3-Minute Business Insights

Course Operations

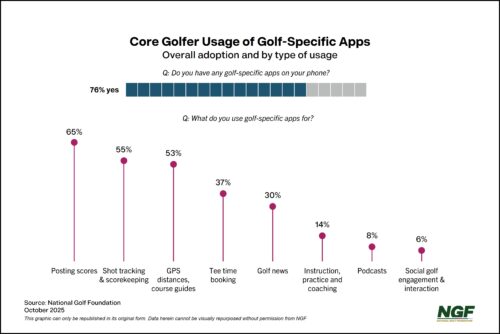

As the traditional game continues to modernize and evolve, mobile apps are an increasingly important part of the golf experience, on and off the course. More than three quarters of Core golfers say they use golf-specific apps, with the most notable recent increases in usage coming in several main areas.

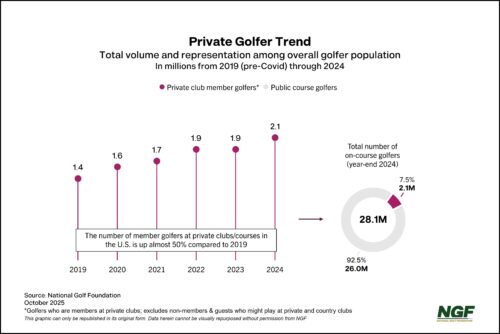

Private club golfers account for less than 8% of golf's green-grass participation base, but this group plays and spends more on the game and is a popular target market audience for businesses inside and outside the golf industry.

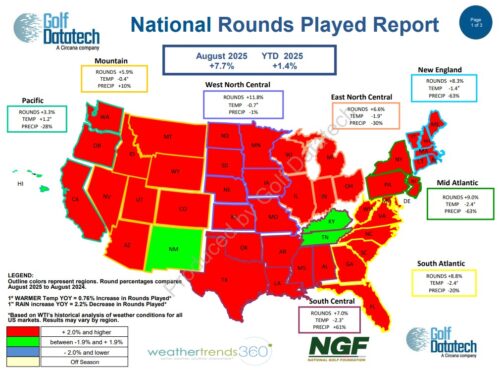

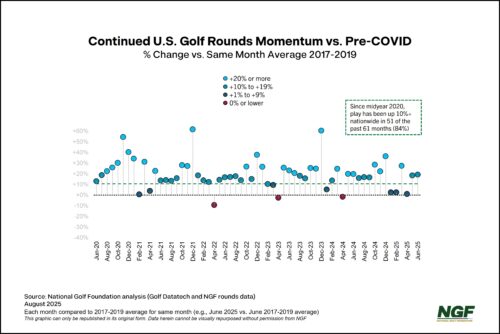

August rounds of golf saw the biggest year-over-year jump of any month this year, pushing the industry slightly ahead of the record-setting play pace set in 2024.

A New Yardstick of Success

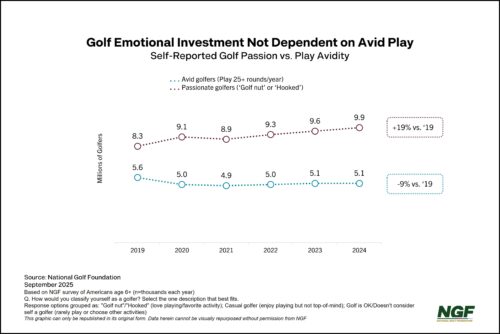

Whether temporarily or otherwise, golf has captured the global zeitgeist. So, what are the notable differences when it comes to golfers in the current era? For one, the number of golfers who place themselves on the highest level of NGF’s ‘passion scale’ has grown nearly 20% since the pandemic.

Topics: Course Operations, Green-Grass Facility

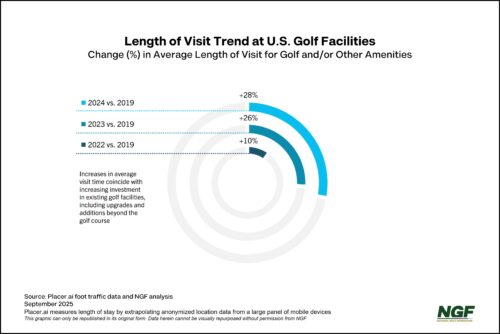

Golfers aren’t just playing more, they’re also spending more time at golf facilities in general. As golf courses continue to position themselves as destinations beyond on-course golf – from practice and retail offerings to additional amenities and broader food & beverage offerings – the average length of stay has increased significantly compared to the pre-Covid era.

Greg Nathan sits down with Golf Inc. for an in-depth industry Q&A, discussing health metrics, growth opportunities, the sustainability of golf's resurgence, emerging technologies and more.

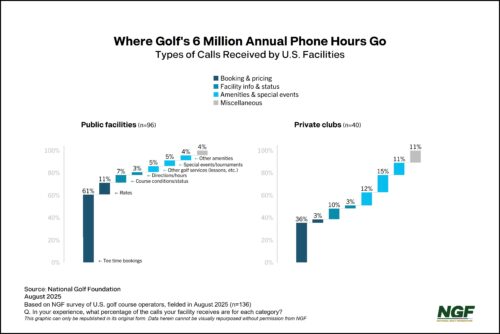

Member Presentation: Understanding Golf’s Hidden Phone Costs

NGF research shows the majority of golf course operators are aware of the opportunity cost of 6 million phone hours, but only a small percentage have actually implemented technology solutions to minimize waste, with a fraction more exploring their options. This gap points to a competitive advantage opportunity for operators willing to act.

Buoyed in part by play at private clubs, rounds jumped in July and put 2025 almost on the same pace as last year's record-setting trajectory. It bears noting that July is traditionally the highest-volume month of the year when it comes to rounds-played.

NGF research shows many golf facilities are hemorrhaging resources on avoidable (and often trivial) phone calls, diverting staff from higher-value touch points and revenue-generating activities. Consider that two-thirds of golf course calls are about reservations and pricing, and only 40% of golfers are booking tee times exclusively or mostly online – compared to 80-90% for flights, hotels, and rental cars.

Greg joins Syngenta's Changing the Business of Golf podcast to discuss the critical changes golf clubs and courses can make to boost customer retention and reposition the game as a more accessible, growth-oriented sport.

When it comes to indicators of golf’s sustained play levels -- at least nationally -- consider this: all 26 peak-season months dating back to 2020 have seen rounds trend at least 10% higher than recent pre-Covid comparisons. And based on mid-year play data, it’s quite possible 2025 could hit record levels yet again.

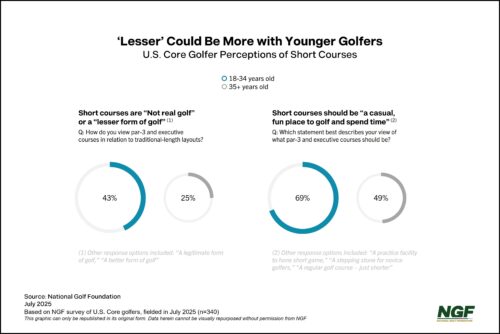

For decades, many short course operators have marketed themselves with a "championship-lite" promise to deliver all the hallmarks of the "real thing," but with the added benefits of speed and accessibility. While a sensible strategy for some, the pursuit of legitimacy through scaled-down emulation appears to have created a perception trap for many short courses.

Topic: Course Operations