over the top.

September rounds of golf were up again on a national level over the same period a year ago, keeping the U.S. golf market on pace for a record-setting year for rounds in 2025.

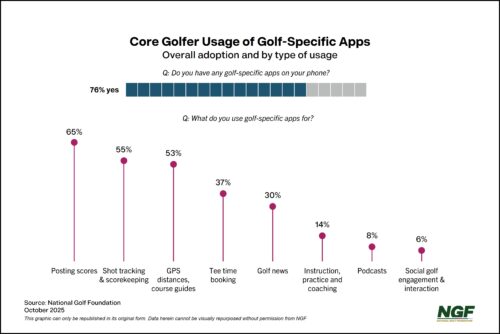

As the traditional game continues to modernize and evolve, mobile apps are an increasingly important part of the golf experience, on and off the course. More than three quarters of Core golfers say they use golf-specific apps, with the most notable recent increases in usage coming in several main areas.

What is Behind the Rise of Private Golf Development?

Three states are leading the way, with over 50% of new private projects

The recent rise in private golf development is a notable departure from the current U.S. supply landscape, as more than half of new courses under construction or in-planning are private clubs. The current trajectory is attributable to a multitude of factors, both economic and societal, but is representative of a more measured and targeted approach than the industry experienced in the 1990s and into the early 2000s.

August rounds of golf saw the biggest year-over-year jump of any month this year, pushing the industry slightly ahead of the record-setting play pace set in 2024.

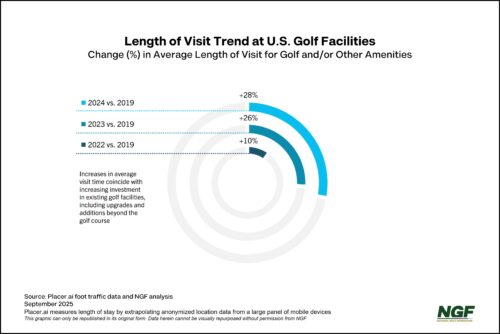

Golfers aren’t just playing more, they’re also spending more time at golf facilities in general. As golf courses continue to position themselves as destinations beyond on-course golf – from practice and retail offerings to additional amenities and broader food & beverage offerings – the average length of stay has increased significantly compared to the pre-Covid era.

Member Presentation: Understanding Golf’s Hidden Phone Costs

NGF research shows the majority of golf course operators are aware of the opportunity cost of 6 million phone hours, but only a small percentage have actually implemented technology solutions to minimize waste, with a fraction more exploring their options. This gap points to a competitive advantage opportunity for operators willing to act.