3-Minute Business Insights

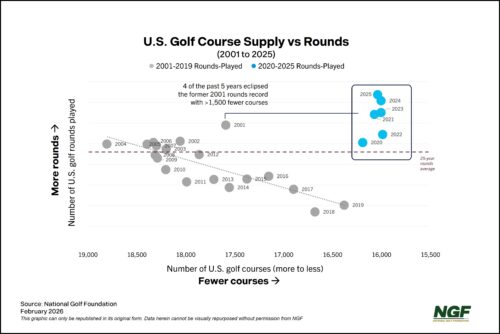

The post-pandemic surge has proven more durable than some initially expected, with rounds of golf at U.S. courses climbing to yet another all-time high in 2025. It's a run that has similarities to the early 2000s "Tiger Boom," but is far from apples-to-apples comparison.

Topics: Course Operations, Facility Management

Greg Nathan joins Golf Business Live host Michael Williams for a conversation reflecting on the state of the golf business and economy in 2025, and a look ahead to the game's future.

Moderate year-over-year gain pushes 2025 closer to record-setting territory

Limited play in Northeast states due to weather is offset by warmer weather increases further west as November rounds get a slight boost on a national level.

At a time when more people are playing more golf in more ways than at any time in history, NGF President and CEO Greg Nathan shares a few observations about the game's momentum and growth, and expresses immense gratitude for the tens of thousands of friends and members throughout the industry.

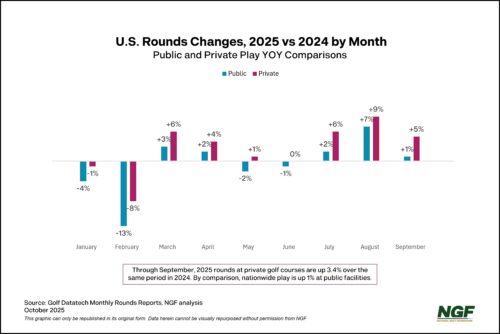

The golf industry is on the verge of another record for rounds-played for the fourth time in five years, and it could be the play at private clubs that pushes the industry over the top.

September rounds of golf were up again on a national level over the same period a year ago, keeping the U.S. golf market on pace for a record-setting year for rounds in 2025.

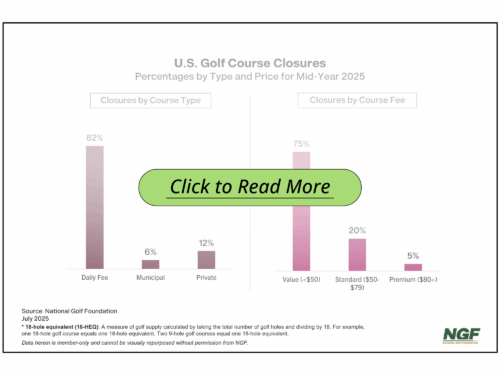

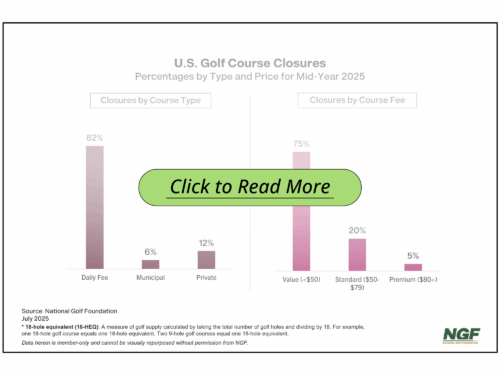

Midyear Update: Golf Supply and Development

The U.S. golf market continued its march toward equilibrium at the midway point of 2025, with supply and development patterns reinforcing trends that emerged in 2024 and previous years.

Topic: Facility Management

Rounds of golf for June -- one of the most high-volume months for play -- were virtually unchanged from a year ago, as the U.S. market remained within striking distance of the record-setting rounds pace of 2024.

Topic: Course Operations